The Wednesday HOT TAKE

September 18 | Ethanol's Decarbonized Future with Todd Becker, CEO of Green Plains Inc.

HOT Nugget

Welcome to the second in a series of updates, recapping each session of last month’s Summit 24 - Wheels Up | Taking Agriculture to New Heights.

If you missed the first in the series of Summit 24 recaps, click HERE to read From Field to Flight with Justin Kirchhoff, CEO of Summit Agricultural Group.

This week, I am recapping my session with Todd Becker, CEO of Green Plains Inc. - Throttling Up - Ethanol’s Decarbonized Future.

Previously, I reserved the remaining Summit 24 recaps for paid subscribers. However, given the critical juncture for U.S. ethanol, I've decided to make this one publicly accessible.

The future of biofuel demand and the long-term viability of the U.S. ethanol industry, and by extension, U.S. corn demand, hang in the balance.

Before diving in to my one-on-one with Todd, I want to do a quick recap of ethanol and the important role it plays in American agriculture.

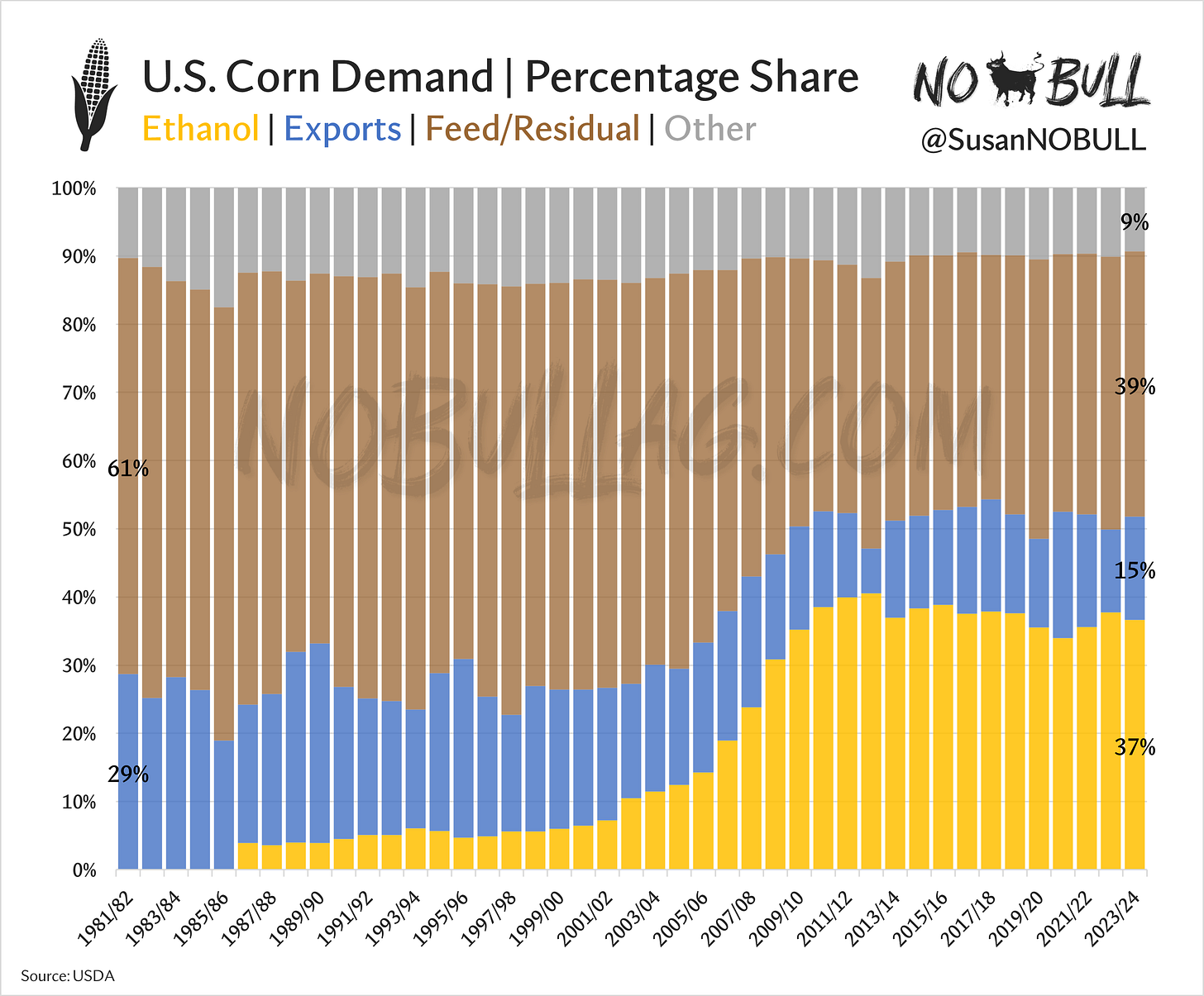

Thirty years ago, feed and exports accounted for 90% of corn demand.

Today, feed continues to hold the largest percentage share of demand but it runs neck and neck with domestic ethanol demand, who has been the predominant driver in demand growth since the Renewable Fuel Standard’s inception nearly 20 years ago.

As a result, ethanol has been a cornerstone of rural economies since the mid-2000s, consuming over five billion bushels of corn each year, whittling away at U.S. grain surpluses.

This steady stream of demand not only provides support to board prices, but more importantly, it has created local markets in areas that would otherwise have a grain glut.

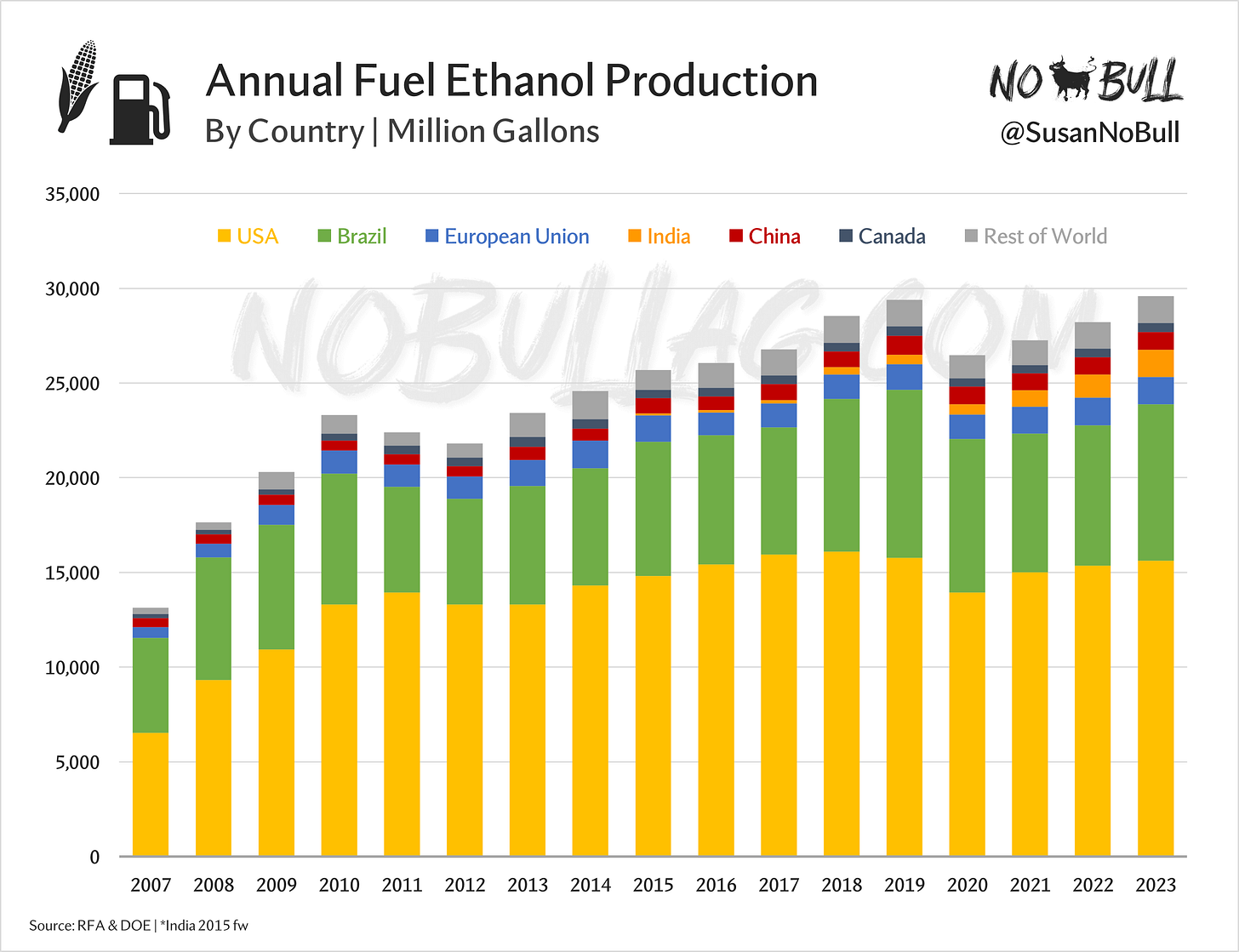

As a result of the U.S.’ desire to reduce emissions and protect our energy independence, ethanol production has grown to more than 15 billion gallons annually - accounting for one of every two gallons of ethanol produced in the world.

The problem is… U.S. production growth has stagnated:

…and so has demand:

As Todd pointed out in our conversation on stage, the U.S. has faced significant challenges in raising the ethanol blend over the past decade.

Todd's sharp wit was on full display during our 25-minute session at Summit 24. If there were an award for the most memorable one-liners, he would have been the undisputed champion.

His quip about "a monopoly on your fuel tank" perfectly captured the stranglehold that Big Oil has on the U.S. fuel market, as illustrated in the percentage blend chart above and depicted in the cartoon below:

Over the course of the past decade, the U.S. blend has increased less than one percent!

LESS THAN ONE PERCENT!

In contrast, Brazil has seen large increases in previous years and its current mandate of 27% surpasses the U.S. by nearly threefold:

Getting back to Todd’s one-liners, here’s another:

“It's the big energy guys, big oil guys. They win. They control it. They control policy. They control the island where we buy our gasoline.”

In fact, I was reminded of this over the weekend while reading The Mysterious Case of Rudolf Diesel.

In chapter 14, author Douglas Brunt writes (of oil magnate John D. Rockefeller):

…Standard Oil engaged in predatory pricing tactics.

In the way that Standard Oil had dumped low-priced kerosene on the Chinese market to undercut competition from vegetable oils for illumination, Rockefeller selected isolated competitive markets where he would reduce prices temporarily and kill off the competition.

While vegetable oils could provide fuel for illumination, as well as fuel for Diesel’s new engine, there were enormous infrastructure costs associated with developing the agriculture and refinery operations to produce the oil. Rockefeller was strategic in supplying his petroleum-based oil to certain markets at an attractive cost to undermine the incentive to develop vegetable-based oils at large scale.

**Side note: Full circle, baby! Standard Oil (U.S. company) first dumped cheap kerosene on China to undercut their vegetable oils… fast forward more than a century and China is dumping UCO on us, undercutting bean oil.**

Todd said it is a relentless fight for ethanol’s place at the table:

“It's a battle we fight every day for every 1%. By the way, that 1% or 2% doesn't just change the ethanol industry. It changes every thing from buying seeds and fertilizer to land and tractors. It changes the landscape of US agriculture dramatically for every 1% and if we can get to the 15% national level, if we can get into sustainable aviation fuel.”

Let me illustrate just how impactful a 1% increase in blend is:

Perhaps the day has come where big oil needs agriculture, though.

Agriculture and energy have found themselves at a critical juncture with sustainable aviation fuel.

Todd continued:

“We begin to take back some of that control and they (big oil) know by the way, they absolutely know it. Who's ringing our bell today for decarbonized alcohol? Who's knocking on the door today? It's big energy because in order for them to justify building a sustainable aviation fuel plant, they have to secure the molecule (low-carbon corn ethanol).”

“Again, we're taking some of that power back. It's not fully there yet, but I think we have an amazing opportunity.”

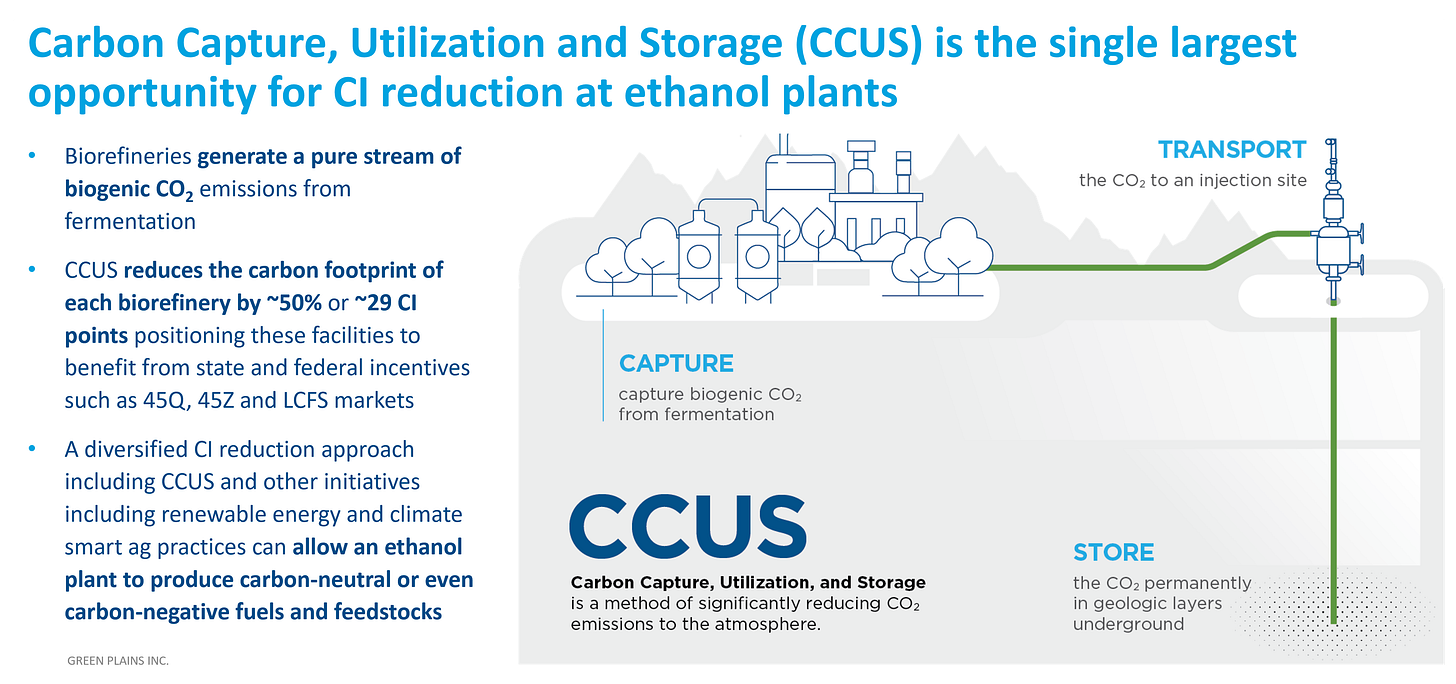

The opportunity, however, is dependent upon the decarbonization of ethanol plants across the country.

As discussed previously, the carbon intensity score of US corn ethanol and the resulting SAF made from ethanol is TOO HIGH to qualify for the IRA tax credit needed to make its production feasible (yellow bars/orange line, below).

Therefore, the ONLY WAY US CORN ETHANOL CAN MAKE ITS WAY INTO SAF PRODUCTION IS VIA CARBON CAPTURE & STORAGE (CCS - green bars).

While Climate Smart Ag (CSA) helps, it’s not enough on its own (under current 40B regulations).

US corn ethanol has the potential to be a widely available feedstock for production of Alcohol-to-Jet (ATJ) sustainable aviation fuel, but it needs to be de-carbonized first.

Plants utilizing carbon capture and sequestration will not only reap the benefits of strong demand for low carbon ethanol, but they have the added bonus of a new revenue stream with every ton of CO2 sequestered.

Particular types of underground geological formations are required to effectively hold on to CO2.

The good news is the US has several such areas (tan):

The bad news is they are largely outside of the corn belt, leaving most US ethanol plants out of luck:

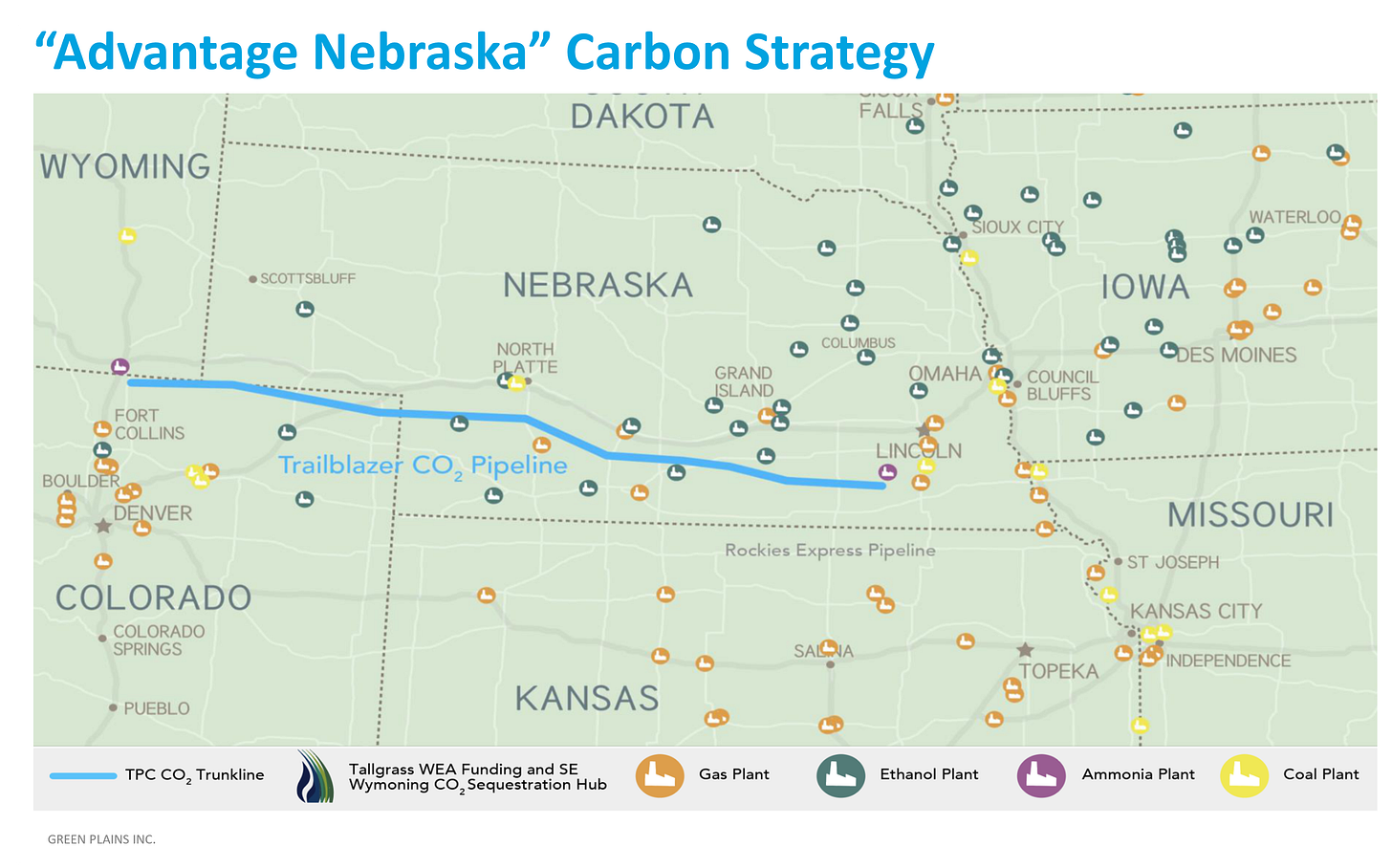

In response, Green Plains is taking a diversified approach to carbon capture, utilization, and storage as they are in partnerships with two different CO2 pipelines.

In addition to having four locations that have signed on to Summit Carbon Solutions’ pipeline project, Green Plains has also partnered with Kansas-based Tallgrass, which is converting an existing 392-mile-long natural gas pipeline to transport CO2, across Nebraska for sequestration in eastern Wyoming.

Green Plains believes Tallgrass’ Trailblazer pipeline will be one of the first sequestration projects operational at scale, set to go online the second half of 2025.

Unlike Summit’s project, featuring 2,500 miles of yet-to-be-constructed pipeline, the majority of Trailblazer is already in the ground.

Additionally, Trailblazer’s first Class VI well (where the CO2 is injected into deep rock formations) has been approved, with more approvals to come. Wyoming is one of only three states in the nation with “primacy” for well permitting (regulated at the state level as opposed to EPA, which has a track record of taking three years or more to approve wells).

Green Plains has three of their 10 plants on the project, with a total of 287 million gallons of production, potentially sequestering 800,000 tons of CO2 each year.

Todd also pointed out that “not all ethanol producers will be able to decarbonize, and some will be ahead of others.”

Be it a plant on Trailblazer, Summit, or on-site sequestration - those with the ability to capture their CO2 will soon realize the new demand as a feedstock in sustainable aviation fuel production, but they will be able to monetize that captured CO2 as well, lifting demand and profitability at the same time.

“We buy million bushels of corn a day locally. Each of those have an opportunity to earn more because of carbon sequestration.”

Todd continued:

“That's really where the opportunity lies, or it’s the advantage for us at least at Green Plains in Nebraska. I just think it all lies sometime in the middle of next year as we’re going to have the first real volumes of decarbonized ethanol to hit the market.”

“If anyone is going to build an Alcohol-to-Jet sustainable aviation fuel plant, they need to have a supply of low-CI ethanol, and Nebraska could be the epicenter for that a year from now.”

Green Plains is well-positioned to capitalize on these opportunities, not only for their success but also for the benefit of the producers they serve throughout the Midwest.

As we look ahead to 2025, the impending changes in IRA tax credits will significantly shape the landscape of the industry.

Although the Department of the Treasury has yet to provide final guidance on 45Z, ethanol plants utilizing carbon capture and sequestration will have a leg up on its non-sequestering counterparts.

Todd's insights reinforced the bipartisan support for these policies, ensuring a favorable environment for growth - no matter November’s outcome.

“It (45Z) will transcend whoever the president is going to be…. it's one of those bipartisan things that is going to be driven by both parties”

“We feel strongly that we will have policy in place no matter who the President is and we think it will be favorable to the infrastructure that we're going to build.”

The aviation sector’s decarbonization presents a tremendous opportunity for US ethanol, so long as we are able to reduce the carbon intensity of America’s original biofuel.

“It’s a massive opportunity that is coming for this industry.”

For perspective, the U.S. currently burns over 25 billion gallons of jet fuel every year, compared to the roughly 16 billion gallons of ethanol production today.

As Milton Berle said, ‘If opportunity doesn’t knock, build a door.’

In the context of agriculture and corn ethanol, this means investing in pipelines that will fuel our future growth.

As Todd said, “The real opportunity is SAF and it's great because it’s what you're talking about - WHEELS UP.”

I have had the opportunity to sit down with a fair amount of heavy-hitters the past few years and I have to say, Todd Becker ranks up there.

Given the fact my company is called No Bull, not only do I appreciate Todd’s no bullsh*t approach but the conviction with which he delivers his message.

A good friend and long-time mentor once told me, ‘nobody likes vanilla’ - and Todd is anything but.

I will be back this weekend.

Thanks!