Happy Lunar New Year!

Chinese New Year is one of the country’s most important holidays, with more than two weeks of celebrations packed full of myths, customs and feasting.

This annual holiday marks the end of winter and beginning of the spring season in the lunisolar calendar. The first day of Chinese New Year begins on the new moon that appears between January 21 and February 20 each year.

For us, it generally means Chinese buyers are quiet as celebrations take precedence over soybean purchases. Likewise, the event was preceded by two consecutive months of strong weekly crush rates, in preparation for holiday downtime.

2023’s Year of the Rabbit celebrations mark China’s first such event since lifting its strict zero-Covid restrictions. Celebrations have been muted the past three years due to the pandemic.

The next two weeks will be filled with food, festivities and travel which leaves us to keep a watchful eye on consumption during the celebration, plus any spikes in Covid cases as millions of Chinese are traveling for the first time since 2019.

Weekly Winners & Losers

Winner’s Circle

I’d consider it a small win - but it is a win in what was otherwise a fairly bleak week in ags.

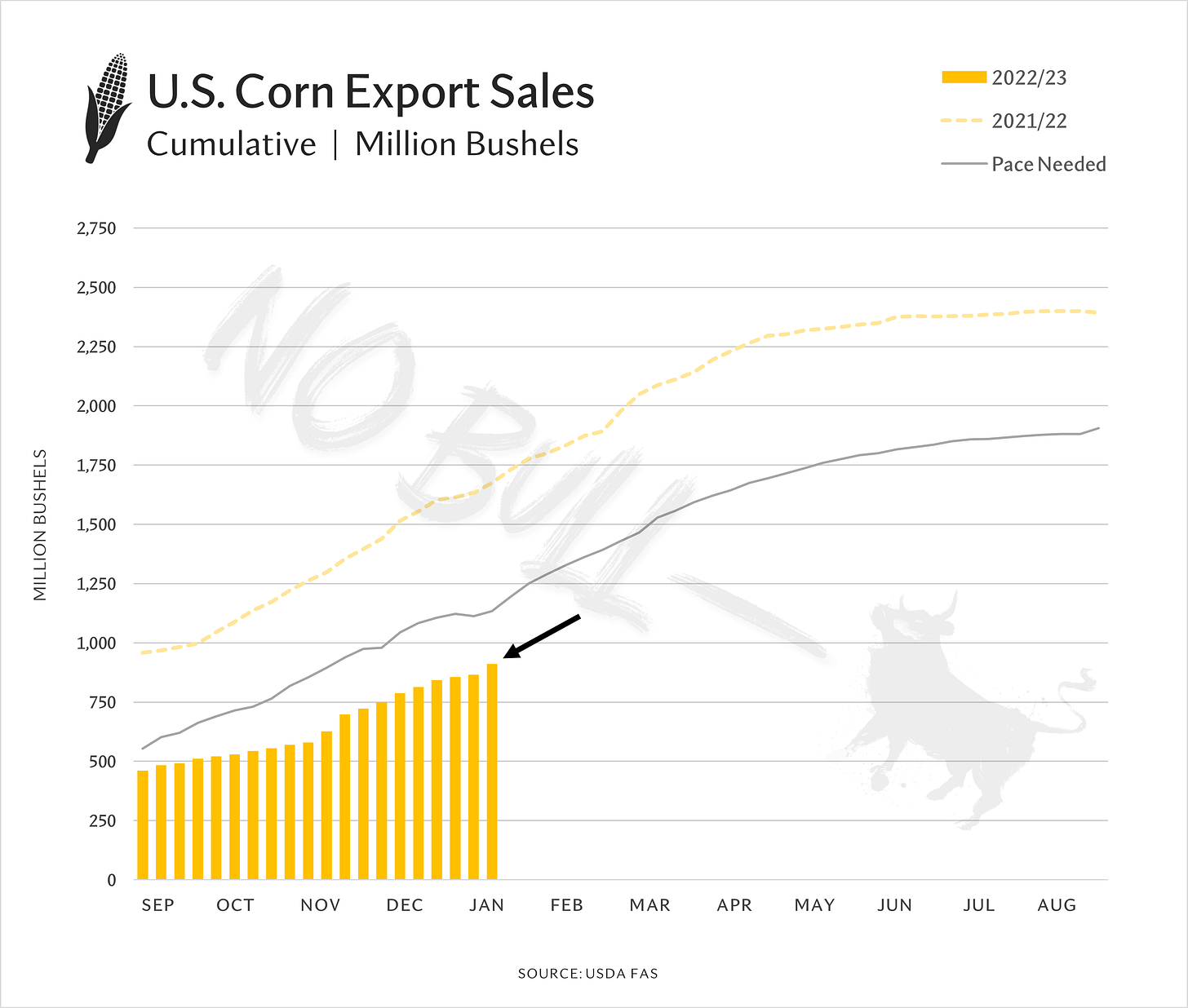

Corn export sales came out of the basement last week. Sales were near 45 million bushels, more than 4x the abysmal sales the week prior and one of the highest single weeks this marketing year.

Japan was a featured buyer with their largest single week of purchases yet this marketing year. It is nice to see what used to be very routine business back on the board.

While it feels good to be loved, we are not out of the woods yet. Cumulative sales still lag the pace needed to hit USDA’s recently reduced full-year estimate by more than 200 million bushels.

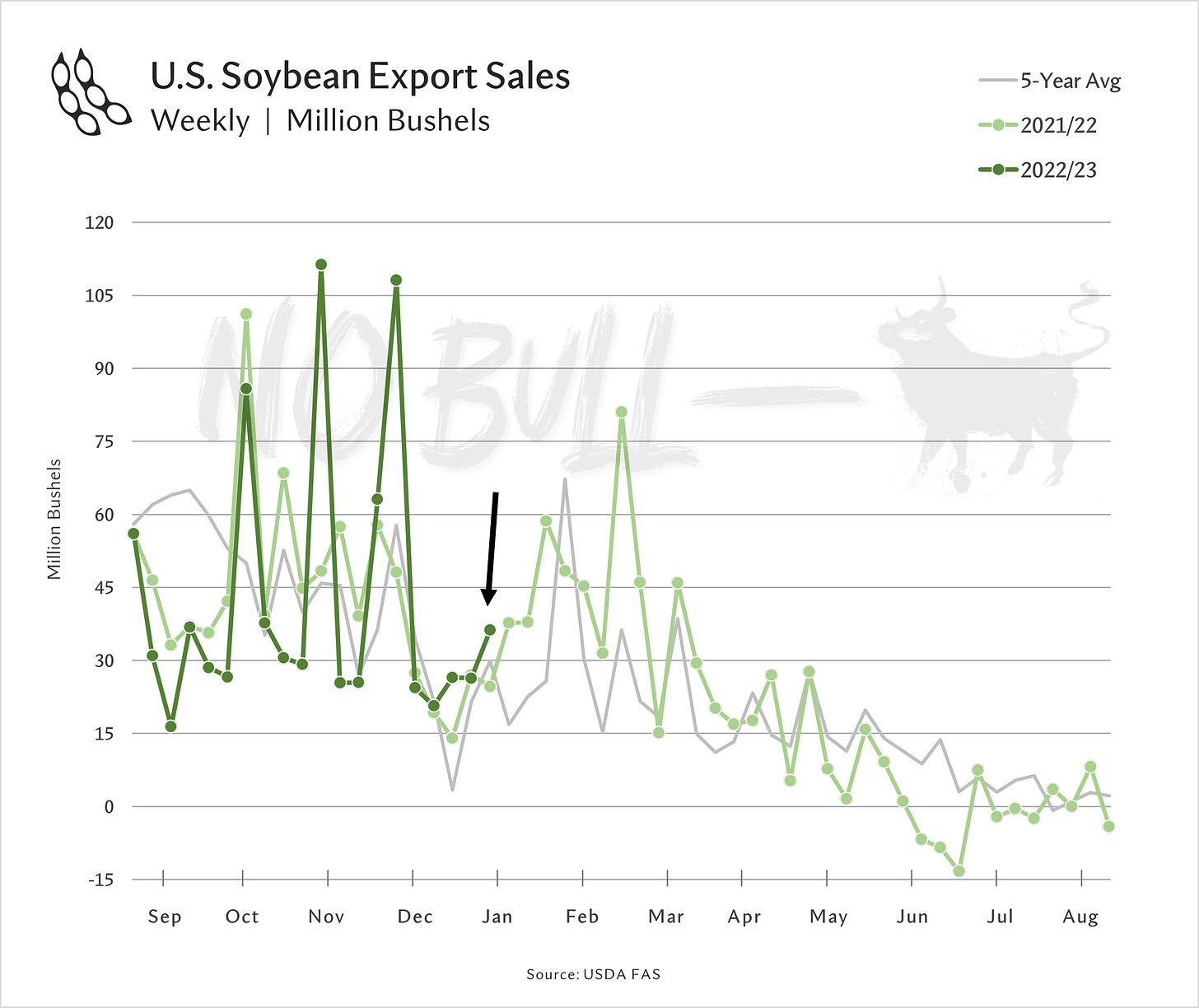

I suppose we might as well list soybeans among the winners too - as sales maintained an above-average pace at 36 million bushels.

With 32 weeks remaining in the marketing year, cumulative sales are at 84% of USDA’s current full-year estimate. That is 8% faster and 167 million bushels ahead of a normal, seasonal pace.

Recent rain delays in Brazil with continued forecasts for above-average precip chances in the north are helping extend the US soybean exporting window a few more weeks.

Parade of Losers

The Grand Marshal of this week’s parade is the poor, pitiful Nov-23 bean contract, down more than 40 cents the past three sessions.

$13.52 isn’t the end of the world, but considering we have bounced around in the $13.90s for the past eight weeks and haven’t been this low since late-October…

Fun fact: you had a chance to lock in $14.00+ November futures 11 of 17 trading sessions from late Dec through Jan 13.

November beans are far from alone in the loser’s parade as March crush was down 17% the past two sessions, settling at its lowest level since early December.

A stronger soybean market coupled with weaker products (particularly meal on better Argy weather) contributed to the break.

Side note - managed money’s net long in meal was another record as of Jan 17, its third such record week in a row.

Headline of the Week

Before we get into the actual headline, - take a gander at this - a satellite view of Mato Grosso, Brazil - the heart of South American soybean production:

In the year 2000, Brazil was home to less than one in five acres of soybeans in the world. The U.S., on the other hand, harvested two of every five acres.

Since then, Brazilian expansion has rocketed past the U.S. as Brazil now plants and harvests one in every three acres of soybeans globally, accounting for 40% of world production.

Their growth has averaged 5% each year for more than two decades running compared with average annual growth of 1% here in the U.S.

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.