In today’s update:

Top Five:

Soybean oil = the star of the show

Skinny stocks

Spreading the love: palm oil vs. soybean oil

A meltdown in meal

Corn commitments: strong, like bull! Today’s history lesson: Big export programs have the ability to inflict max pain on anyone short the spread

Funds Fun:

The corn conundrum

Managed money on meal: For your safety, remain seated with hands, arms, feed and legs inside the vehicle.

Headline of the Week:

Creditors Force Broiler Depopulation: 1.3 million chickens unnecessarily killed in Iowa

The Week Ahead:

Tuesday: an end to relentless election & the start of a new administration

Friday: Nov WASDE

This Week’s Top Five

Star of the Show

Soybean oil continued its dominance of the soy complex last week as new highs in palm oil, firming energy markets and strong export demand rallied futures 8% the last three days of the week and over 46c for the first time since July.

Skinny Stocks

NASS Sep industry crush was released after the close Friday, confirming a uncomfortably tight stocks situation in bean oil that is getting tighter, especially after a huge flash sale (20k tonnes/44 million lbs) of oil to India that morning.

With Sep stocks of 1.5 billion pounds, that leaves official 2023/24 ending stocks at a 10-year low.

Here’s the wild thing:

September crush was a monthly record at 186.5 million bushels, up 6.7% year-on-year as more US crushing capacity comes online.

While Sep crush set a record, oil stocks told a different story, plummeting 6.6% year-on-year.

This stark contrast underscores the U.S.’s ongoing struggle to balance domestic oil supplies amid growing biofuel demand and a resurgence in exports.

More on Wednesday!

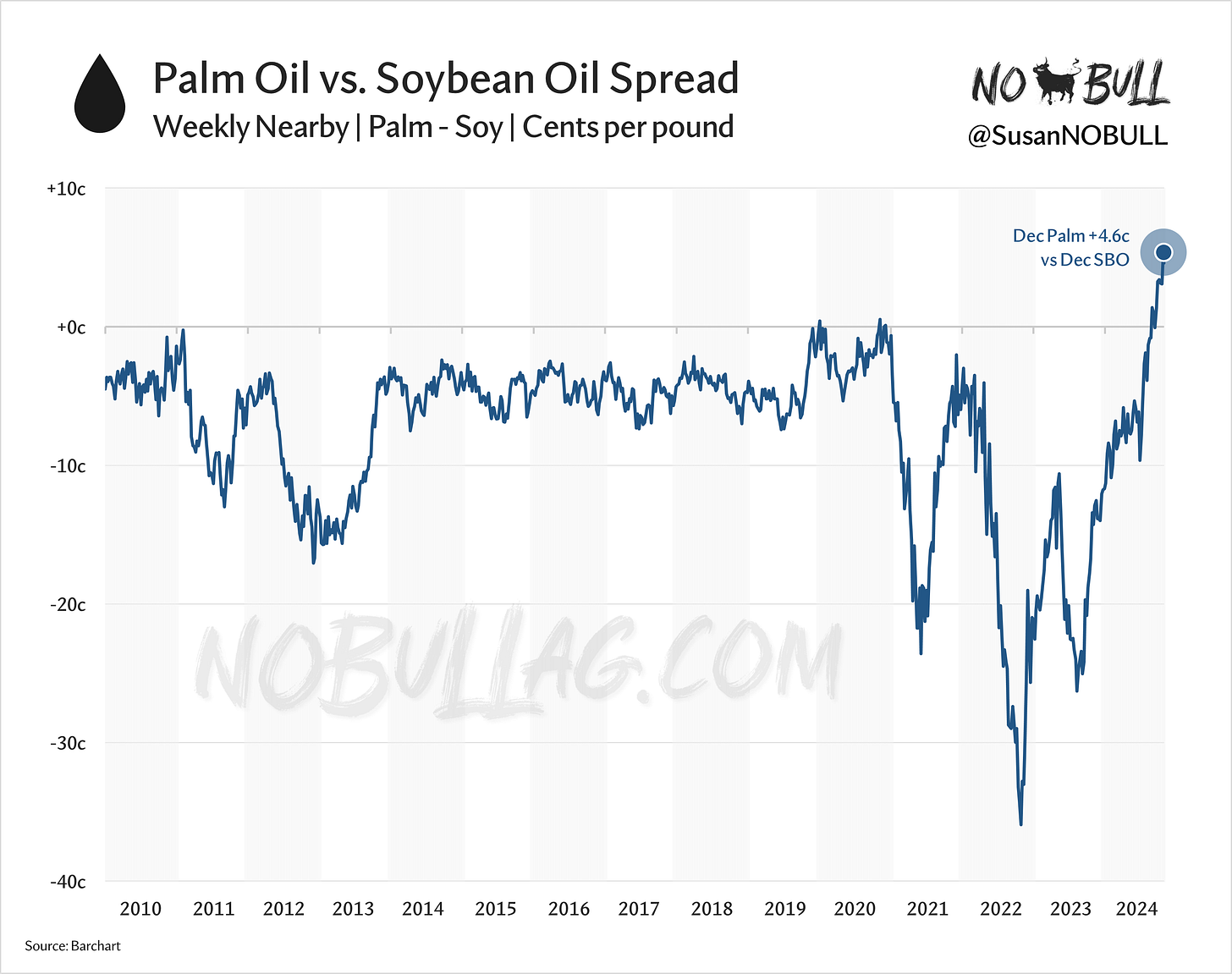

Spreading the Love

Although US soybean oil stocks are tight and getting tighter, pushing futures higher - bean oil’s move has nothing on palm.

Nearby bean oil futures are down 4% year-to-date at 46.3 cents/lb. In contrast, front-month palm oil has rallied 31% in 2024 on Bursa Malaysia, priced in ringgit.

Once you take into account the ringgit’s 5% appreciation versus the US dollar this year, palm has rallied 38% year-to-date in dollar terms, at 50.9 cents/lb.

This has pushed palm’s premium over soybean oil to a high of 4.6 cents - a sharp contrast from the lows of 25 and 35 cents per pound discount in recent history and the prior 10-year average near a 6-cent discount to soy.

Meal’s Meltdown

I originally typed ‘soybean meal had a rough week’ - but that is wrong.

Meal has had a rough last 30 days, falling 16% from its early October highs helped along by two 8+ day losing streaks during that time.

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.