The clock is ticking! Registration ends July 31. Visit NoBullSummit.com for more info & to register.

Post-Report HOT TAKE

Corn

Remember just two weeks ago when we had a 120 million bushel miss on corn stocks - which implied we have more corn laying around than initially thought…

That went out the window today as USDA raised feed/residual to the tune of 75 million bushels.

I shouldn’t complain as this was a friendly surprise - but it was a surprise nonetheless.

The bigger takeaway is USDA didn’t want to print a whopper carryout for 2024/25 (after adding 1.5 mil ac at 181bpa for new crop), therefore they backed into the math.

I will leave it as that and take it as a win - for both old crop and new.

Old crop corn exports were also increased 75mbu to 2,225mbu (expected). Quite the contrast to the path we were on one year ago!

Today’s YUGE 150mbu uptick in demand dropped our corn carryout estimate below 2 billion bushels for the first time in the 2023/24 marketing year.

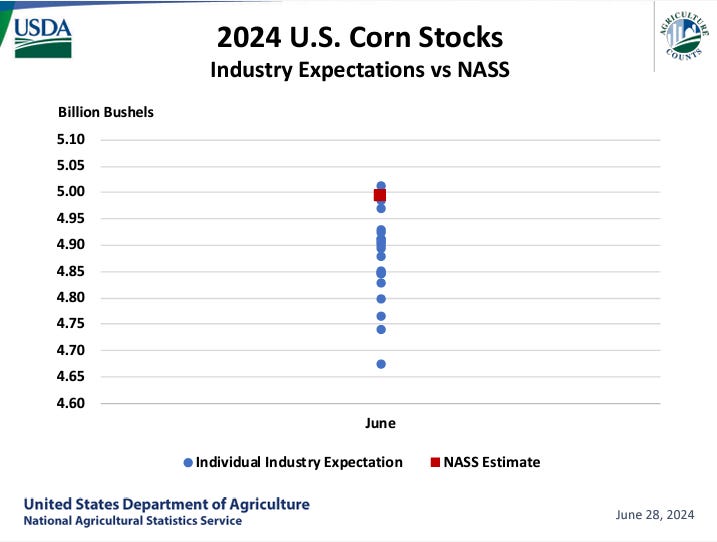

It also caught the market off guard as 1.877bbu (12.6% stx/use) was more than 170mbu below the average pre-report estimate.

Too bad the market barely reacted as Sep corn closed fractionally higher and remains down 7 cents on the week:

But wait, there’s more!

The best part about the reduction in old crop ending stocks is that it flows directly into new crop as beginning stocks.

For new crop, USDA incorporated June 28th’s planted acres of 91.5 million into their 2024/25 S&Ds - leaving yield at 181bpa alone, resulting in a 240mbu increase in production.

More bushels implies cheaper prices and more demand. Farm prices dropped a dime to $4.30 while both feed/residual and exports were increased 75mbu & 25mbu, respectively.

The bottom line:

145mbu reduction in 2023/24 ending stocks (—> 145mbu LESS 24/25 beginning stocks)

+240mbu in 2024/25 production (increase in acres)

+75mbu feed & +25mbu export demand

Net effect = 5mbu reduction to 2024/25 ending stocks at 2,097mbu (14.1% stx/use).

We saw very minor adjustments in world corn S&Ds today. Argentina’s 2023/24 crop was reduced 1mmt (exports were reduced the same) & Brazilian production was left unchanged.

FAS reported further declines in international corn prices with the US seeing the largest drop - not only month-on-month but year-on-year.

US corn (on a FOB basis) is near $4.90/bu (same as Argy) while both Ukraine and Brazil are near $5.10.

The US has reclaimed its title as the largest corn exporter in the world.

LOW PRICES CURE LOW PRICES IN THE FORM OF NEW DEMAND (unfortunately, it just takes a while).

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.