LAST CALL FOR AGRINEXT!

Registration ends Friday - don’t miss your chance to attend this incredible event!

Visit NoBullAgriNext.com for details and to register.

The Weekender

10 Things Driving the Bus Last Week

10 | Seasonal Sh*tshow

New crop corn fell 25 cents last week, closing at a new contract low near $4.12 on Friday:

Unfortunately, the seasonal chart has proved accurate once again:

9 | Bin buster

Crop ratings remain above average, ranking among the highest recorded for this point in the growing season.

Historically, similar early-July ratings have translated to above-trend yields by harvest — notably in 2016 (104% of trend) and 2018 (103% of trend).

Every 1% yield above the 2025 trend of 181 bpa adds roughly 160 million bushels to total production.

With most of the U.S. corn crop pollinating under generally favorable forecasts for the next couple of weeks, it’s becoming increasingly difficult to 'kill' the 2025 crop.

8 | Tariff Tirades

While weather is definitely part of the “problem” - Trump’s tariff tirades have added a layer of uncertainty markets are none too pleased with.

The week kicked off with disappointment as rumors of a major China ag “deal” announcement during Trump’s appearance in Iowa fizzled, fueling the early-week market nose dive.

Then the July 9th expiration of the 90-day pause came with a bang as he announced 50% tariffs on Brazilian goods effective August 1st. The move sent the Brazilian real tumbling 2.3% on Wednesday.

Biofuel producers won’t like this one as they likely continue to import record amounts of Brazilian tallow ahead of new 45Z amendments and upcoming RFS rule changes in January.

Then Thursday he hit Canada with 35%, effective August 1:

Followed the next day by Mexico and Europe at 30%, all of which are set to go into effect on August 1.

Japan and South Korea were also on the hit list last week, receiving notices of 25% tariffs.

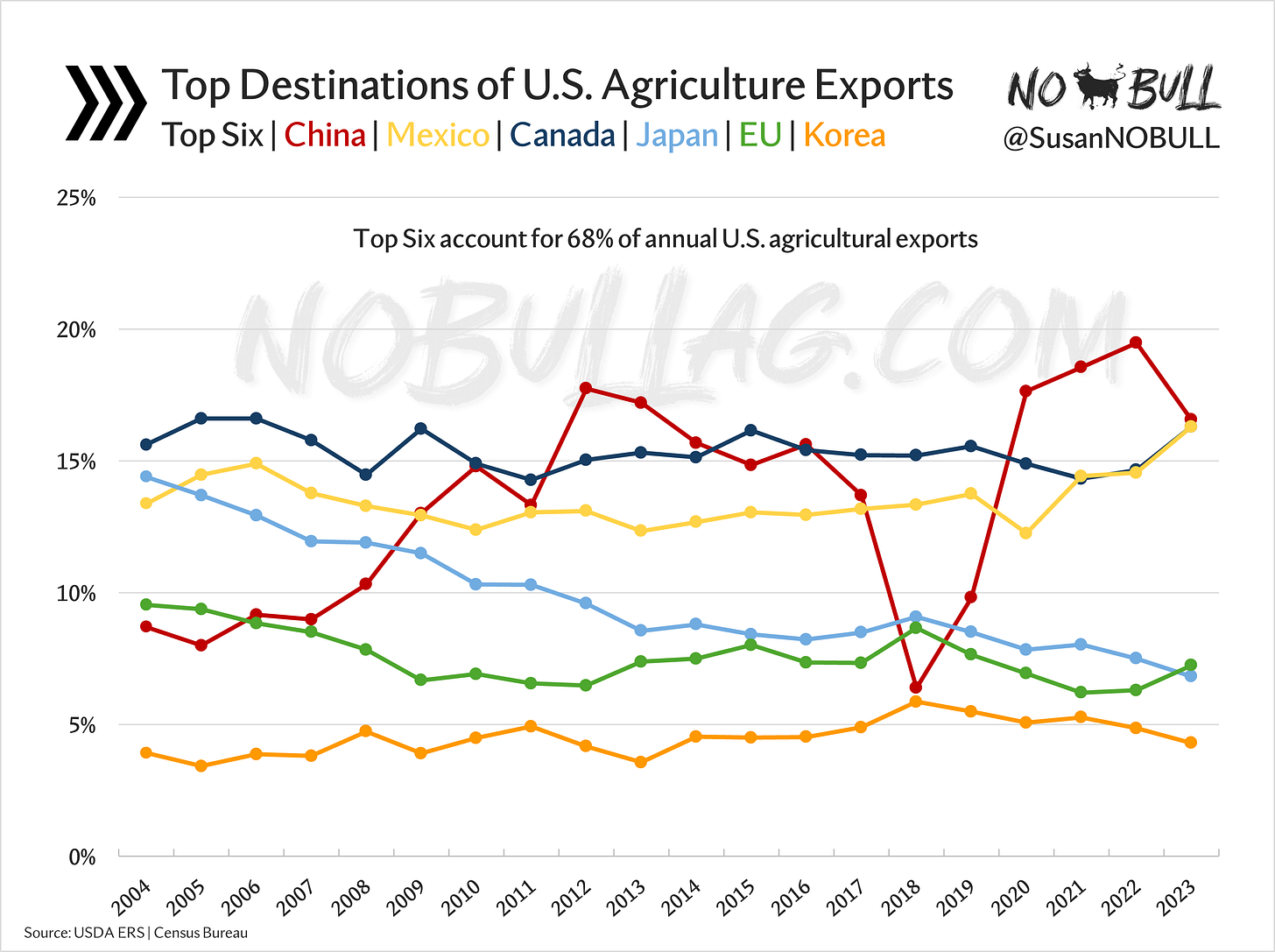

Reminder of the who’s who of US ag trade:

Also worth noting USMCA (Mexico and Canada) goods are exempt, but markets don’t like chaos… EVER.

7 | Policy Matters

Speaking of trade and policy, USDA cut its sky high 2025/26 soybean export projection in Friday’s WASDE - down 70mbu to 1745mbu - citing stronger domestic demand and stiff competition as the reason for the cut:

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.