The Weekender

What’s Inside

« Weekly Winners & Losers, including the answer to the Weekend(er) Teaser

« Funds Fun: The Big Short

« Yay or Nay: A can’t miss update on 45Z

« Headline(s) of the Week: Deal or No Deal

« The Week Ahead: a BBB timeline, the heat is ON, & why tomorrow’s report matters

The Weekend(er) Teaser

Hints:

« It's a ratio

« When this chart spikes or sinks, it impacts our feathered & oinking friends

Answer below

Weekly Winners & Losers

The U.S. Dollar Index dipped below 97 last week for the first time since February 2022, amid rising expectations for Fed rate cuts and renewed uncertainty following Trump’s comments about replacing Fed Chair Jerome Powell.

Down 10.3% year-to-date, the dollar is on pace for its worst first half since 1973.

Here’s an updated look at the U.S. Dollar Index by administration:

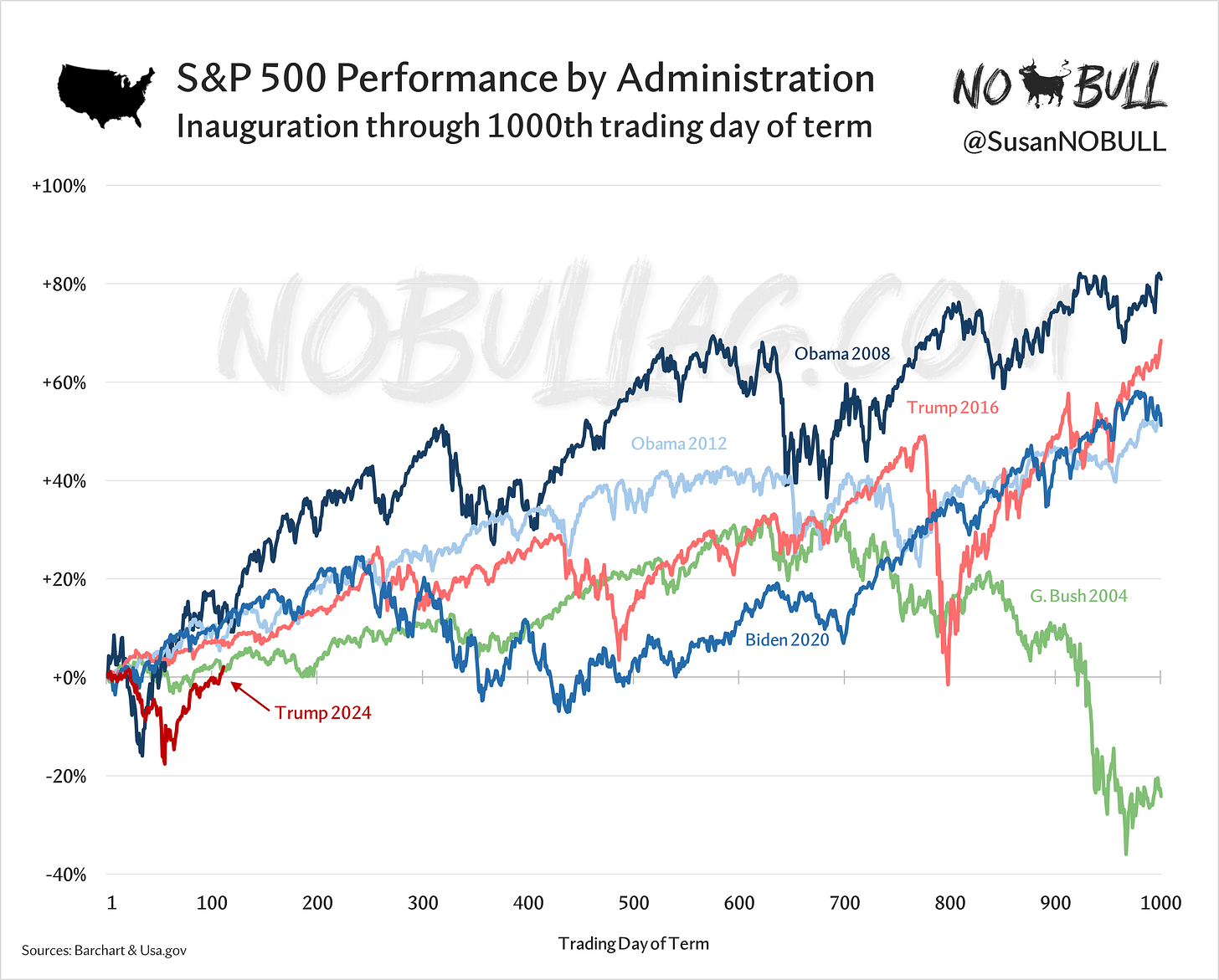

The S&P 500 closed at an all-time high Friday, up 3.4% on the week - now 27.7% off its April lows:

After clawing its way out of April’s Liberation Day hole, the $SPX is up 2% from Inauguration Day levels:

Stocks continue their climb higher while commodities, unfortunately, continue their grind lower:

Speaking of lower - it’s been a race to the bottom for meal and corn in June as both markets continue to make new lows.

30-day chart:

The only notable difference is year-to-date where corn had two umm… ‘rallies’ of sorts, compared with meal that has been steadily marching lower for months.

Year-to-date:

That brings us to the Weekend(er) Teaser, depicting the ratio of meal to corn on a per-ton basis.

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.