Weekly Winners & Losers

In case you were wondering, cocoa futures haven’t let up. The May contract made a new all-time high just shy of $6,500 per tonne on Friday, closing up 11.6% on the week.

For comparison, March corn closed at $157 per tonne… or another way to look at it - cocoa is trading at the equivalent of $165 per bushel.

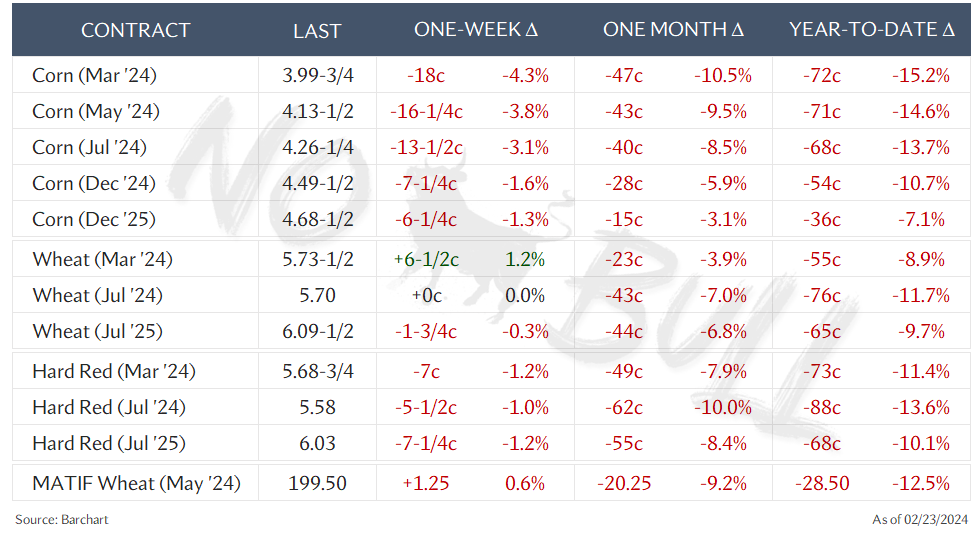

Before we dive into last week’s bloodshed, notice nearby Chicago wheat is living on an island, up 6-1/2c on the week.

March futures continue to climb relative to May as exporters work to fulfill big Chinese commitments, driving the H-K spread to as high as a 6-cent inverse last week.

If you are sitting on old crop SRW and are located near a river facility that is accepting wheat - HERE IS YOUR SIGN.

Check out basis levels for Feb/March delivery - I bet you will be pleasantly surprised.

No, that doesn’t mean put it on a basis contract. The futures inverse and strong basis are screaming, “SELL CASH!”

It was a brutal week in markets as front-month corn dipped below $4 for the first time since 2020.

Friday’s trade was especially painful watching March hover right above $4 for what seemed like an eternity before finally dropping into the 3s just after 10am central.

The market managed to recover a bit before getting high-centered on $4 for the last two hours of trade. ~11:30am until 1:20pm was like watching paint dry (while in pain).

New crop futures made new lows as well, closing just below $4.50 Friday.

Only a handful of days remain in the Feb averaging period:

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.