Weekly Winners & Losers

The Roller Coaster in Review

Keep your head, hands, arms, legs and feet inside the ride at all times. Remain seated in the ride, in the "locked and loaded" position, until it comes to a complete stop and you are instructed to exit.

In today’s update:

Highs and Lows

« Gold🏆

« US Dollar Index 📉

« Crude 🚀

« Corn☹️

« Soybean oil 🪁

Event of the Week = Big, Beautiful RVO 💪

« Turns out it wasn’t the US-China meeting that moved markets last week - it was a Big, Beautiful RVO that will set the tone going forward

Word of the week = FARMERS 🚜

« Love him or hate him, the Trump administration is making farmers great again

Highs and Lows

Gold = Highs

Gold saw its highest close in history Friday, as investors continue to flock to the safe haven amid recessionary fears and now, major conflict erupting in the Middle East.

Front-month futures settled at $3,452.80 to end the week, up 27% year-to-date:

Central bank gold buying and a soaring price have solidified the precious metal’s place as the world’s second-largest reserve asset, surpassing the Euro for the first time in more than a decade:

Chart: Financial Times

Dollar = Lows

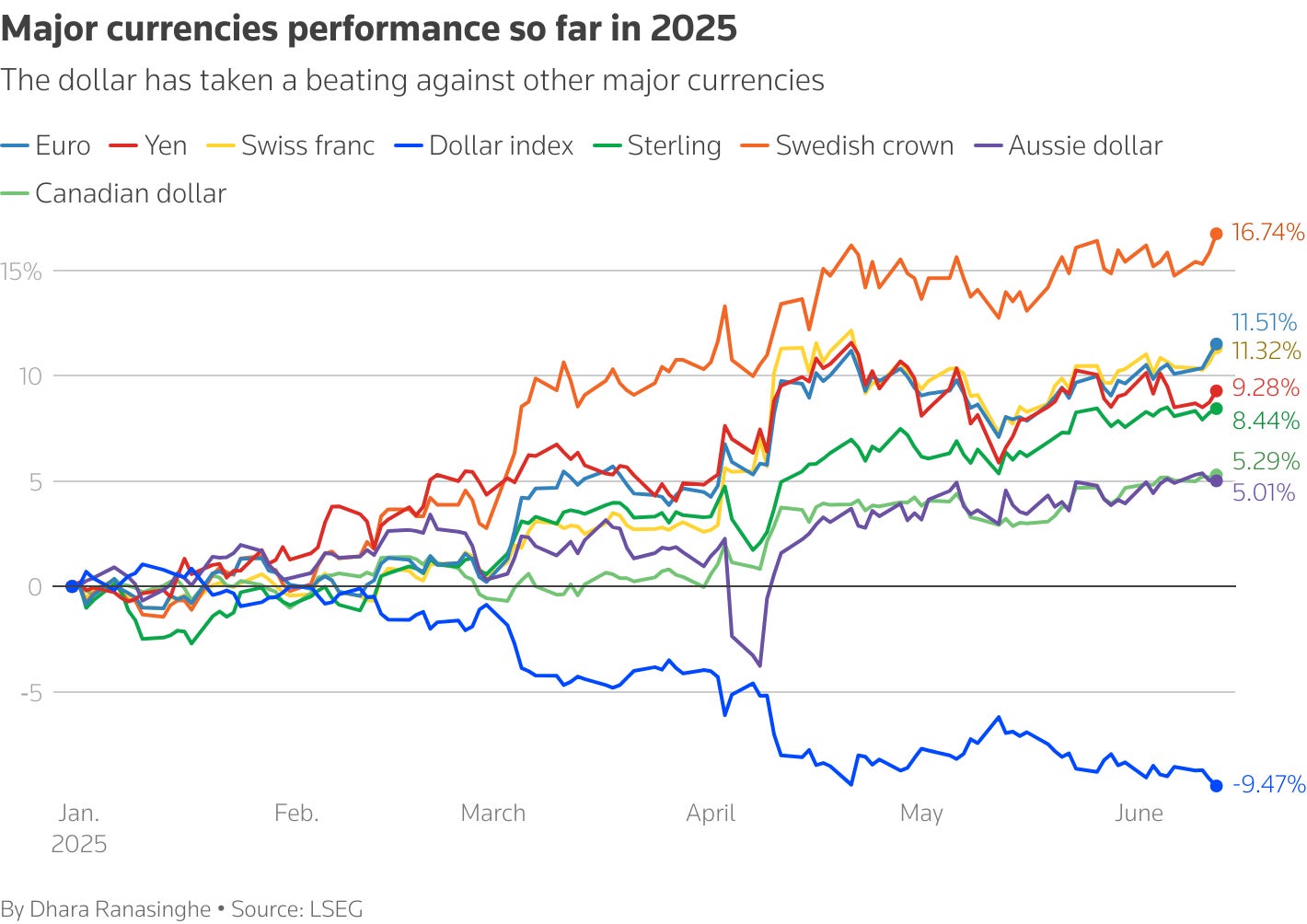

The US Dollar Index fell below 98 for the first time in over three years last week, pressured by trade policy concerns and expectations of future rate cuts.

Three-year chart:

Year-to-date, the dollar is down 9.5% against other major currencies:

Chart: Reuters

Crude oil = Highs

It was a big week for crude oil, up 4% on Wednesday amid US-China trade deal optimism, then surging again Thursday night - marking its largest one-day gain since the aftermath of Russia’s invasion of Ukraine - as conflict erupted in the Middle East.

Easy to see Thursday night’s spike (30-min chart):

Yee haw!

Canola = Highs

New crop canola has been quietly marching higher, supported by dry conditions across the Canadian Prairies and improving Canada-China relations, before rallying sharply on Friday, following crude and bean oil higher:

Corn = Low {Spirits}

Technically, corn didn’t make new lows last week - closing down just 2 cents - but sentiment remains weak after a friendly WASDE and escalating conflict in the Middle East failed to spark a meaningful rally.

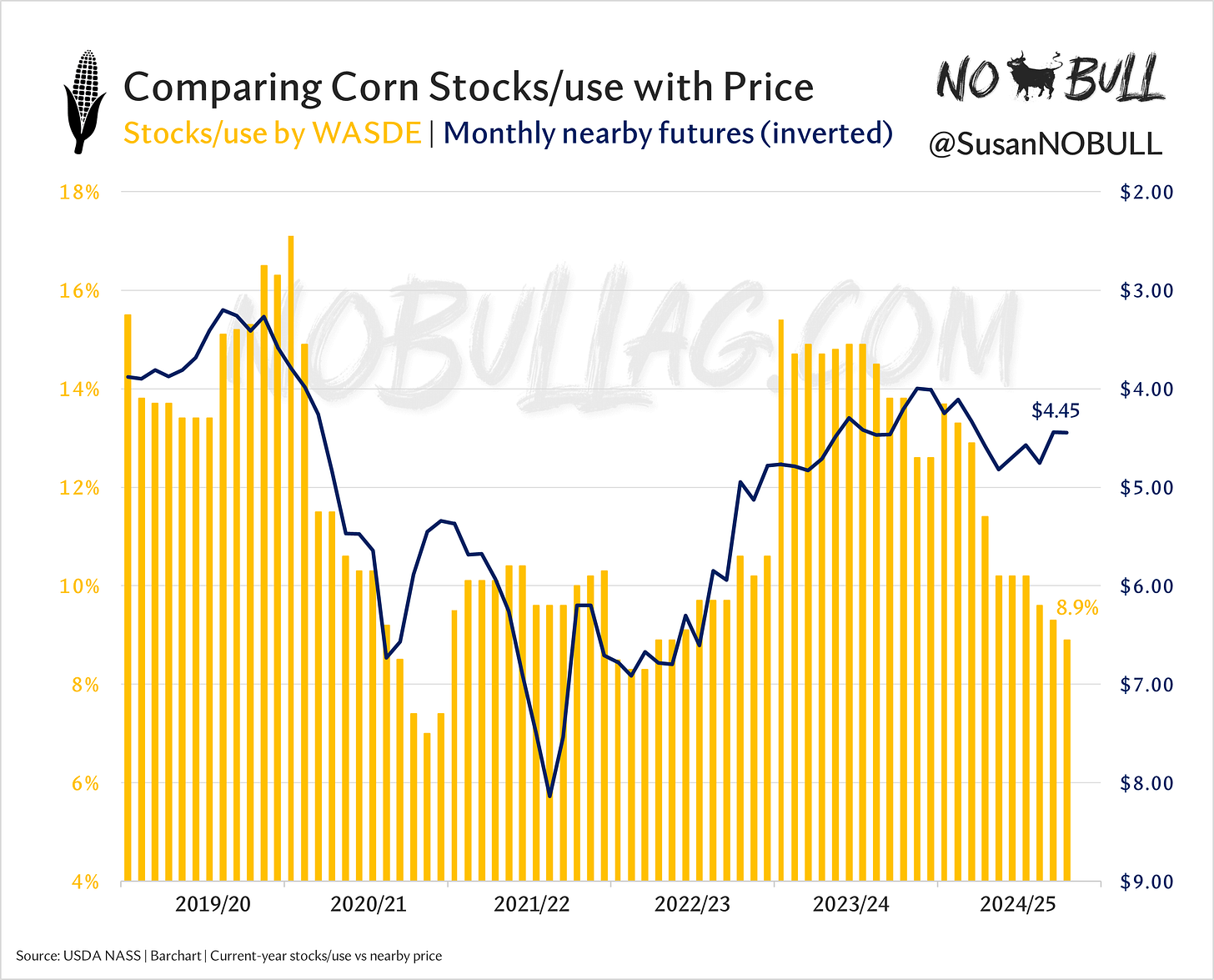

Near $4.45 - July remains stuck near its recent lows:

USDA raised old crop corn exports for the 4th report in a row on Thursday, reducing 2024/25 ending stocks to 1.365 billion bushels at a 8.9% stocks/use ratio.

The market was unimpressed though, rallying a whopping 1-1/2 cents by the close, even though stocks/use sits at its tightest since January 2023 - when nearby futures were nearly $7!

Today’s $4.45 is a FAR cry from $7.00… so, what gives?

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.