I decided I would wait until today to send an early Weekender ahead of the holiday weekend, plus I was waiting on the USTR to release its decision on Section 301 (Chinese vessel fees) before calling it quits for the week.

In other news, I am excited to announce the first two guests who will be joining me on stage at AgriNext in July:

Scott Gerlt - Chief Economist for the American Soybean Association

Karen Braun - Global Ag Columnist at Reuters

I will be announcing more details next week and registration will open in May.

Checking in on Trade War 2.0

Trade tensions have been refreshingly calm this week with no new escalations blasted to the world via Truth Social and ongoing negotiations with several countries… except China.

Both the U.S. and China are in an impasse with a mutual refusal to initiate talks. The U.S. is waiting on China… and China is demanding the U.S. remove tariffs before talks can begin.

Yesterday, China appointed Li Chenggang as its new trade negotiator, replacing Wang Shouwen, who helped negotiate the 2020 U.S.-China trade deal, while also urging the U.S. to designate a point person for future talks.

China's appointment of a new trade negotiator is positive, but tensions persist in Trade War 2.0.

China's Foreign Ministry, via spokesperson Lin Jian, criticized recent White House claims of 245% tariffs (this appears to be 145% on top of a few products with existing 100% levies) on Chinese goods, signaling ongoing frustration.

Translation:

Foreign Ministry Spokesperson’s Remarks on U.S. Statement that China Faces up to 245% Tariffs

Q: On April 15 EST, the White House issued a Fact Sheet about Section 232 investigation on its website, saying that China faces up to a 245 percent tariff on imports to the United States as a result of its retaliatory actions. Do you have any comment on this?

A: We noted relevant reports. You should probably ask the U.S. side as to how they arrived at that figure. China has made it very clear that the U.S.’s extortionate tariff hikes on China have become a numbers game, which economically does not make much actual difference anymore, except further demonstrating how the U.S. weaponizes tariff to coerce and bully others.

Tariff and trade wars have no winners. China does not want to fight those wars but neither are we afraid of them. If the U.S. continues to play this numbers game with tariffs, it will simply be ignored. But if the U.S. continues to inflict actual damage on China’s rights and interests, China will respond with resolute countermeasures and will stand our ground to the end.

Putting China’s appetite for soybeans in perspective

China is set to import 109mmt (4 BILLION BUSHELS) of soybeans this marketing year - more than 1.5X the quantity of the other 60 importing countries COMBINED.

Since 2008, China has imported more beans than the rest of the world combined, maintaining a 60% share of global imports since 2009.

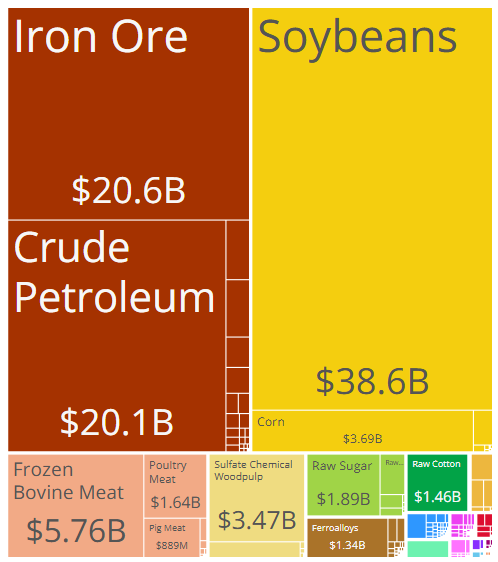

Soybeans, this crowd’s favorite oilseed (sorry, Canada!), are central to the U.S.-China trade dispute as they are China’s largest import from the U.S. by value.

China’s imports from the U.S. (2023):

Source: OEC, 2023

Unfortunately, their imports of Brazilian beans dwarf trade with the U.S. Quite the contrast between imports from each nation!

China’s imports from Brazil (2023):

Source: OEC, 2023

Dollar down

The US Dollar Index continues its post-Liberation day slide, hovering near 100 for a full week now as markets grapple with the global economic implications of the U.S.-China Trade War 2.0.

Although trade wars are not fun for agriculture, we are all breathing a collective sigh of relief as a weaker dollar bodes well for exports (except when there is a triple-digit tariff in place).

The United States has spent the better part of three years fighting the headwind of a stronger dollar, making U.S. bushels more expensive for foreign buyers:

In 2025, most major currencies have strengthened against the U.S. dollar, with significant gains in the past 30 days, driven by escalating trade tensions from widespread U.S. tariffs on all trading partners.

Don’t cry for me Argentina, just sell your soybeans

Mind the gap

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.