In today’s update:

Top Five: Going for the gold, racing bean:corn ratios, lower lows on the Mississippi, mind-boggling bean spreads & bean oil doin’ its thing trading like an energy

Funds Fun: meal’s been on a ride, plus year-to-date cumulative changes by commodity

Headline(s) of the Week: Neste's Singapore diesel line shuts over equipment failure, raising global supply disruption concerns & Hedge Fund Farrer Raises $500 Million to Trade Agriculture

The Week Ahead

Join No Bull in Panama this January

Only a few spots remain! Visit NoBullAgVentures.com or reply to this message for additional information.

This Week’s Top Five

Going for the Gold

Gold hit an all-time high on Friday at $2,730 per ounce:

Gold is now up more than 30% year-to-date, the best performer among all asset classes:

(check out commodities in light green, last place in 2020, first in 2021 & 2022, last again in 2023 and second to last so far in 2024)

The surge in gold can be attributed to several factors including ongoing geopolitical tensions, central bank reserve purchases, and the 2024 U.S. presidential election. In combination, these events have created a strong demand for gold as both a safe haven and a promising investment.

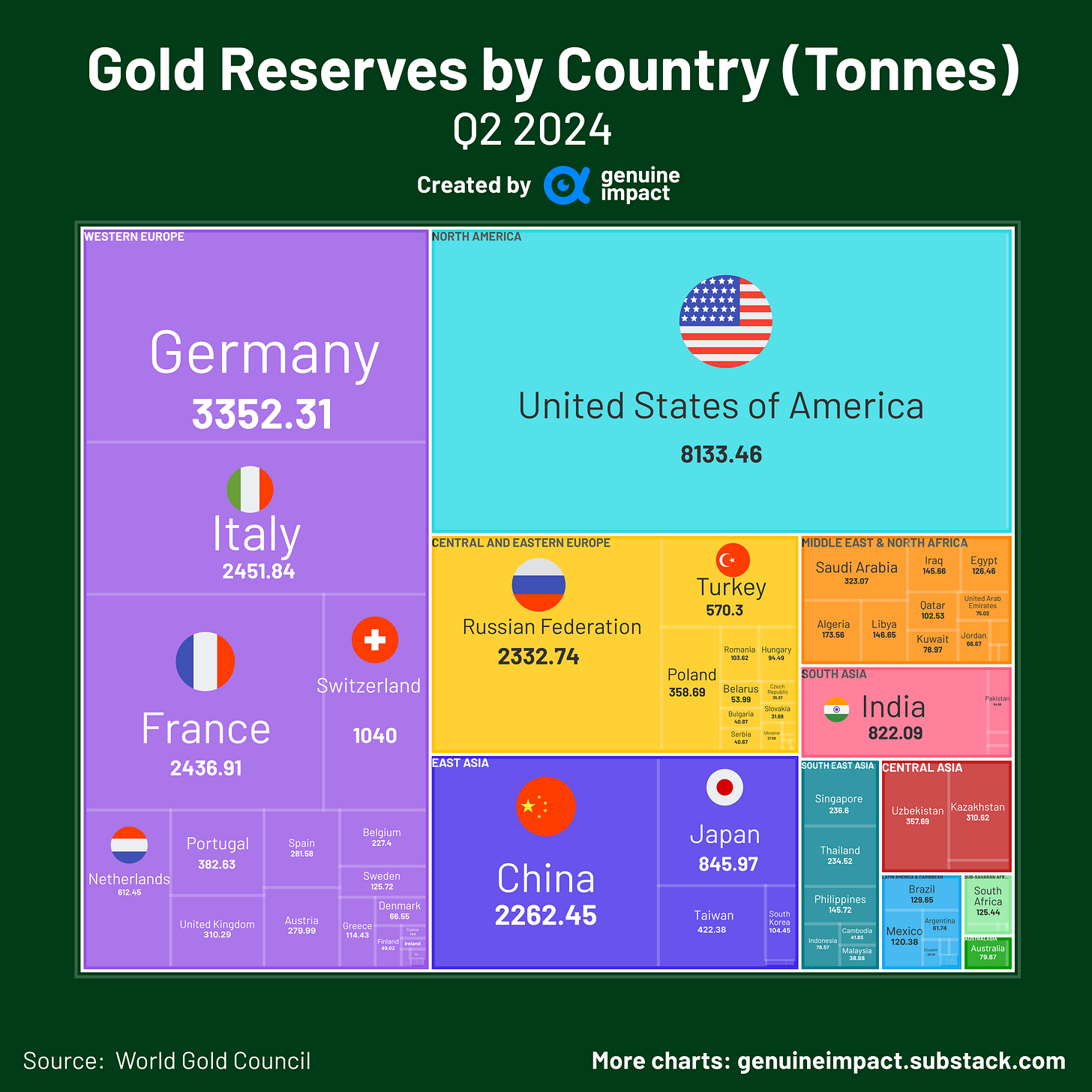

According to the World Gold Council, central banks purchased more than 1,000 tons of gold during each of the last two years - a threshold that had never been crossed previously.

The People’s Bank of China has been the largest single buyer of gold recently with 18 consecutive months of purchases from 2023 into mid-2024.

The United States continues to sit on the largest pile of gold in the world at 8,133.46 tonnes - more than Germany, Italy, and Russia combined.

A little rough math:

U.S. reserves of 8,133 tonnes = 261.5 million troy ounces

Worth $714 billion at today’s prices….

(if you’re thinking ‘wow, that’s a lot’… don’t)

If the U.S. would cash in its gold reserves today we could pay off a whopping 2% of the current federal deficit - WOOF.

Racing Ratios

The recent collapse in the bean market has left Dec 24 corn at its largest advantage over soybeans in more than one year.

Meanwhile, Dec 25 corn continues to have a strong edge over 2025 new crop bean futures:

Lower Lows

Live look at the Lower Mississippi:

Conditions on U.S. rivers are bad and getting worse as mounting precip deficits (and a continued dry outlook) have left the Mississippi right back where it was prior to the post-Helene bump.

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.