Weekly Winners & Losers

Some of last week’s biggest winners were in markets we rarely talk about but they are commodities that we consume plenty of: cocoa, orange juice and sugar.

On Tuesday, cocoa hit new highs as tight supplies and strong demand have rallied US futures 43% since the start of the year.

The return of El Niño bringing prospects of hotter, drier weather in top-producing countries is also threatening to make tight supplies even tighter.

Global benchmark futures in London sit at 46-year highs due to production concerns in West Africa, where 70% of chocolate's main ingredient is sourced.

The West African nation of Ghana has increased priced paid to farmers during the 2023/2024 season by over 63% in an effort to boost farmers' income and prevent cocoa beans from being smuggled to neighboring countries with higher prices.

Farmers will receive 20,943 Ghana cedi ($1,837) per tonne, the highest price paid to farmers in the region in over 50 years.

Orange juice continues its run as well with futures making a new all-time high on August 31 as Hurricane Idalia barreled across Florida.

To put this rally in perspective (50-year chart):

A series of hurricanes and disease pressure have left US production at a nine-decade low, doubling prices in two year’s time.

And last in our list of top-performing softs: sugar - #11 to be exact, the world benchmark for raw sugar trading (#16 = US futures).

Again, El Niño poses a threat to production in some of the world’s top suppliers like India who is expected to ban sugar exports for the first time in seven years as a lack of rain has cut crop prospects.

Before we get into weekly performance for ags - check out this year-to-date chart (might want to grab a tissue before looking too close):

October feeders made another new all-time high on Friday at 259.65, up 25% on the year.

To put this year’s rally in perspective - check out this 20-year chart:

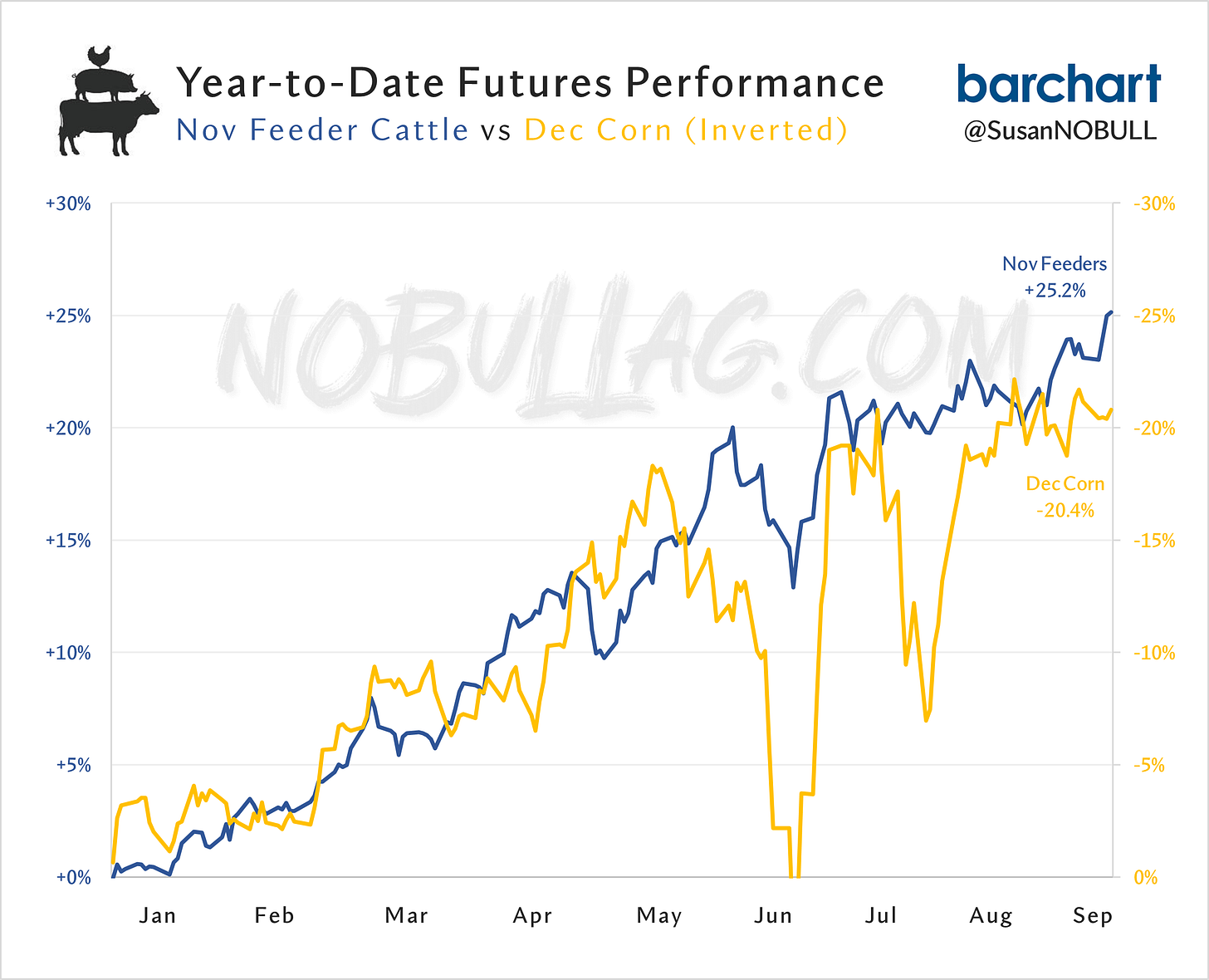

The inverse relationship between feeders and corn remains intact:

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.