Don’t miss the boat!

Registration deadline for the Panama Canal is Friday! For more information, reply to this email or visit NoBullAgVentures.com.

There is still plenty to talk about in my series of deeper dives into the policy and administration changes ahead.

It has been a hot minute since I have touched on other aspects on the market however, and considering we have a WASDE release on Tuesday, today’s update will revert to the normal format.

In today’s update:

Top Five:

1 | King corn: Export sales, strong like bull

2 | Fair share: all about the stocks

3 | The 16mmt gorilla: Where you at, China?

4 | Soy complex conundrum: winners & losers

5 | How low can the Mississippi go? Yes, again.

Headline of the Week:

« US lawmakers seek crackdown on Chinese used cooking oil imports over fraud concerns -Reuters

« UCO import records continue to fall

« WHAT IN THE HELL ARE WE DOING?!

This week’s HOT Five

1 | King corn

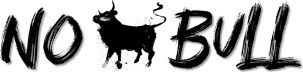

U.S. corn export commitments continue to run miles ahead of the pace needed to hit USDA’s current 2,325 million bushel full-year estimate.

While bullish (↑ exports = ↓ carryout), this has been a known for a while now. USDA kicked the can down the road in November, but should revise their estimate higher in next week’s Dec WASDE.

(Ethanol could potentially see an increase too. Average estimates call for a ~30mbu drop in ending stocks near 1.9Bbu)

How we got here:

Black Sea drought, 10% YoY reduction in Brazil’s crop, near-20% YoY reduction in Brazilian exports (combo of smaller crop, low water, & increased domestic ethanol demand), & ample U.S. supplies.

Thing to watch going forward:

Trade relations, currency relationships, 24/25 & South American crop development.

2 | Fair share

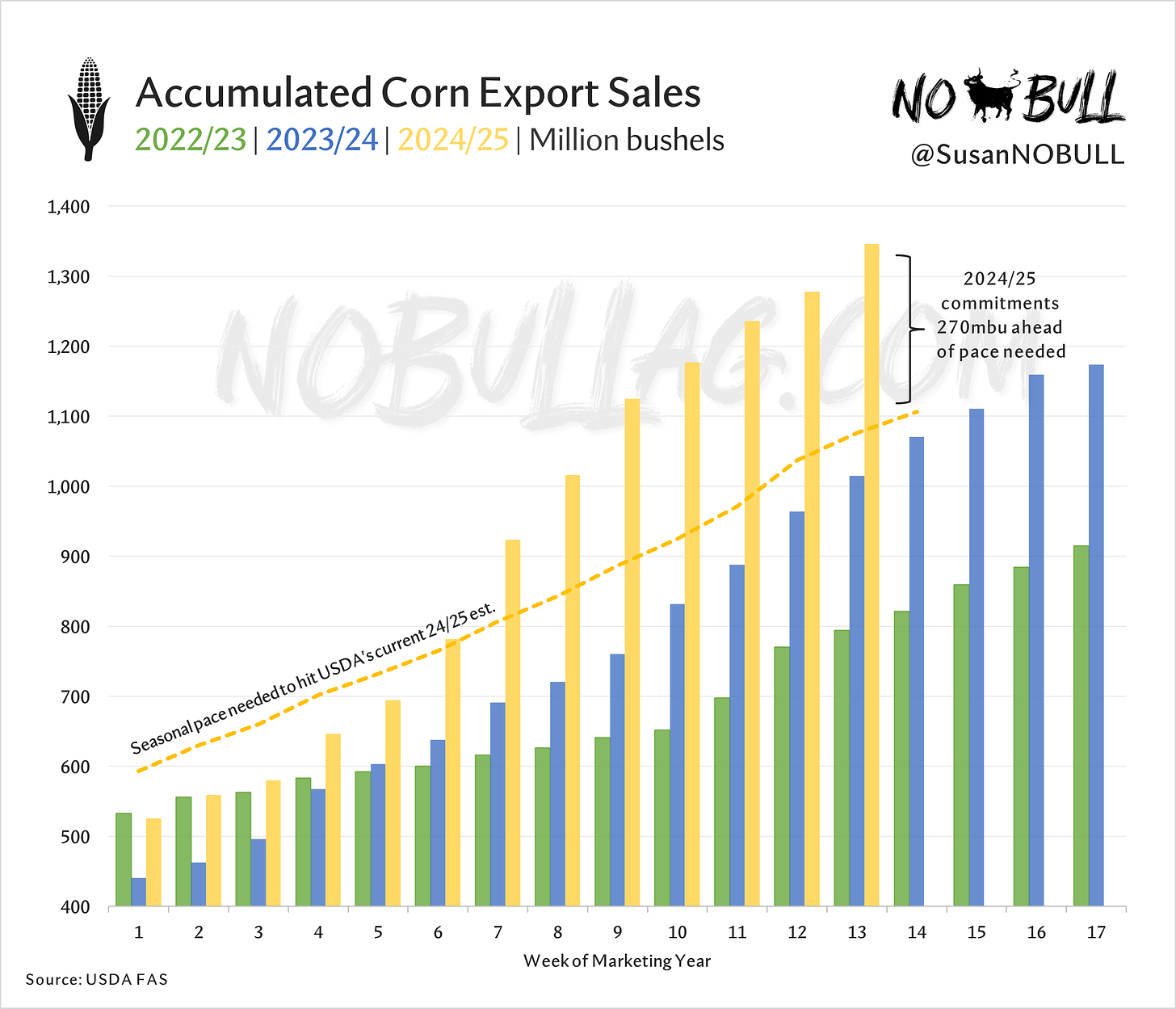

Despite remaining the world’s largest corn exporter, the U.S.’s dominance has been challenged by rapid export growth from Brazil, Argentina, and Ukraine in recent years.

20-year change in annual corn exports:

« U.S. +9%

« Argentina +280%

« Ukraine +833%

« Brazil +983%

The U.S., Brazil, Argentina, and Ukraine account for more than 85% of world corn exports each year, leaving their weather and subsequent production as driving force in the market.

So far in 2024/25 we have been making U.S. corn exports great again and there is no better way to illustrate the catalyst behind our new-found resurgence in business than the chart below.

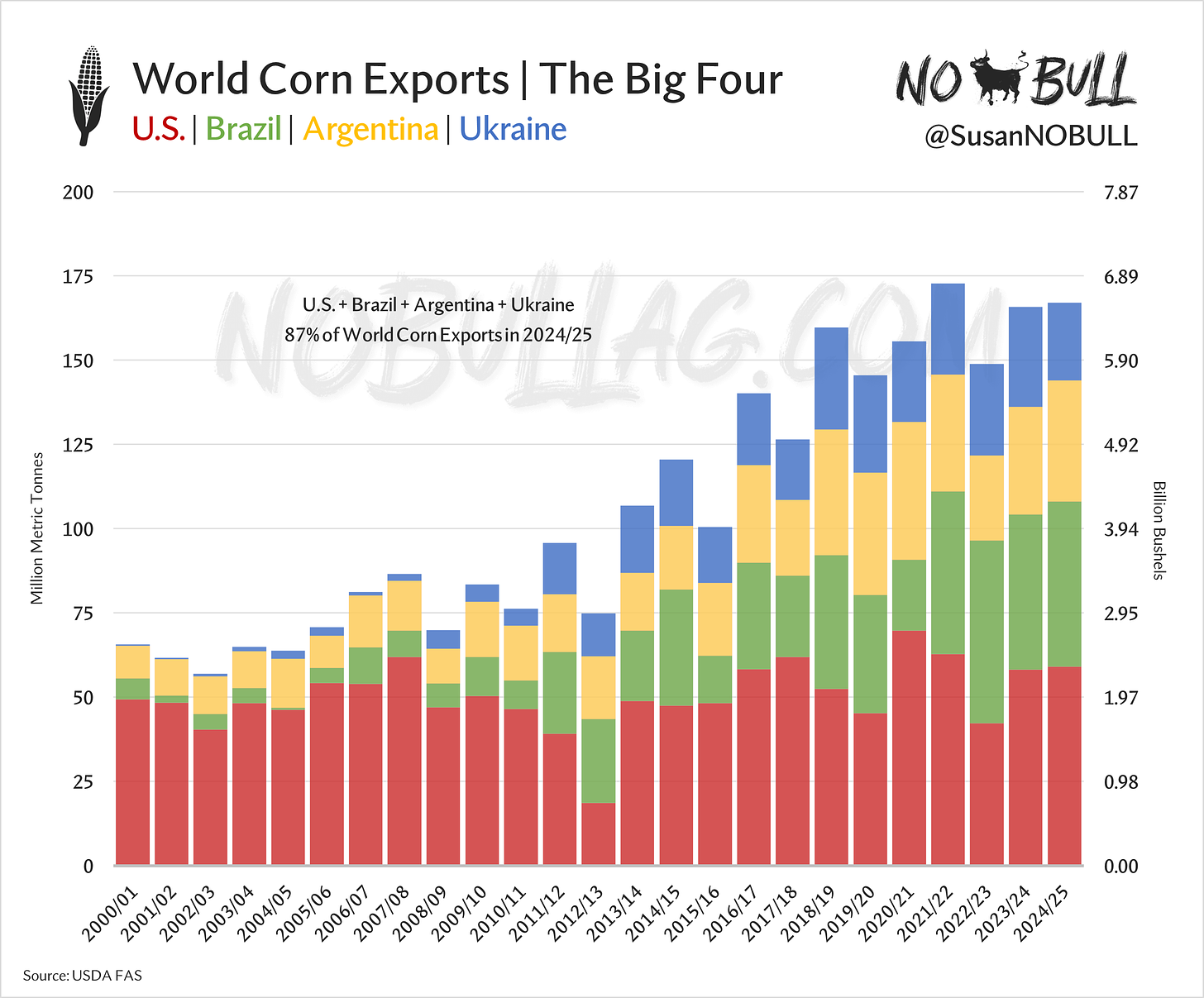

Stocks/use among the four major world exporters sits at 9.4% in 2024/25….

Strip out U.S. stocks and that number drops to 3% - the lowest stocks/use in Brazil+Argentina+Ukraine combined since the 80s.

3 | The 16mmt gorilla

Before you get too excited and raise all your corn offers to $6, let’s talk about the other issue… China.

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.