The Weekender

May 11

Register in May to save $100 off admission to Summit 24!

For event details, agenda, and registration, visit NoBullSummit.com.

Weekly Winners & Losers

This weekend update will be shorter than usual, after yesterday’s marathon May report recap.

First off, I want to clarify something from Wednesday’s HOT TAKE.

Thanks to a reader for pointing out that the uptick in China’s UCO exports to Singapore are likely related to energy giant Neste doubling its renewable diesel production capacity in Singapore last year, with plans to expand into SAF production in short order.

Dec corn finished the week up 9 cents (after Friday’s 12-cent gain), for a close at $4.92 on Friday.

This is new crop’s highest close since January 10, after dipping to a low of $4.46 in late Feb before climbing out of a near-50-cent hole in the weeks and months to follow.

The pressure into February and March came as markets began realizing new crop ending stocks were headed in the direction of 2.5bbu+.

It wasn’t until an acreage surprise (to the downside) in late-March followed by a rallying wheat market and a friendly WASDE that we could muster up a close above $4.90.

CZ24 continues marching along the same path of CZ14, which is especially evident after I offset CZ14 by 30 trading days in the chart below:

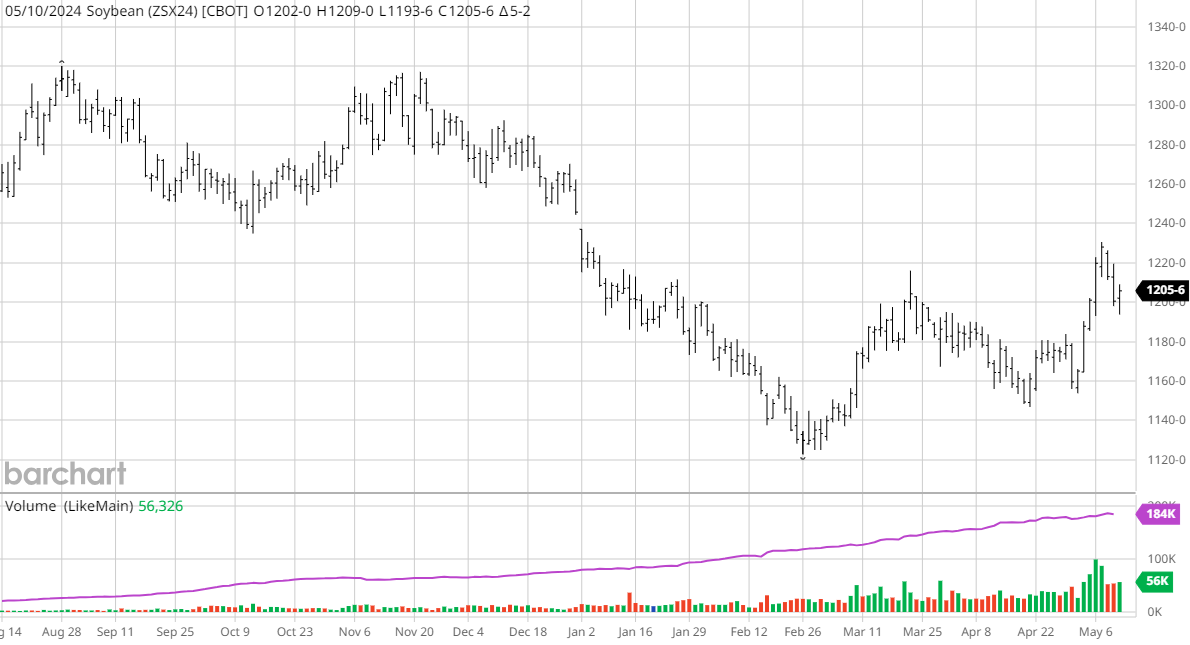

New crop beans are a bit of a different story compared with corn.

If Nov had not closed up 5 cents Friday, beans would have lost ground this past week as double-digit losses on Wednesday and Thursday wiped out Monday and Tuesday’s gains.

New crop performance since the March acreage report:

Comparing US & Brazil new crop production projections:

Related - China has exactly 0.0 bushels of US new crop beans on the books:

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.