This is the LAST WEEK to register for Summit 24!

Agriculture is CHANGING.

Buy your ticket and reserve a seat before this plane takes off!

Click HERE for more info & to register.

Weekly Winners & Losers

What a wild week.

We started with a bang on Monday as markets rallied on deteriorating early-August forecasts. New crop corn jumped 10 cents for its largest one-day gain in 8 weeks. New beans had an even more impressive move - up 33 cents for their largest one-day gain in more than a year.

Unfortunately we did not end the week in such fashion. In fact, Friday was the near-opposite of Monday as corn closed down 11 cents and beans tanked 31.

Dec corn did close higher 4 days in a row last week though for its longest “winning” (I use that term loosely) streak since the first week of May… but then gave 2/3rds of it back Friday, finishing the week up 5 cents at $4.10.

Beans were headed for decent gains on the week before Friday’s meltdown. Nov managed to close 12 higher in spite of late-week losses, just below the 10.50 mark.

Both corn and beans started out weaker in overnight trade Thursday into Friday, with losses accelerating into the 830am open.

The selling in beans picked up additional momentum mid-morning too, as soybean oil plummeted into new lows.

When I say ‘plummeted’ I mean PLUMMETED for a 5.3% loss on the day, closing near the new contract low of 41.79.

Soybean oil’s demise came as the U.S. Court of Appeals for the District of Columbia Circuit issued a judgement that appears to side with dozens of small petroleum refiners who challenged the EPA’s blanket denial of their small refinery exemptions in a 2022 case.

Although the opinion remains sealed, it suggests a win for small refineries. The market (bean oil especially) tends to have outsized reactions to news like this as the Court is effectively giving certain refiners a free pass re Renewable Fuel Standard compliance.

Less gallons of biofuels required to blend = less demand.

Soybean oil is super sensitive to ANY headlines (and rumors, for that matter) related to biofuel policy.

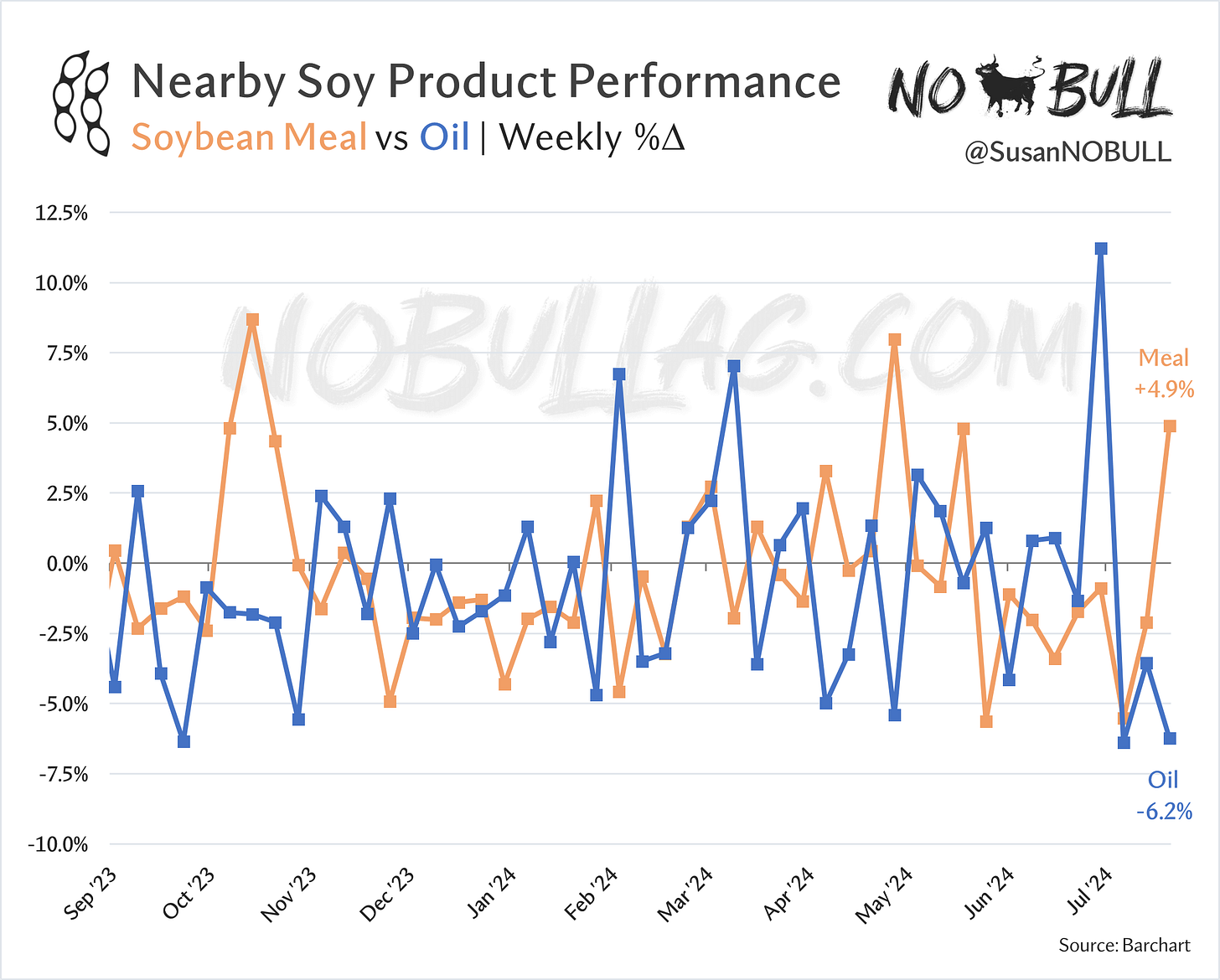

The inverse relationship between soybean meal and oil remains intact as nearby meal rallied nearly 5% last week while oil wiped out with a 6.2% loss.

Same thing, different view:

Last week’s big divergence in meal and oil performance put the whammy on oilshare - down 2.7% for its lowest close in a month.

New crop meal had a strong performance Monday (bolstered by hot/dry forecasts) and Thursday (strong new crop export sales):

Last week’s new crop meal sales were a whopper at 521k tonnes - the largest single week of sales since October 2022 (to put it in perspective: ~24,000 truckloads).

This boosted cumulative new crop commitments to 1.5mmt - the largest since 2015/16.

Looking at the chart above you’d think we should be high-fiving each other based on strong export demand… but don’t get too carried away just yet.

As additional US soy crush capacity continues to come online (driven by BEAN OIL demand) we have 11 million short tons of additional annual meal production to contend with over the next three years.

When you have EXCESS you EXPORT and that is just what US processors will have to do in order to clear the additional tonnage we will be cranking out over the next few years.

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.