In this weekend’s update

Week in Review: Energy meltdown, soy oil strength, new crop nuisances, a premium collapse in wheat, plus funds fun: putting the past 12 months in perspective

Headline Wars: A quick guide to the latest in US-China relations

A “big, beautiful” budget bill: Don’t get caught up in the headlines - here’s what it really means for ag

Weekend(er) Teaser Revealed: A lesson in Brazilian corn & the implications for US markets

The Week Ahead: Four market drivers

Weekend(er) Teaser

Hints:

Brazil

Corn

Keep reading to reveal the answer and the implications for US corn.

Week in Review

It was a rough week for energy markets as OPEC+ members agreed to expedite the unwinding of voluntary production cuts.

Front-month Brent and WTI crude closed down 6.9% and 7.5%, respectively:

Heating oil finished the week at $1.99, its first close below $2 since August 2021:

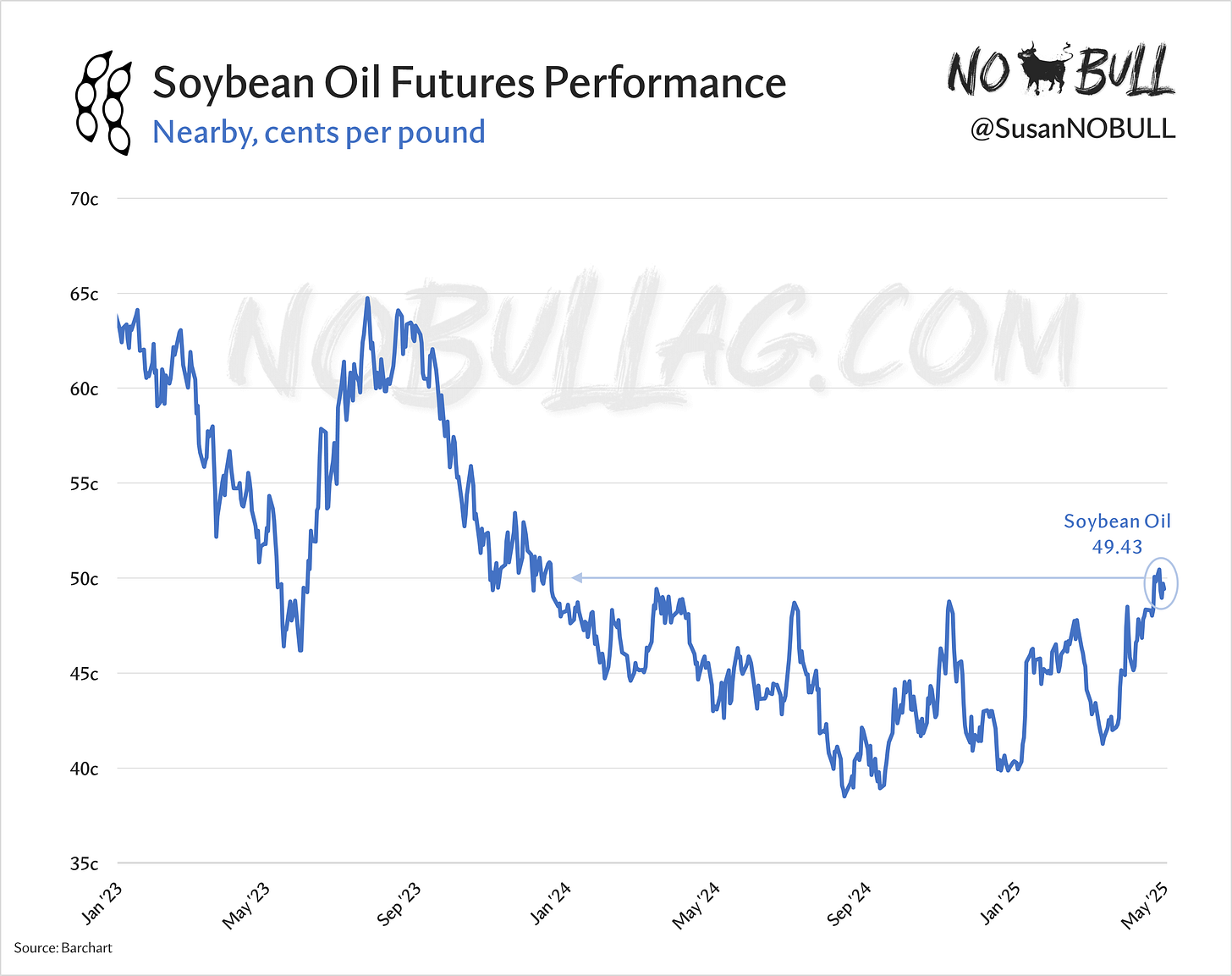

Bean oil continues to hold its own despite the continued weakness in energies, maintaining its position near 50 cents for the longest streak since since late 2023:

Speaking of position, managed money increased their net long in bean oil for the 5th consecutive week, reaching 63,387 contracts in the week ending April 29.

This net long is one of the most bullish stances funds have taken on bean oil in the past few years:

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.