Ready for an AgVenture?

The full itinerary and trip deals are out! Click HERE to download or visit NoBullAgVentures.com.

Worth a look!

Attention all merchants, producers with a desire to learn or anyone looking to understand fundamental aspects of risk management in grain - this is for you!

My friends at The Agricultural Scholarship Centre will begin another Merchandising Skill Building Class in December.

This is a free scholarship program; 27 weeks in duration. It includes a few days of travel each month, a weekly class conference call and resources to complete White Commercial Corporation’s Grain Merchant Certification.

This is a fantastic program with some of the most fantastic people in this industry.

I highly recommend it for anyone interested in merchandising or simply learning (as an elevator or even large producer) how to navigate highly volatile futures markets and come out on the other side in the black time and time again.

I was taught this set of merchandising principals nearly two decades ago and it has served me well!

Visit ASCApply.org or contact my friend Scott Hardy at hardy@ascapply.org. They are in the final few days of registration, so don’t delay.

Weekly Winners & Losers

All good things must come to an end and that is exactly what happened to soybean oil’s 8-day, 14% rally the end of last week.

Oil getting frothy mid-week especially as we traded above 44 for the first time since July, palm put in a reversal and energy markets have weakened.

Thursday, Dec futures took a 2.8% nosedive followed by another 1.3% loss on Friday, finishing up just 2.4% on the week.

Soybean oil: Rallies 14% over 8 days in its biggest winning streak since April 2022

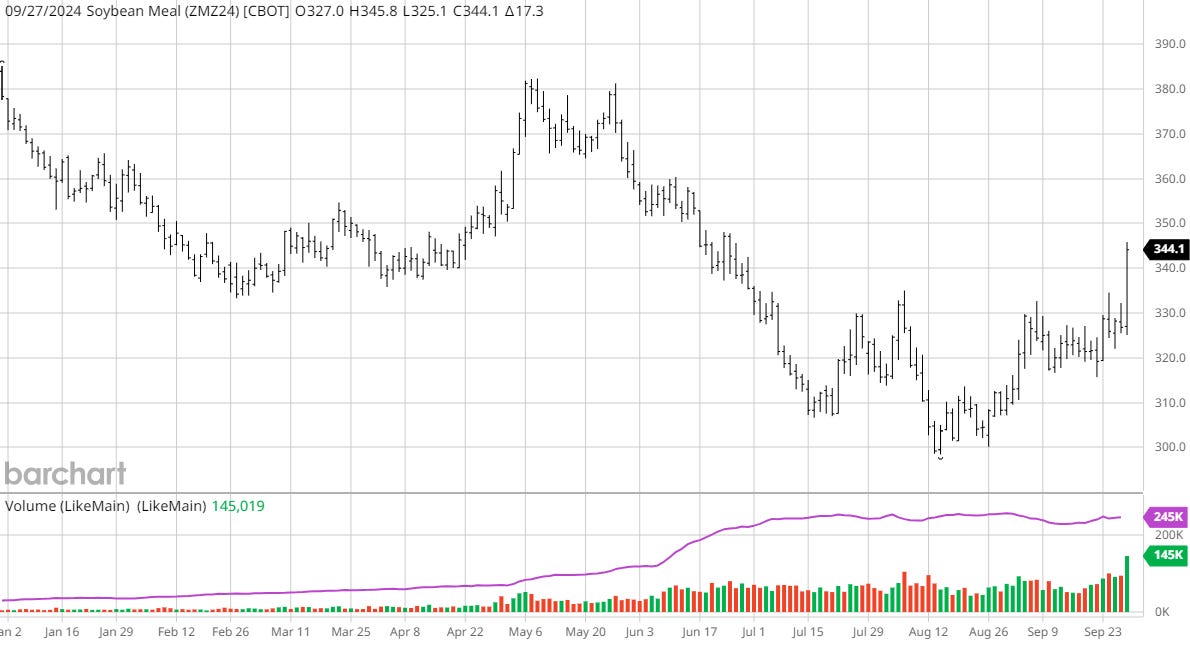

Soybean meal:

In fact, Friday’s rally was meal’s largest one-day move since June 2023 and in the top 10 of largest single-day rallies of the past decade.

Friday’s move was a combination of a couple things.

First, Helene hit the Florida Gulf Coast, cutting power to a handful of US crushers amid a time cash meal markets were already too tight for comfort.

Additionally (and likely the bigger driver) was a large meal exporter caught short September barges, leaving them to run CIF bids to new highs without an offer in sight.

This resulted in a massive one-day move that is yet again one more display of the nine lives of the meal market.

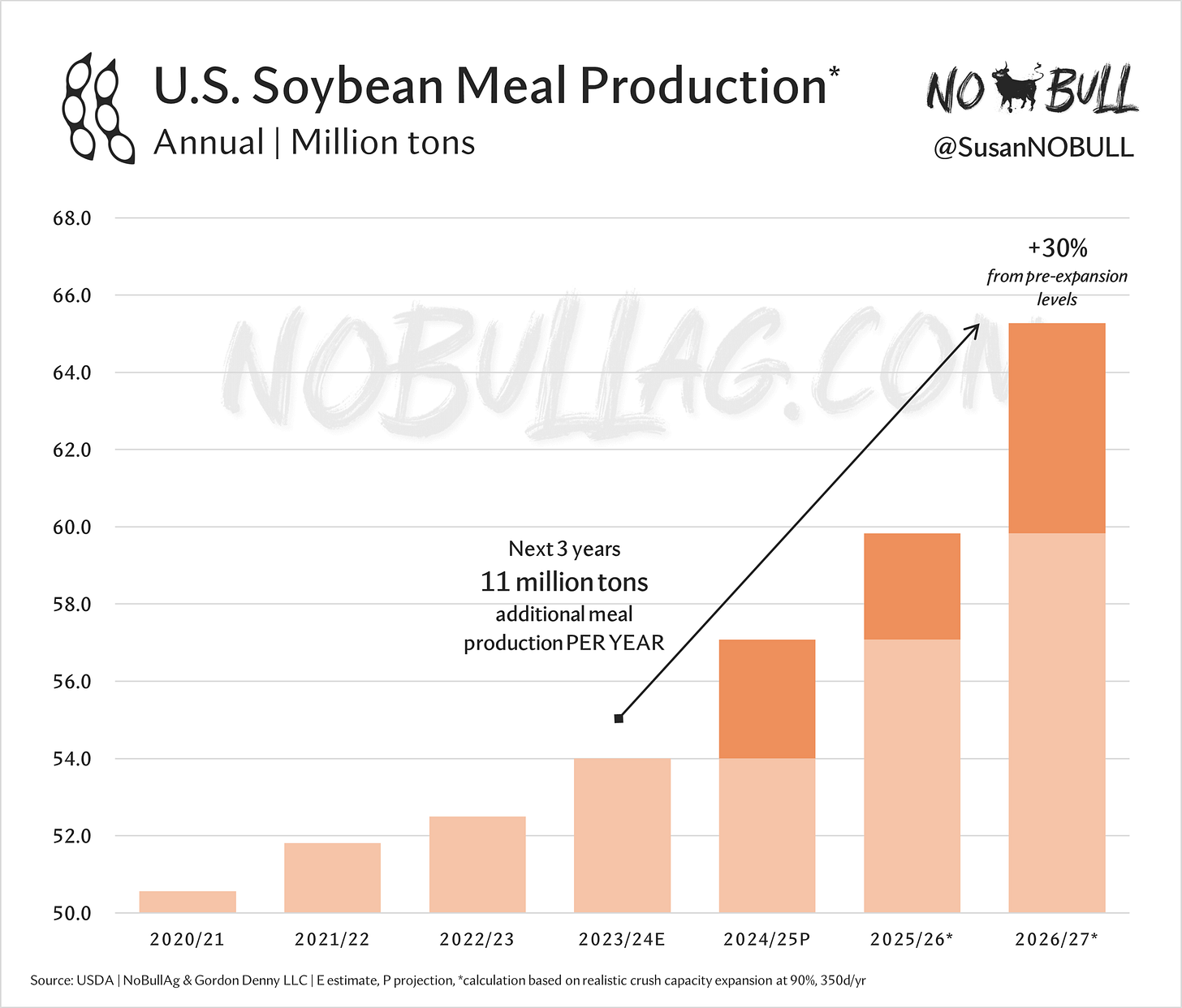

For months upon months now (off the cuff, let’s say back to pre-Argentina 22/23 drought), the meal market should have died especially as US crushing capacity continues to expand (Brazil is cranking out record amounts of meal, too).

And for months upon months now we have seen one oddball event after another keep it propped up like Weekend at Bernie’s.

It is fascinating to say the least, especially as we are set to increase production by 30% over the next three years.

Back to bean oil - Friday brought us an export flash we rarely see: 20,000 tonnes of soybean oil sold to South Korea for the 2024/25 marketing year.

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.