AgriNext | July 23-24 | St. Louis

No Bull is pulling out all the stops at AgriNext with an unbeatable lineup representing companies and associations from all facets of agriculture and biofuels, with speakers and attendees from across eight nations in 2025!

If you are looking for one event covering today's biggest topics from tariffs and trade to 45Z, policy, MAHA, and South American insights - look no further.

Visit NoBullAgriNext.com for details.

There’s still time to partner with AgriNext in 2025! Every opportunity includes at least one event registration. Reply to this message for information.

Weekend(er) Teaser

Can you correctly identify the green and yellow lines?

Hints:

« Brazil

« Ethanol

Answer below!

Last Week, Play by Play

It was another roller coaster week of headlines and Truth Social posts.

Friday (of the week prior), Trump accused China of violating its agreement with the US (I was unaware that we had an official agreement yet…):

Monday, in response, China said in a statement, “the U.S. government has unilaterally and repeatedly provoked new economic and trade frictions, exacerbating uncertainty and instability in bilateral economic and trade relations."

Soybeans closed 10 lower on Monday.

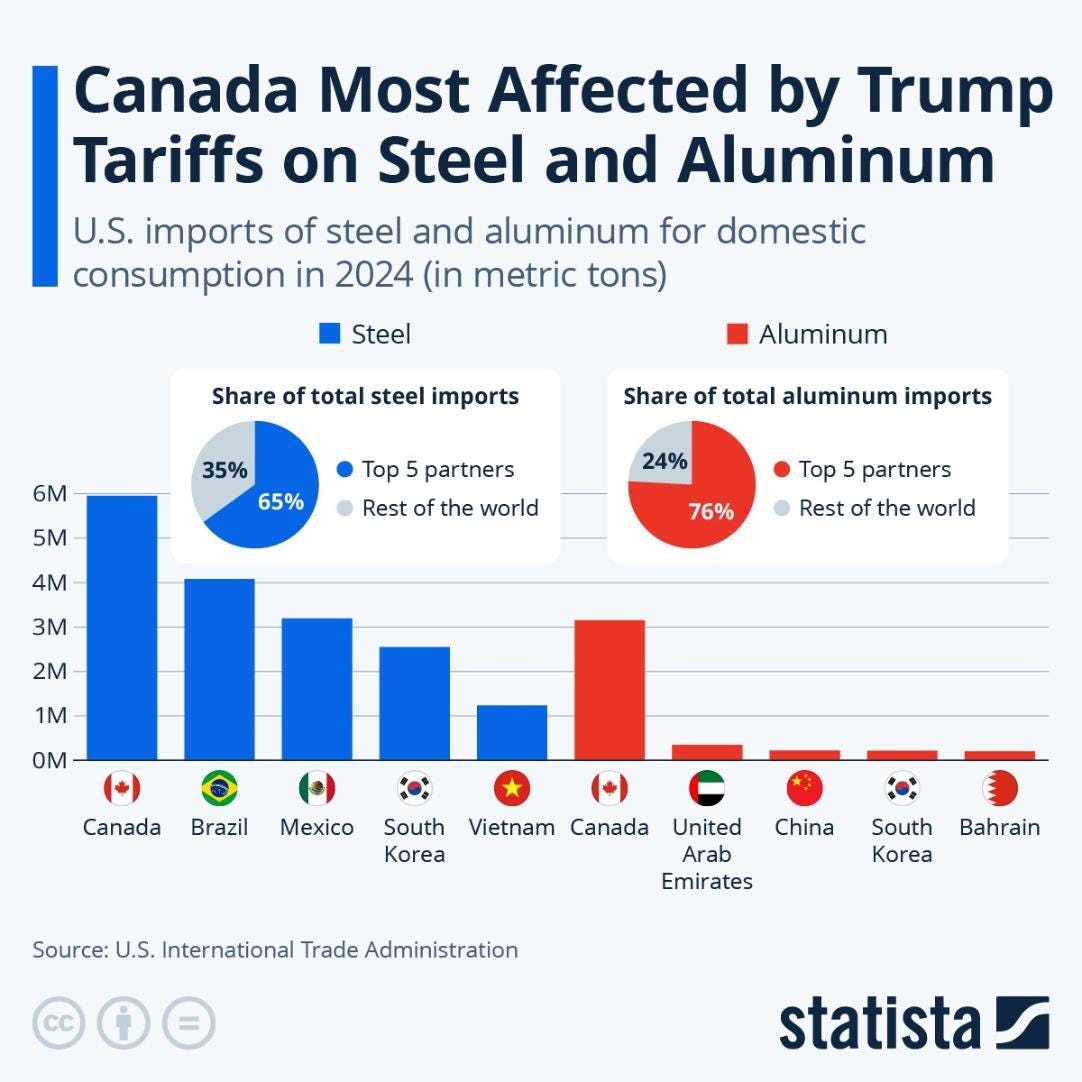

The US-China drama died down by mid-week as tariffs on steel and aluminum were increased to 50% (as promised by a Truth Social post from late last week):

The United States’ neighbor to the north/potential 51st state is its largest steel and aluminum supplier by a mile:

Thursday morning Trump announced he had just concluded a “very good phone call” with Chinese President Xi, also mentioning US and China representatives would be meeting soon:

The world quickly forgot about the Trump/Xi call though as the Trump/Elon breakup over social media quickly took front and center Thursday.

Whether real or staged, the spectacle was an embarrassment for our nation.

Thankfully, we made it through Friday relatively drama free. After the close, Trump announced US and China representatives would be meeting in London on Monday to discuss trade:

Weekly Winners & Losers

It was another strong week for the Brazilian real, up 5 days in a row and 3% on the week - its highest close this year.

Year-to-date, the BRL has gained more than 11% vs the dollar (light gray below), outpacing the 3.8% climb in July beans (green).

In other words, front-month bean futures are UP 50 CENTS since January 1, but are DOWN 70 CENTS in BRL-equivalent.

Both managed money’s position and the bean market continue to chop along, oscillating back and forth between net buying and week-on-week futures gains to net selling and futures losses for the past six weeks:

For the past three trading days, selling the Jul-Nov bean spread as you are headed out to lunch then buying it back on the close would have, in fact, paid for your lunch:

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.