The (Crazy) Week in Review

The weeks continue to pass in dog years as the industry holds on for dear life with every twist and turn of the trade war saga.

If memory serves me correctly (as of my last writing Wednesday), Trump had hit Canada and Mexico with 25% tariffs in addition to an extra 10% on China (went into effect Tuesday).

Since then, China hit the U.S. with additional tariffs, Canada retaliated in kind, Mexico played nice, then this happened:

Late Thursday, tariffs on USMCA-compliant goods from Canada and Mexico were stalled for a month.

Under USMCA (formerly NAFTA), products of “North American origin” are able to move freely between the three nations, dramatically changing the scope of Trump’s latest tariff tirade for ag.

Pretty much (or until he changes his mind again).

Although I am a fundamentalist at heart, last week’s back and forth rhetoric and flip-flopping led me to identify a new chart pattern - the infamous ‘tariff tug-of-war roller coaster reversal’.

The formation was evident in corn, making new lows for the move on Tuesday before recovering 30 cents to close unchanged on the week:

The tug-of-war roller coaster reversal pattern was also evident in beans with new lows on Tuesday before clawing back to unchanged by Friday:

Having fun yet?

Headline(s) of the Week

China hits back at Canada with fresh agriculture tariffs -Reuters

While things haven’t exactly been rosy here in the U.S. as we took a head first dive into Trade War 2.0 with Mexico, Canada, and China last week - at least we aren’t Canada who is feeling the heat from all sides.

Late Friday, China announced tariffs on $2.6 billion in Canadian agricultural and products, in retaliation for levies Canada introduced against Chinese EVs, steel, and aluminum last fall.

Canadian products impacted include canola meal, canola oil, and peas - at a 100% tariff - plus pork and aquatic products - hit at a 25% rate.

This 100% levy on canola products further-complicates an already-messy situation for Canadian canola producers.

For the sake of this discussion and as far as USDA data is concerned, canola and rapeseed are one and the same

Canada’s Canola Conundrum

Canada is the largest exporter of canola (rapeseed) and its products in the world by a mile:

China and the United States are Canada’s largest canola customers…

Nearly 70% of Canadian canola seed exports have been destined for China the past few years:

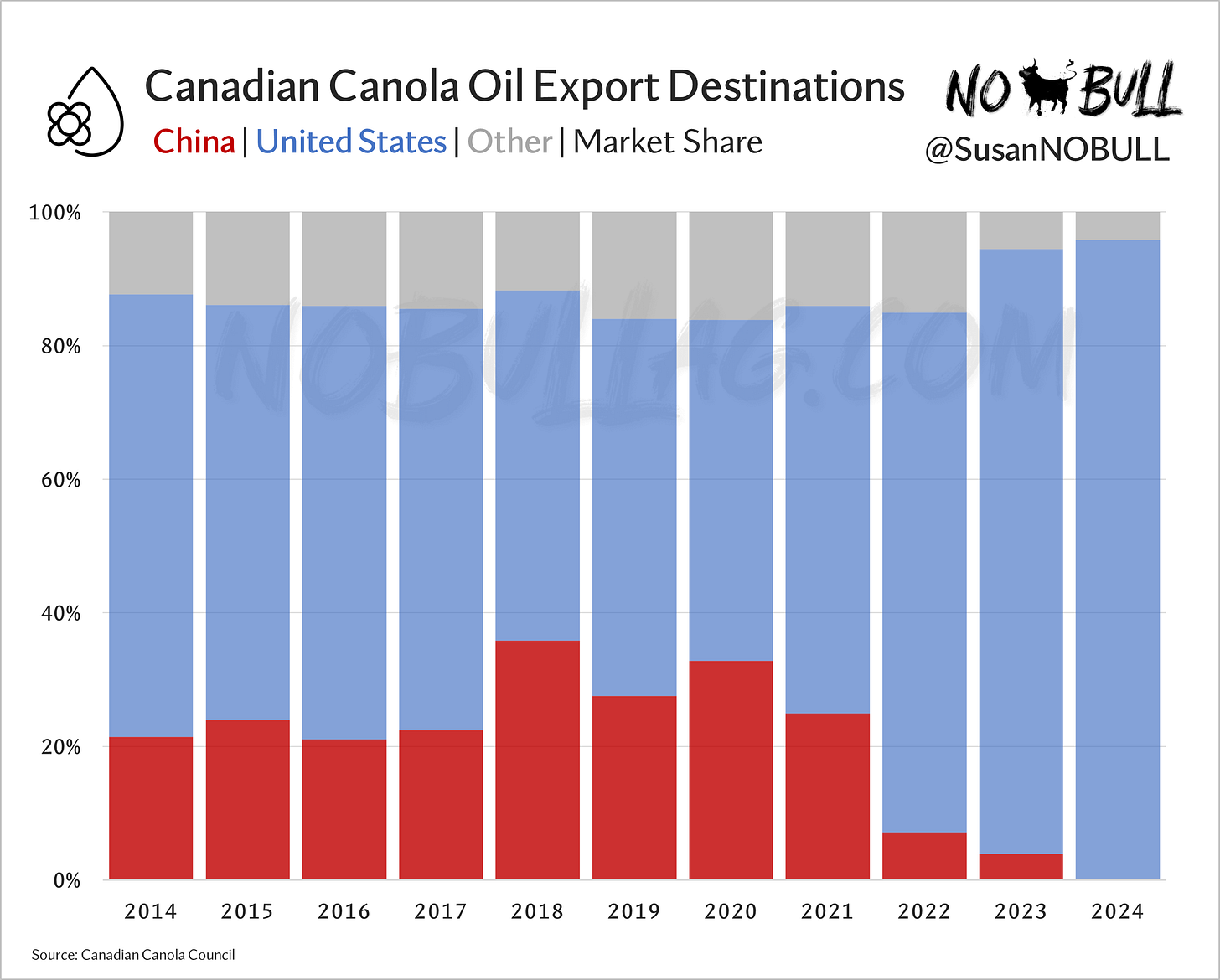

The United States accounted for 96% of Canada’s canola oil exports last year, stealing market share from China in recent years as rapid growth in renewable diesel production increased the need for veg oil imports:

The U.S. is also Canada’s largest canola meal customer, though China maintains a significant market share as it increasingly seeks alternative protein meals to lessen its reliance on imported soybeans.

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.