Only two weeks left to SAVE $100 with Earlybird Registration!

Registration includes Wednesday’s welcome reception, Thursday’s Summit (including all food & drinks), and the all-inclusive Cardinals game that night.

Click HERE for a detailed agenda.

Click HERE to register.

Weekly Winners & Losers

Wheat continues its run, with KC futures making at high of $7.10 on Monday while Chicago followed close behind with a high tick of $6.97 on Wednesday.

Both saw a 4-day losing streak to finish out the week down 12 cents though as uncertainty about the size of top-producer/exporter Russia’s crop caused heightened volatility, leaving us with 25 to 45-cent trading ranges EACH DAY this week.

Are we having fun yet?

Regardless (at this past week’s highs) new crop futures moved $1.50 off their lows from just one month ago.

And speaking of month(s) - it took more than 7 of them to get back to this point:

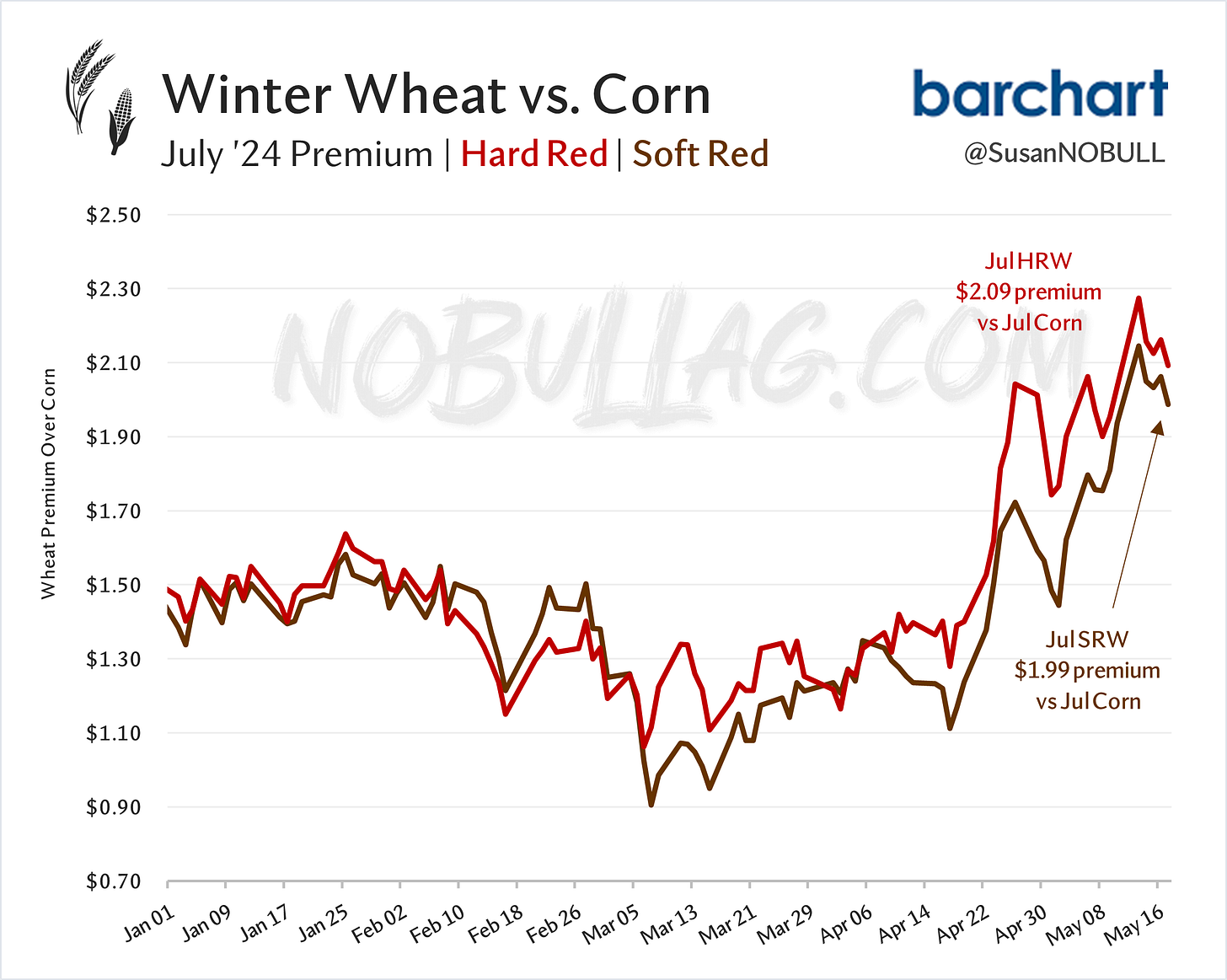

The rally in wheat has left corn behind as wheat’s premium over corn hasn’t been north of $2 since July 2023.

Corn, like wheat, closed higher Monday followed by 4 down days in a row. Corn also saw wider trading ranges (avg 10c the past two weeks vs as the oscillation in wheat tends to reverberate in corn.

While corn has definitely been on edge around the May WASDE and amid spring planting, things likely won’t settle down until the market has a better grip on Russian production. Until then - corn will be along for wheat’s ride to some extent.

New crop corn futures had an interesting week, taking a few runs at the $5 mark before succumbing to (what felt like) hedge pressure, a few open planting windows and a lack of strength in wheat to finish the week with a 15-cent loss.

We are entering that time of year where the market typically provides pricing opportunities as production problems arise.

In the past 10 years, new crop corn has made its highs in May 3 times, June 3 times and the first half of July twice (dots + date = high settle).

Remember, not all rallies are based on U.S. growing conditions either as production problems with Brazil’s Safrinha crop have also spurred rallies in the past (2021 is a good example of this).

Interesting way to look at new crop futures performance by year as the market typically presents the best selling opportunities from May into June:

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.