Weekly Winners & Losers

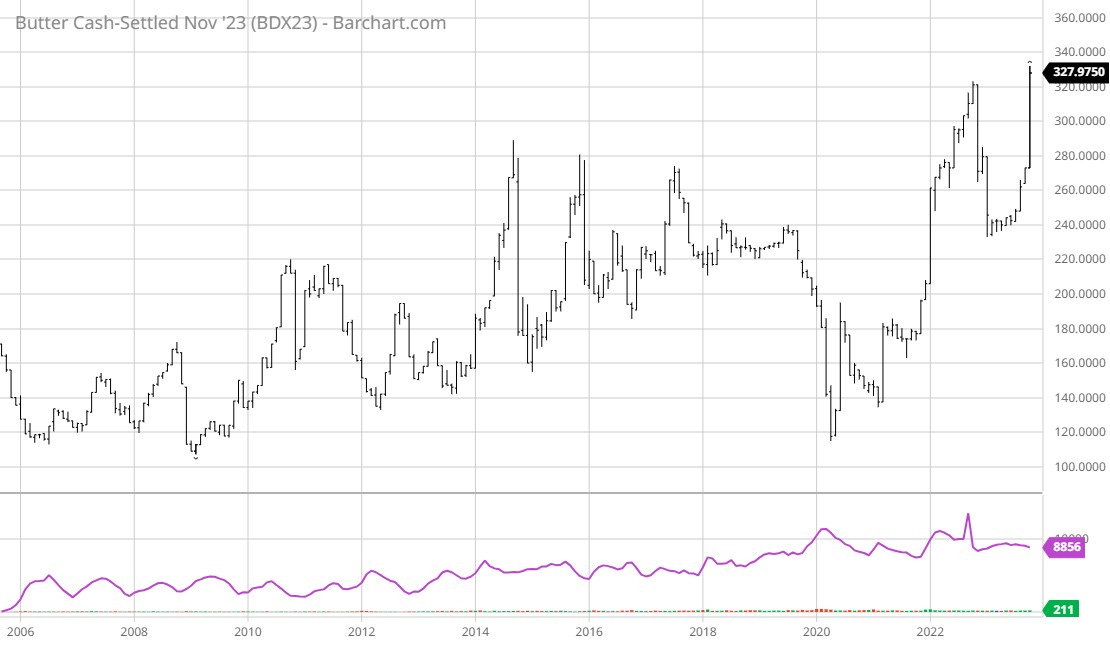

Here’s a new one - butter - where CME prices have reached new all-time highs as a drop in production comes just as demand ramps up heading into the holiday season.

According to USDA, August butter production hit a five-year low due to a tightened milk supply, fewer imports and the increased use of cream in the manufacturing of other products like ice cream.

This past summer’s sweltering temps held a one-two punch for butter as hot weather impacted milk production at the same time consumers demand more frozen treats to cool off.

Historically, butter rallies into the end of the year (holidays) but we have gone parabolic early in 2023:

In case you were wondering, OJ is still on the run:

Jan futures were up another 3.4% last week, 17% the past 30 days and 105% year-to-date, making another new all-time high at $3.8655 per pound Friday.

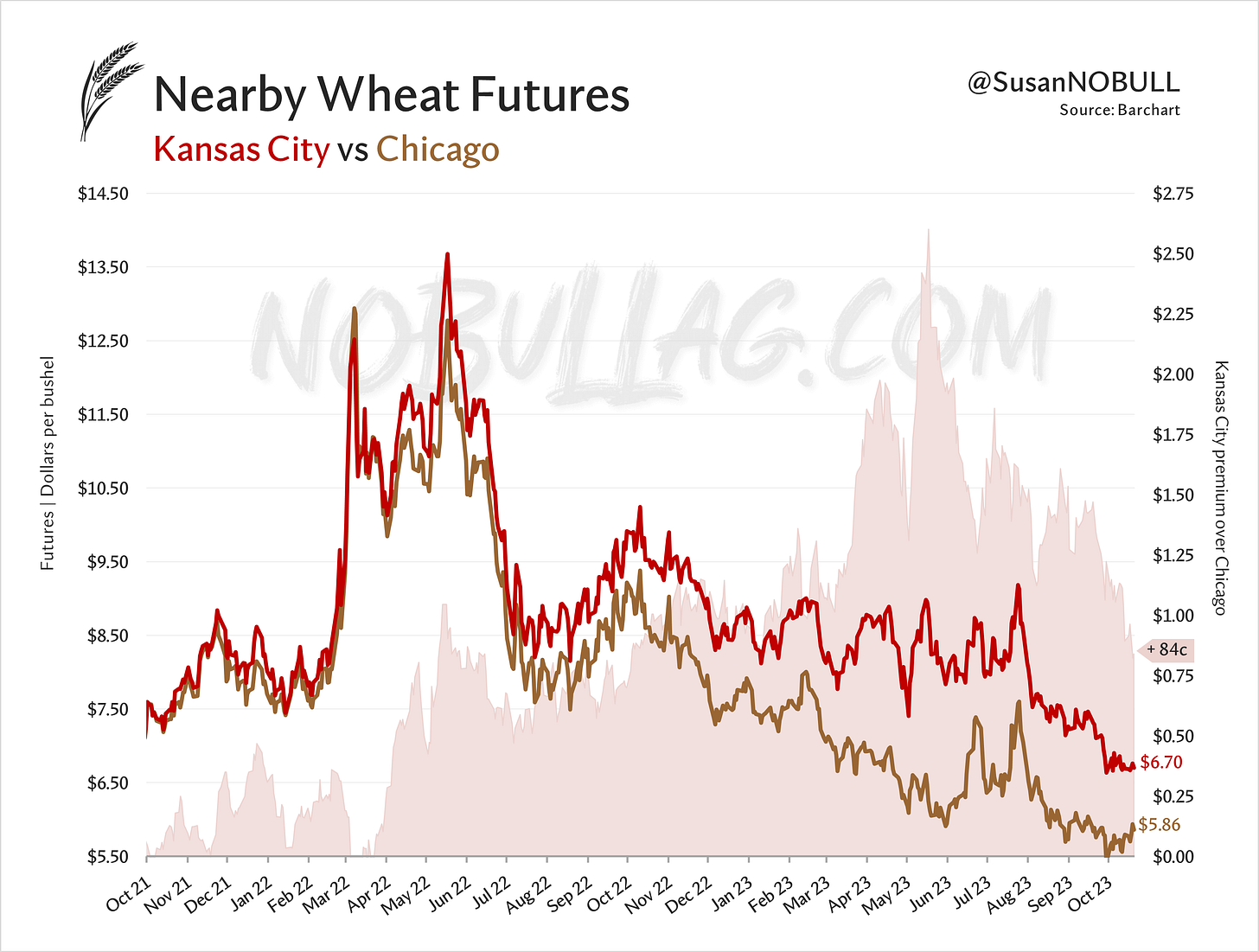

Both Chicago and KC week managed to finish the week without losing any additional ground.

Chicago gained ~1%, bringing KC’s premium over soft red wheat to its narrowest since January.

Although it has climbed a bit in recent weeks, Dec SRW remains near its lowest premium relative to Dec corn for the life of the contract.

Remember - wheat has a higher protein content than corn, giving it an advantage in some feed rations which makes this relationship an important one.

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.