Weekly Winners & Losers

ATTENTION SERIAL FORWARDERS: I don’t work every weekend just for the fun of it.

If you are a paying subscriber forwarding No Bull updates regularly, you run the risk of getting cut off with no refund.

I CAN SEE FORWARDS therefore I CAN SEE YOU!

I intentionally set this subscription service at a low price point to encourage paid subscriptions in lieu of mass forwarding. If your larger group enjoys the updates, enterprise rates are available.

Thank you!

A winner!

I recently recorded a podcast with Jared Flinn, CEO of BulkLoads - the largest bulk freight marketplace in the United States.

In this episode Jared and I covered everything from my career path to river logistics, global tradeflows, renewable fuels, and ultimately ended down a California rabbit hole.

I have recorded countless podcasts in the past but this episode of The BulkLoads Podcast ranks among the best.

Check it out HERE.

Oil saw its largest one-week gains in more than a year last week as tensions in the Middle East continue to rise.

Dec Brent closed just above $78 on Friday, up $6.51 for a 9.1% advance on the week. Nov WTI closed the week at $74.38, up $6.20, also gaining 9.1% on the week.

Last week, almost every day was a wild ride as energies rallied big mid-session before drifting off the highs into the close.

Tuesday was particularly notable for Brent with a $5.50 trading range before settling up $1.86. Thursday was also a doozie as futures settled up nearly $4 to end the day.

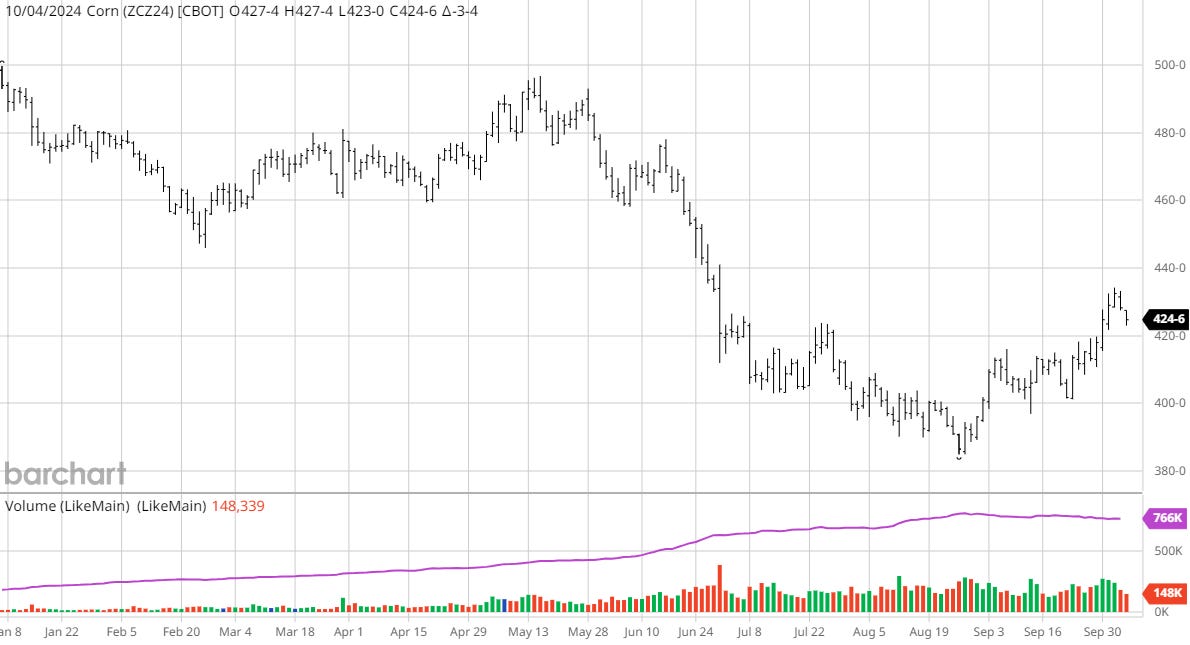

Corn did its best to hitch its wagon to rallying energy markets, but ultimately met resistance end of the week.

Even though Dec saw near-1% losses both Thursday and Friday, it finished the week up 7 cents (+1.6%) for its highest weekly close since mid-June:

The correlation between corn and crude is undeniable:

In fact, when you look compare the percentage-changes in Brent, WTI & corn for the past 10 years - they are nearly identical:

While firming energy markets don’t hurt a bit - corn’s larger driver is demand (it’s been a while since I have been able to say that!!) as the US is back in the export market after a long hiatus.

In fact, we saw two flashes to unknown last week totaling more than 15 million bushels - largely expected to be Japan or Spain - two customers that might normally be leaning on inexpensive Brazilian or Ukrainian supplies at this time of year.

A picture is worth a thousand words, and in this case, some much-needed business!

US corn is substantially cheaper than both Brazil and Ukraine, driven by a

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.