Only one month until Summit 24 takes the stage in St. Louis. Reserve your spot today! NoBullSummit.com

Weekly Winners & Losers

Soybean oil was this past week’s undisputed winner, up all 4 trading days for an 11.9% gain.

In total, August futures have rallied 14.3% since making a contract low on June 25 and beginning its 7-day rally on the 26th.

Oil’s strength rallied oilshare 2% on the week and helped August beans close higher 4 days in a row, gaining 33 cents on the week.

33 cents down, only another 80 to go!

Better late than never…

Well… it IS too late.

Soybeans aren’t ‘buying’ any more acres today, but they are gaining ground on corn in fast fashion, pulled along by soybean oil’s spectacular rally.

In the last 3 weeks of trading, old crop corn has only closed higher 3 times… At least it seems as if we have found a bit of a bottom for now.

Back to the soy complex for a bit - soybean oil’s recent resurgence from the dead has brought board crush margins back to life in epic fashion:

As board prices have collapsed, old crop futures have had their work cut out for them, in an attempt to pry bushels out of the bin.

August has gained 20+ cents on Nov futures the past few weeks as a result, bringing the Q/X to a 36-cent inverse:

At this point, the Q24/X24 is just a baby inverse compared with the past few years though as an uncomfortably tight stocks situation drove inverses north of $1 in both 2022 and 2023:

The market still has a job to do pulling the near-half a billion bushels of soybeans left in farm bins to market in the weeks ahead, especially as futures remain nearly $1 off of their late-May highs.

It’s river vs processor as strong crush margins (and even stronger cash product values) have prompted basis bushels at crush plants, forcing river facilities to up the ante if they want a shot as ownership.

If you are the guy with old crop left:

WHY?

Listen to the inverse!

And lastly, make a mental note reminding yourself of the frustrations that come with holding onto old crop into the summer months - particularly the accrued interest expense, grain quality & missing the boat by a buck or two.

In the words of the great Kamala Harris - BE UNBURDENED. Get rid of it and move on.

Headline(s) of the Week

China Dealt Major Trade Blow by Neighbor -Newsweek

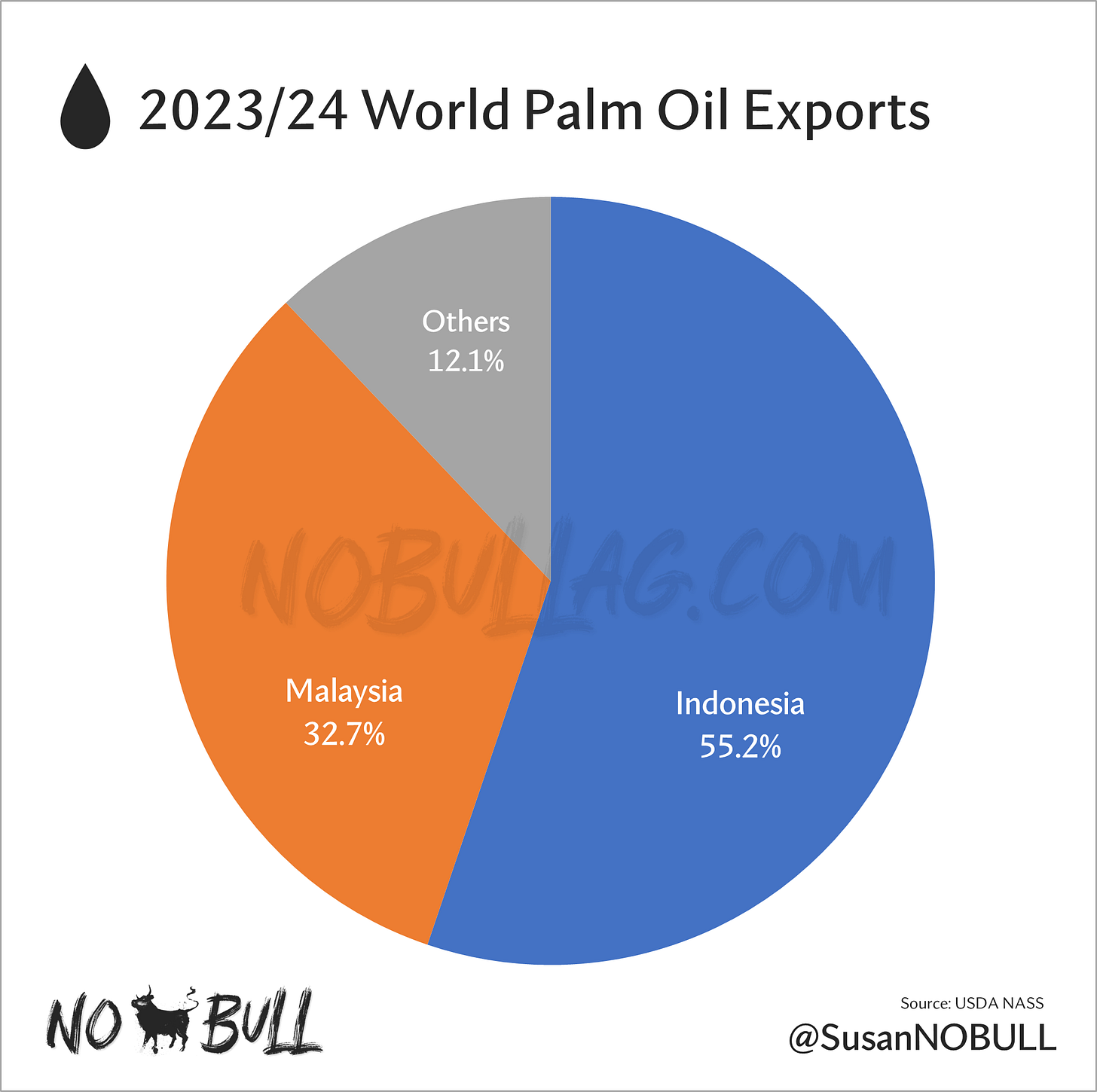

As I mentioned on Wednesday, soybean oil has found additional support on a developing trade spat between China and the palm oil giant, Indonesia (ideas China will turn to importing bean oil as an alternative to Indonesian palm).

Great quote from this story by Indonesian Trade Minister Zulkifli Hasan:

"The United States can impose a 200-percent tariff on imported ceramics or clothes; we can do it as well to ensure our MSMEs [Micro, Small & Medium Enterprises] and industries will survive and thrive."

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.