Weekly Winners & Losers

The Weekend(er) Teaser

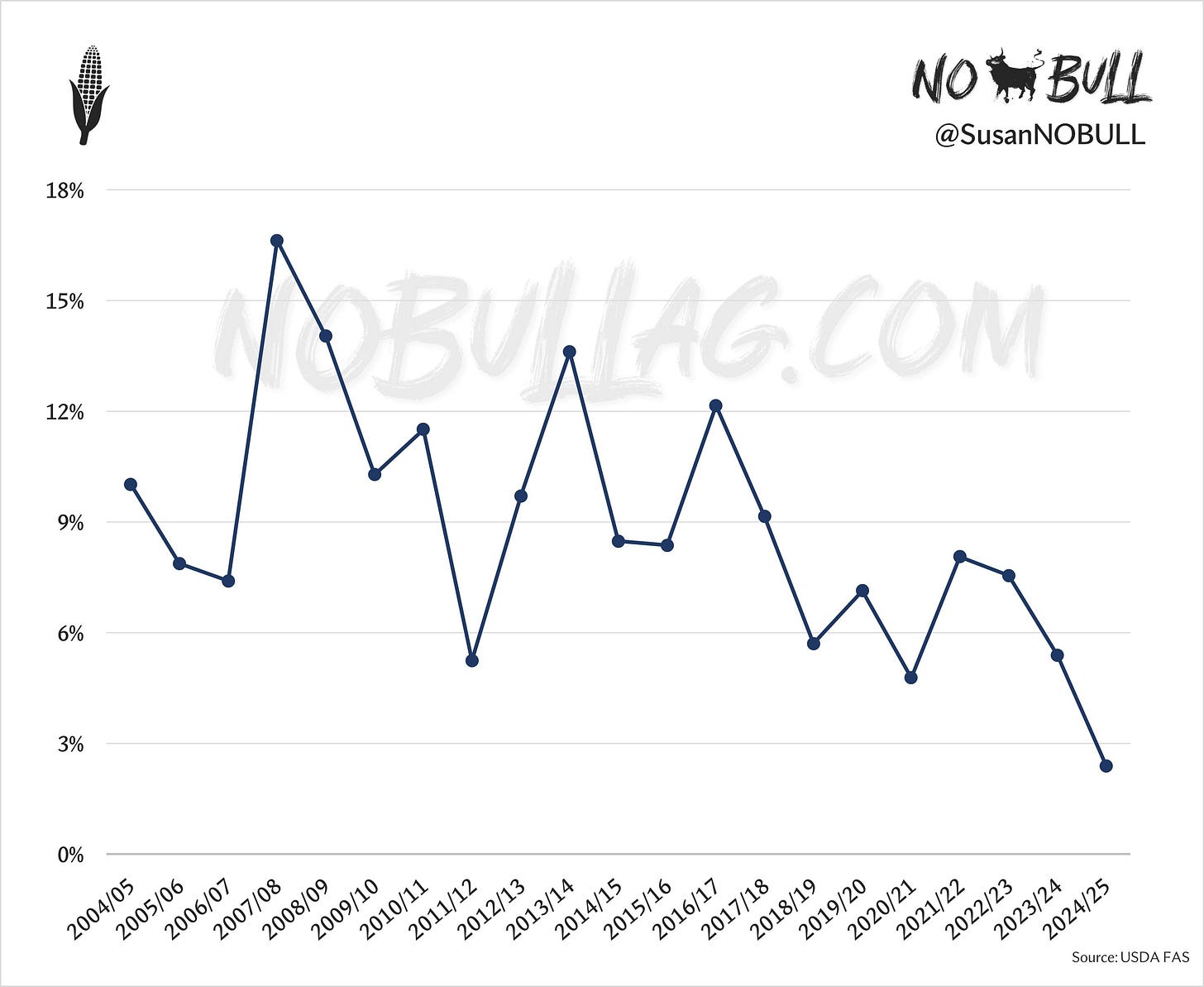

This week's clues:

« It's corn related

« There's no US data on this chart

« It’s a big driver behind the strength in the corn market

You can find the full chart and answer below

Soybeans

That escalated quickly

We began the week with US soybeans facing 10% + 34% tariffs from China…

…and found ourselves at 125% by week’s end.

China has indicated its 125% reciprocal tariffs are it, though, arguing current levels already restrict bilateral trade.

China’s Deputy Director of the Information Department of the Ministry of Foreign Affairs (say that title three times fast):

The bean market managed to shrug the tit for tat tariffs off, however, as May closed higher five days in a row for its longest winning streak since early November, up 66 cents (6.7%) on the week.

November closed 41 cents higher on the week (making a nice 7-cent gain on May Friday, alone), but remains at risk as a trade war with China is far more impactful in 2025/26 and beyond.

We saw two export sales flashes for old crop beans to unknown last week which serves as a reminder US beans remain competitive to non-China destinations as Brazilian premiums strengthened amid tariff escalations.

Needless to say, the U.S. is priced out of the Chinese market:

Although Trump is only three months into his second term (vs >1 year into his first term when the original trade war began), the timing of the 2025 trade war remains quite similar to calendar year 2018.

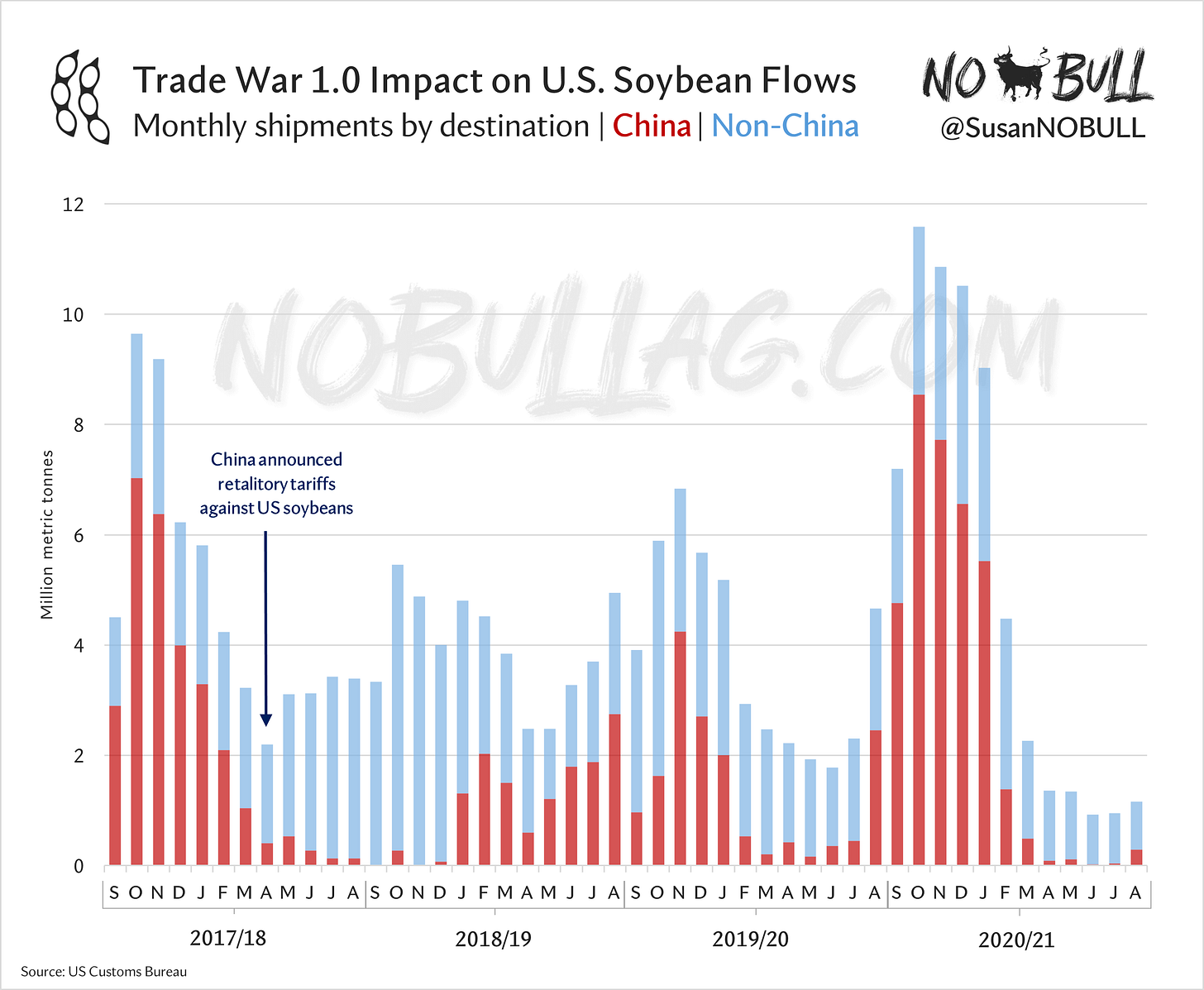

Here’s a look at U.S. soybean exports by month heading into the start of the original trade war and in the months/crop years immediately following:

China quit the U.S. cold turkey as tariffs went into effect over the summer of 2018 and tensions escalated. We did not see a return to ‘normal’ business for two years.

Same thing, including current 2024/25 shipments:

*History doesn’t repeat itself, but it often rhymes*

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.