Weekly Movers & Shakers

The market giveth and the market taketh away

2025 had been off to a fantastic start, with most of our beloved ag commodities rallying to multi-month (and in some cases year) highs the week before last.

Probably the most notable was old crop corn, rallying above $5 for the first time since the summer of 2023, sending waves of euphoria rippling through middle America.

As they say, all good things must come to an end and that is exactly what happened last week though when May corn lost 35 cents (7.2%), continuing its 6-day losing streak to settle at $4.69-1/2 - its lowest close since the day BEFORE January’s surprisingly bullish report.

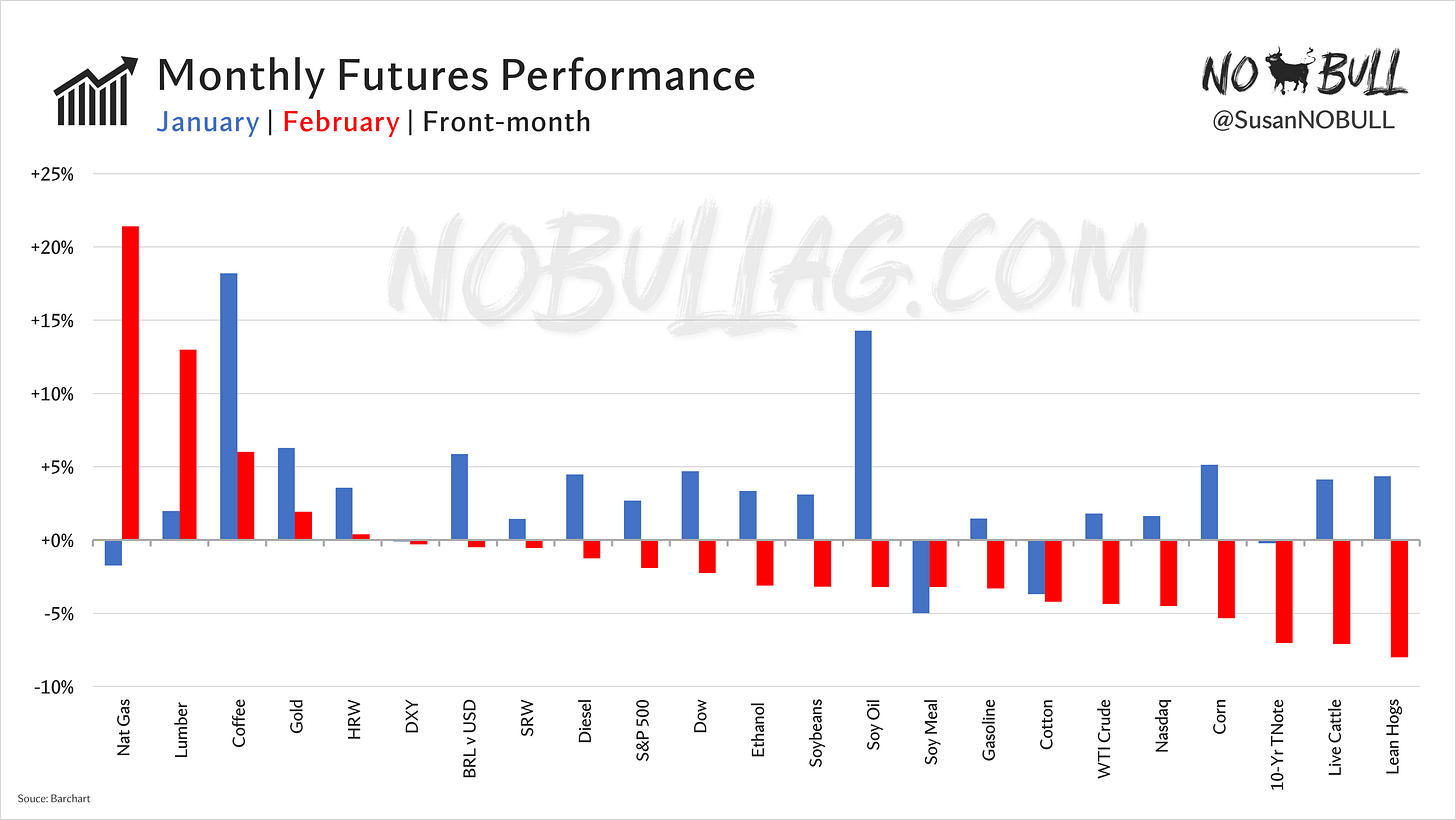

Crazy action year-to-date with wheats and corn giving up all of their 2025 gains in a matter of days:

Stark contrast between Jan and Feb performance:

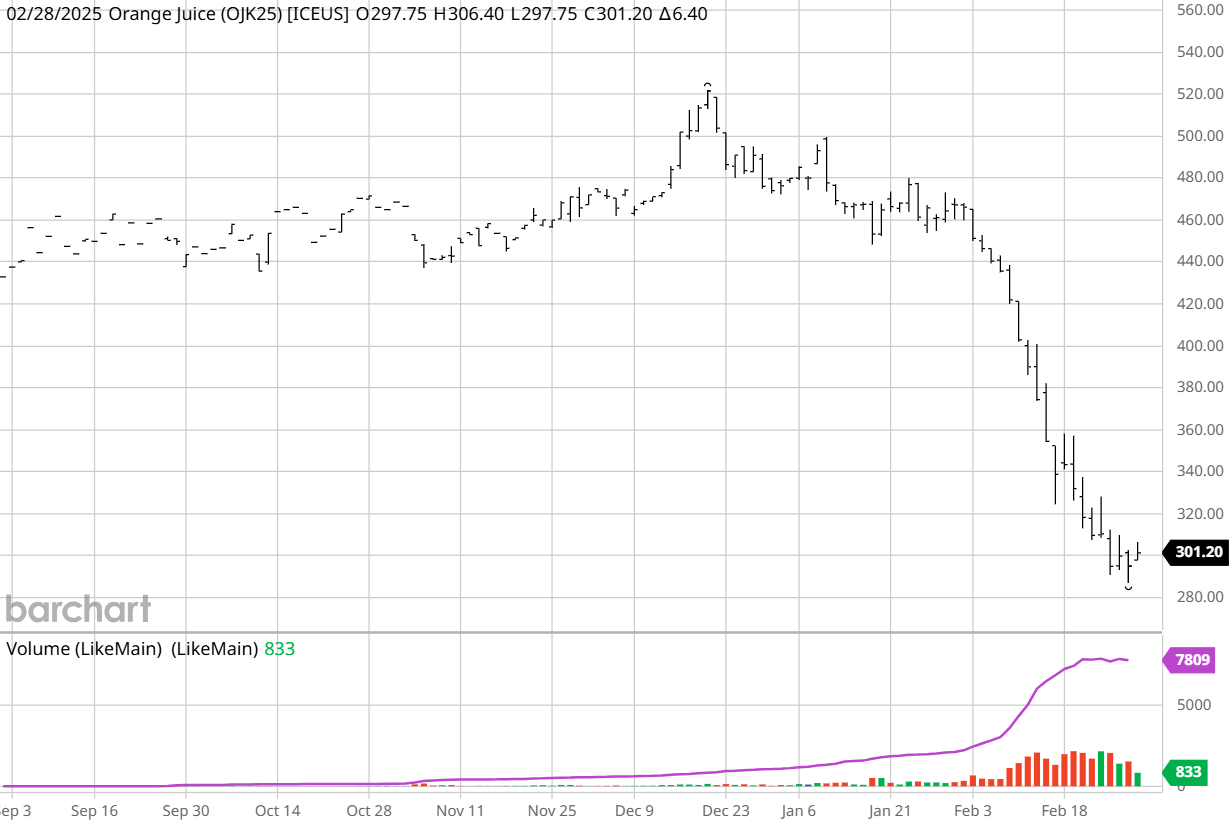

February’s biggest loser was actually orange juice, down an incredible 35% the past month.

Clearly OJ isn’t something I normally write about but here are a few drivers:

« Disease pressures continue to impact domestic production

« High prices are curing high prices with demand destruction

« Stiff competition from Brazil (largest exporter in the world) isn’t helping anything

« A potential trade war with Canada (our largest trade partner by a mile) has served as the nail in the coffin for the OJ market

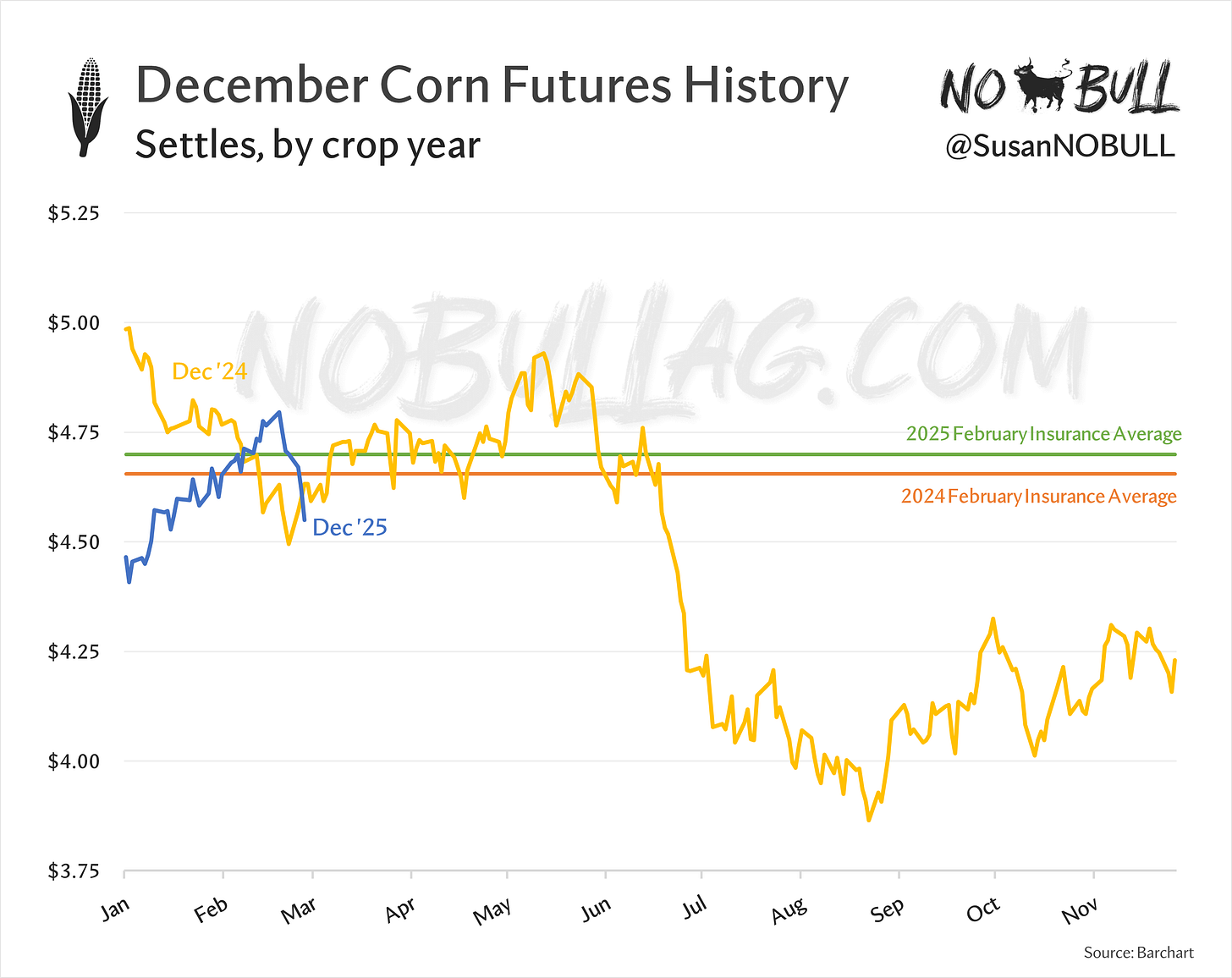

Two months down

Now that February is over, we have official crop insurance base price levels for the 2025 crop.

Dec corn’s average is $4.70, up a smidge from last year’s $4.66:

Nov beans finished at $10.54, down a full dollar from last year’s $11.55 and the lowest since 2020’s $9.17:

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.