The good news is you only have a few more weeks of me promoting Summit 24 round-the-clock.

The bad news is there are only a few weeks remaining to register, so get on it before it is too late ==> NoBullSummit.com

What’s HOT & What’s NOT

Air travel has never been HOTTER as a record number of Americans are taking to the skies.

TSA set a new single-day record on Sunday as more than 3 million passengers passed through US airport security closing out a long Independence Day weekend.

We are only at the beginning of this story but green initiatives and an increase in air travel makes our pivot to sustainable aviation fuel more important now than ever before - especially to agriculture.

Through May, the US’ sustainable aviation fuel supply is up almost 400% year-on-year and the party is just getting started.

This is why Summit 24 is a can’t miss event as it is an incredible opportunity to learn about the ways SAF stands to transform the biofuel landscape.

Click HERE for more info or to register.

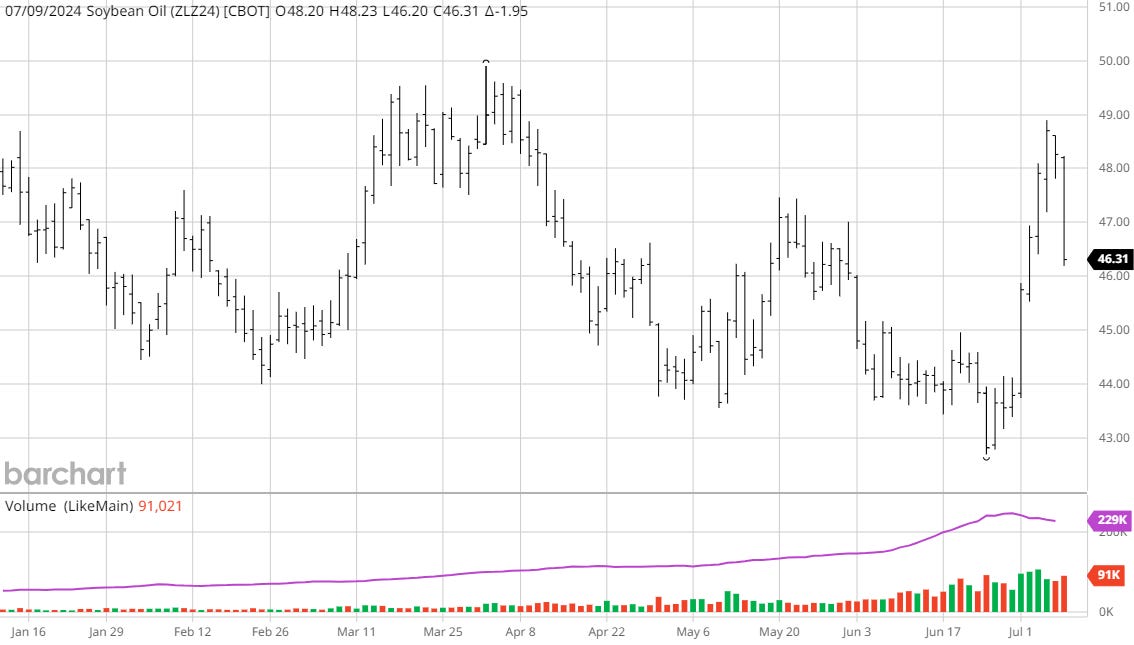

Soybean oil has been on a HOT streak as of late, rallying 14% off its late June lows to a high near 49 in a matter of days.

The party ended this week, however, closing down nearly 1% Monday followed by a 4% collapse Tuesday.

Why?

For starters - a 14% gain in <2 weeks is just begging for a correction.

Plus, energies have taken a nosedive as production sites and refineries in Beryl’s path escaped with only minor damage.

Diesel futures are down 2.7% thus far on the week and soybean oil has followed:

Additionally, late Monday we got word from the EPA that they will NOT be finalizing highly-anticipated Renewable Fuel Standard volume requirements for years 2026-2028 by the November 2024 deadline.

Instead they have kicked the can down the road until March 2025 (leaving the next administration to deal with it/avoiding it until after the election).

This isn’t the first time this has happened, nor the first time the market reacted negatively.

Uncertainty can bring two things to a market:

You can rally on uncertainty - like weather or war.

Markets can also fall on uncertainty - especially when it comes to soybean oil which is extra sensitive to policy as biomass-based diesels and other renewable fuels can be heavily dependent upon subsidies (tax credits), mandates and RINs.

Soybean oil is NOT a fan of what could be another Trump EPA who was keen on RFS waivers and exemptions during the first term.

Buckle up because we have some interesting times ahead in the soy complex:

The transition from 40B (blender’s) to 45Z (producer’s) tax credits a/o Jan 1 should put the brakes on biomass-based diesel imports while increasing the demand for domestic (& imported feedstocks)

The US is on a high-priced meal island & remains uncompetitive in the world market

Old crop beans remain in tight hands

Plus, we likely see record August maintenance downtimes (amid already-tight oil stocks)

Speaking of buckle up - crazy video below of CGB’s soy processing plant along the Ohio River in Mount Vernon, Indiana. The facility took a direct hit from a tornado that developed yesterday afternoon in the remnants of Hurricane Beryl.

Even crazier is the semi racing to get out of the path near the 1:20 mark:

It’s nothing short of a miracle the plant escaped with only minor damage with almost no interruption to operations.

When I asked a friend at CGB about the plant status he replied, “eat more chicken”.

He is correct in that meal is our problem and will continue to be as we expand crushing capacity in the United States as oil demand grows.

Reminder:

Back to markets - even though soybean oil had a not-so-hot start to the week, funds were big buyers in the week ending July 2, erasing the previous three weeks worth of sales and rallying futures more than 300 points in the process.

Last week was a BIG week:

Oil vs. meal:

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.