Mark your calendars!

No Bull’s annual conference is back for its third year with a brand new name this summer.

Join me at AgriNext in St. Louis July 23-24 for Certain Uncertainty: Trade, Policy, and the Future of Ag

Details coming soon!

HOT Nuggets

TEN charts, coming in HOT

10 | Twin Terms

Purely coincidental, but nearby soybean futures continue to trade similar levels and in a near-identical pattern to the market during his first term:

9 | Rough seas ahead

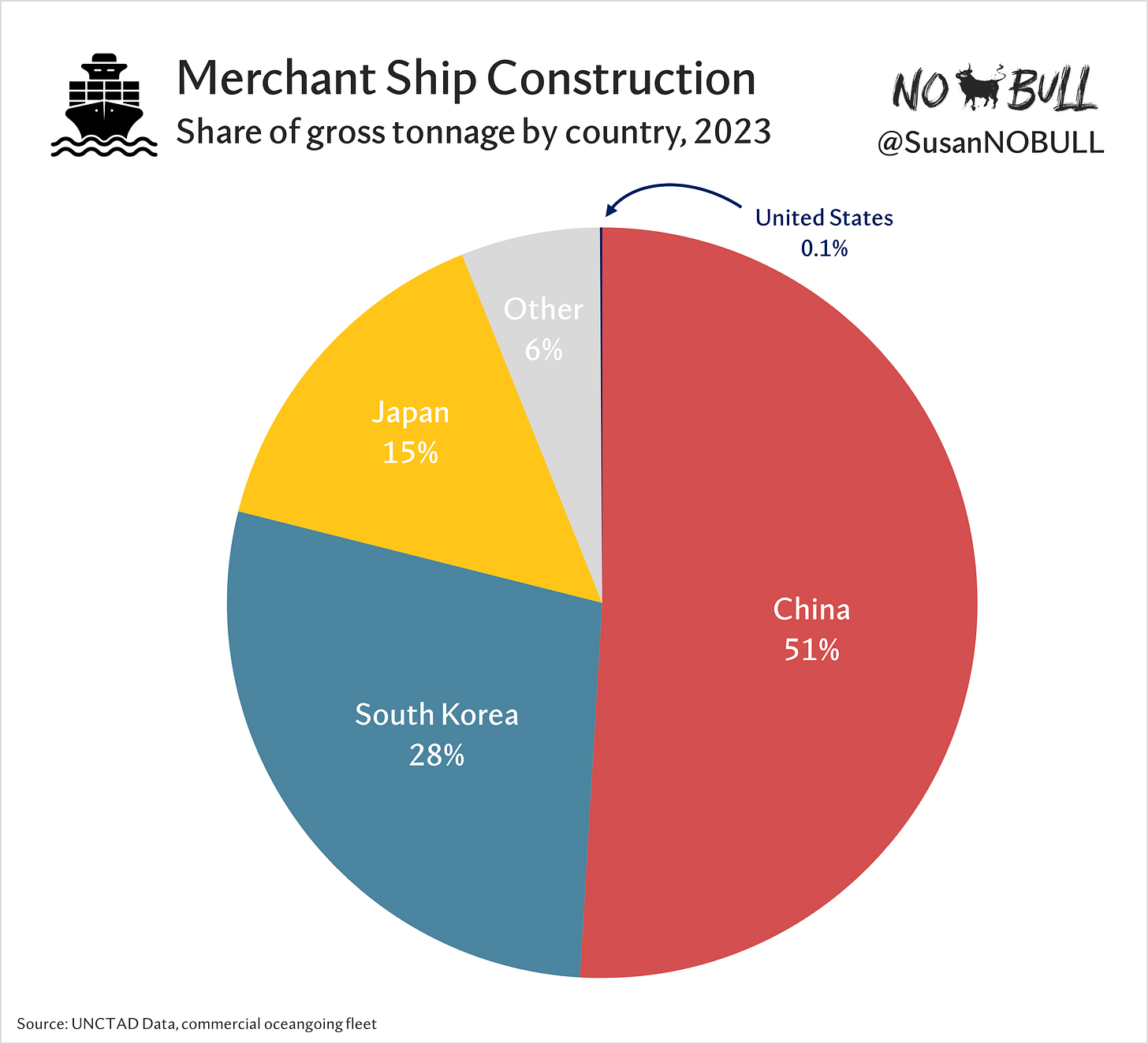

Today wraps up the first public hearings in Washington on the USTR’s proposal to hit Chinese vessels with steep fees when docking at U.S. ports, while providing support to U.S. shipbuilders in the process.

If you didn’t catch last Wednesday’s deep dive into Section 301 and what it means for ag, click HERE.

Yes, the U.S. builds boats… but you will have to squint to see our market share of gross tonnage constructed each year:

8 | Penny pinching

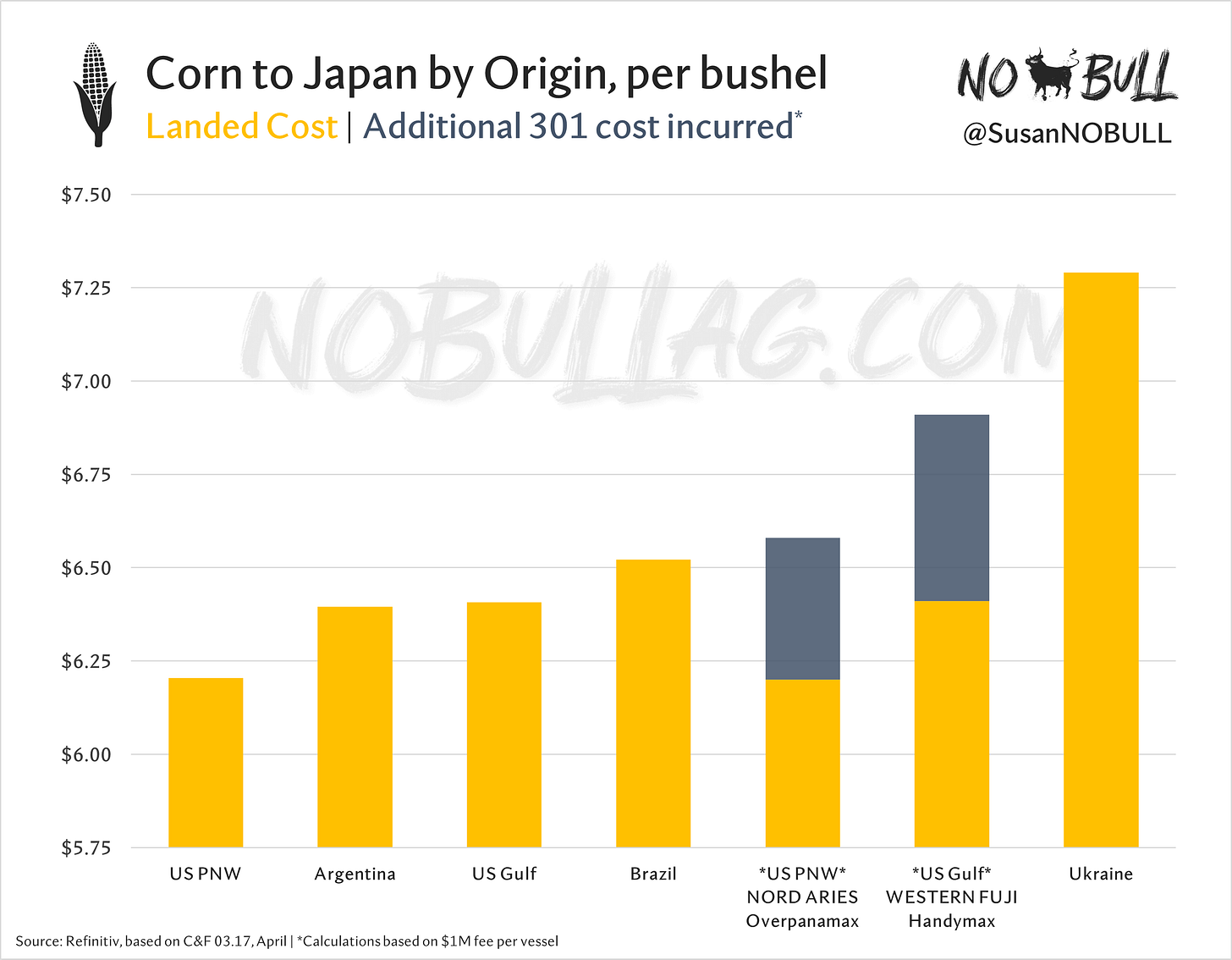

In the commodities business, every penny counts, the USTR's proposed hefty dock fees on Chinese vessels would pinch U.S. grains and oilseed exports.

To illustrate, here’s how a $1 million fee would impact two (Chinese-built) corn vessels that recently left US headed bound for Japan:

As if $1 million isn’t bad enough, take a look at the JIN XIA FENG (Chinese-built and owned) who would be subject to at least a $2.5 million fee, adding nearly $1/bushel to a load of U.S. beans that left New Orleans for China last week:

7 | Ratio Race

While industry groups are in a race to thwart what would be a disastrous policy for ag with the current USTR 301 proposal, new crop futures remain in a race for acres.

Corn lapped beans months ago and remains in the lead by a mile, but beans have shown a few signs of life in recent days as the market comes to grips with the potential for YUGE corn acres in 2025:

6 | Race to the bottom

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.