Dreaming of warmer weather?

Join me in Panama January 15-19 for highs in the mid-80s and sunny skies as we tour the Panama Canal by both land and sea.

Registration deadline is THIS FRIDAY.

Ten HOT Nuggets

10 | MAGA, baby!

Actually, yesterday was MCEGA (making corn exports great again) as USDA raised 2024/25 corn exports 150 million bushels to 2,475mbu - a four-year high and only second to 2020/21’s record high.

9 | A notable absence

The most impressive part about our current export program is the fact China only has one million bushels of U.S. corn on the books.

ONE!

Rewind to 2020/21’s export program and Chinese business was nearly one-third of the total. Same thing in 2021/22 - we had a huge book on with China.

Today, 2024/25’s program is set to be one of our largest ever and it is (almost) completely void of any Chinese business.

…and I expect it to stay thing way.

Chinese imports were reduced 2mmt to 14mmt (550mbu) yesterday - nearing HALF of last year’s program amid record domestic production and low interior prices.

8 | WHACK

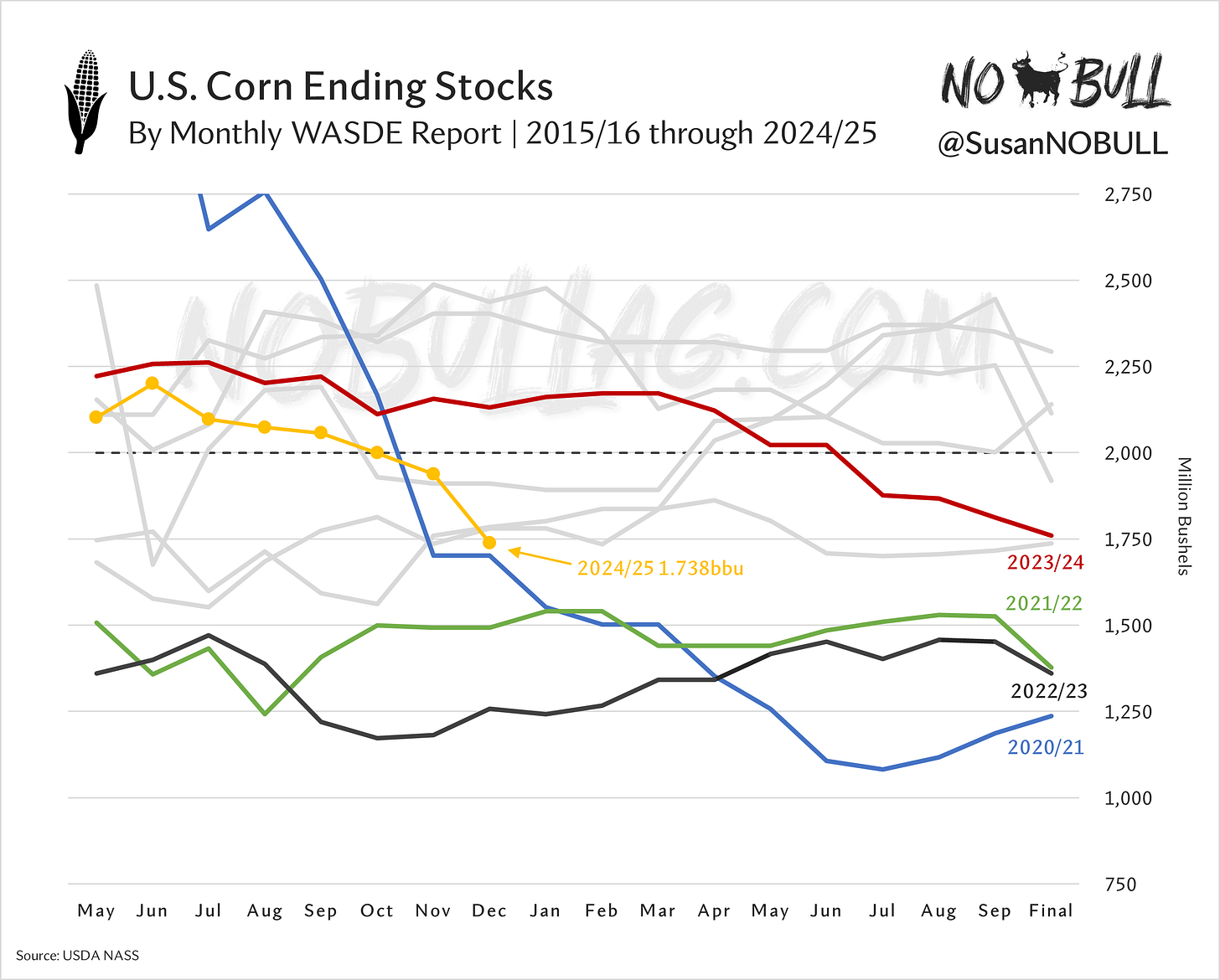

That loud sound you heard yesterday at 11am central was USDA chopping corn ending stocks by 200 million bushels - the largest single month cut since the fall of 2020.

Someone in the crowd just perked up thinking ‘2020 was the start of the boom, $6 here we come’. Not happening - refer to #9 above.

The combination of a 50mbu increase in ethanol demand and 150mbu increase to exports dropped ending stocks to 1.738 billion bushels - the lowest U.S. corn ending stocks print since the fall of 2023.

7 | How low can we go?

While yesterday’s big cut to corn ending stocks was notable, it wasn’t completely unexpected as the market has been well-aware of the big export commitments currently on the books.

All-in-all the market has been trading a tighter stocks situation for a while but it is great to see it in print and has helped nearby corn futures over $4.50 for the first time since June.

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.