HOT Nuggets

I am excited to announce I will be moderating The Government Giveth and the Government Taketh: Navigating Policy Impacts on Agriculture at Bloomberg's Farm, Food & Fuel Summit in Indianapolis this April!

Join me, National Oilseed Processors Association (NOPA) President & CEO Devin Mogler, American Soybean Association Chief Economist Scott Gerlt, and Darling Ingredients COO Matt Jansen for this insightful and timely panel!

Click HERE to view the full agenda and register for this FREE event.

Trade War 2.0

Note: by the time you read this, there is decent chance the specifics regarding goods, tariff rates and everything else will be outdated.

As promised, President Trump embarked on Trade War 2.0 with Canada, Mexico, and China this week.

Canada came back with an immediate 25% tariff on a variety of beverages (alcoholic and non-alcoholic), clothing, paper products and motorcycles, to name a few.

There is a longer list of items that will be subject to the same 25% pending a 21 day comment period, including several ag products - pork, beef, dairy, fruits, vegetables, and ethanol.

Ethanol is a BIG deal.

Here’s why:

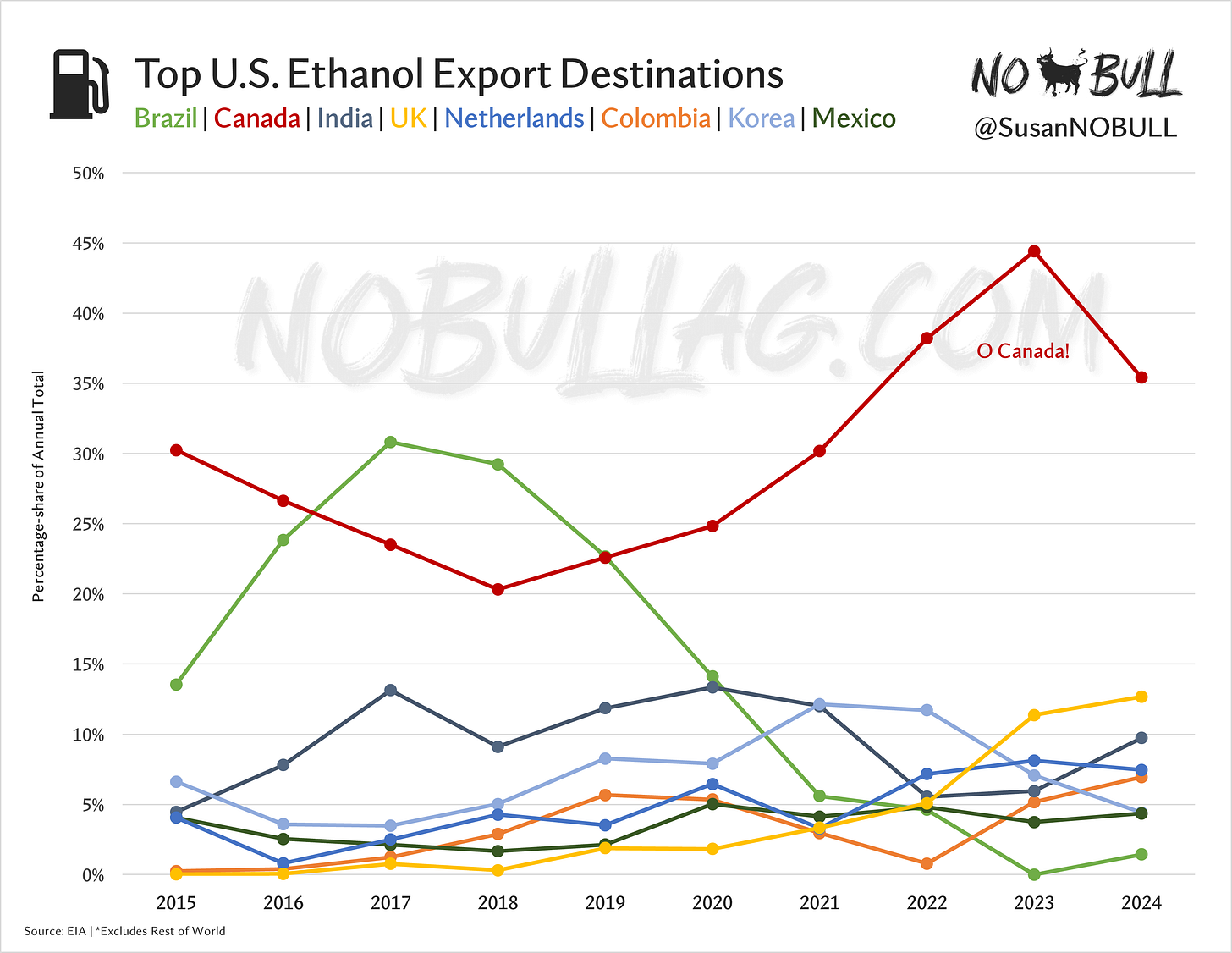

Canada has been our top ethanol customer for five years running, importing more than 16 million barrels (675mgal) from the United States in 2024, as their domestic policies and declining emissions targets drive demand.

Canada’s growth helped push the U.S. to record exports of nearly 45.5 million barrels (1.9bgal) last year, with Canada accounting for 35% of all U.S. shipments, followed by the United Kingdom, India, Netherlands, and Colombia.

Brazil has been a leading U.S. ethanol customer, but a growing domestic industry plus trade policies (cough, cough tariffs), have changed the market dynamic.

Brazil has an 18% tariff in place on U.S. ethanol imports (while the U.S. allows Brazilian ethanol in largely duty free), but Reuters recently reported Brazilian authorities are considering a cut to ethanol import duties in a bid to appease Trump.

The U.S. exported 28 million gallons of ethanol to Brazil in 2024, down from a peak of 489 million gallons in 2018.

PS - It’s not just ethanol.

Canada is THE market for U.S. biodiesel, accounting for around 90% of annual export volumes:

As of late today, Bloomberg is reporting Trump is considering specific agriculture carveouts on the import side, though.

In speaking with Bloomberg, Secretary of Agriculture Brooke Rollins said:

As far as specific exemptions and carveouts for the agriculture industry, perhaps for potash and fertilizer, et cetera — to be determined. We trust the president’s leadership on this. I know he is hyper focused on these communities.

You can read the full article HERE.

Meanwhile in Mexico, President Claudia Sheinbaum doesn’t appear to be backing down. Looks like we will have to wait until the weekend to know more:

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.