10 HOT Nuggets

10 | A rough start

Ooof.

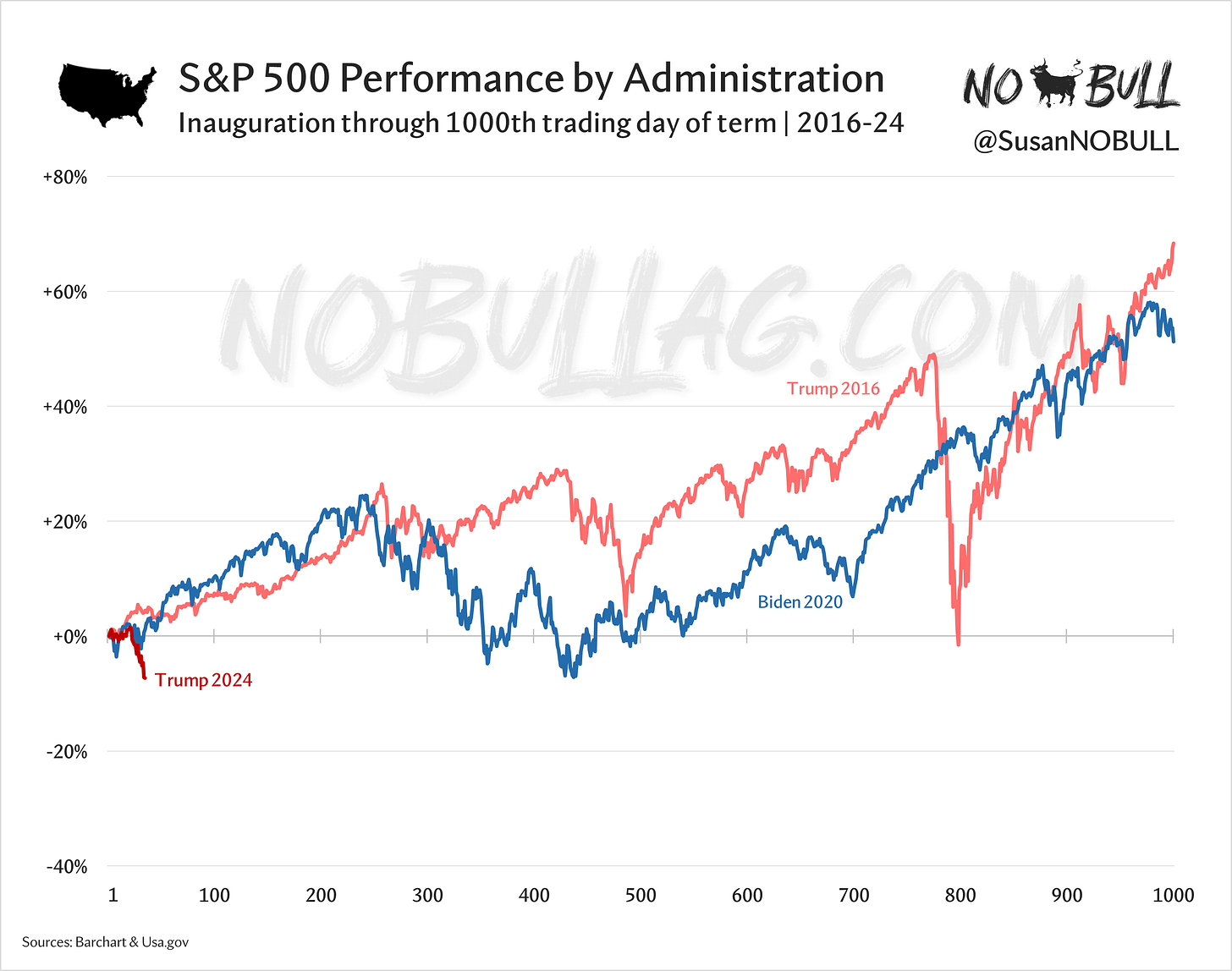

Stock indices are headed in a slightly different direction than they were at this point in Trump’s first term - with the key difference being 2018’s trade war did not begin until Trump had been in office nearly 300 trading days.

This time around, Trump was not only extremely vocal about his intentions, but he hit the ground running and at a mere seven weeks in, has investors running as well.

Zooming out to look at the entire four years (and adding Biden):

(the Covid drop followed by a full recovery and then some by the end of Trump’s first term is crazy)

9 | Certainly Uncertain

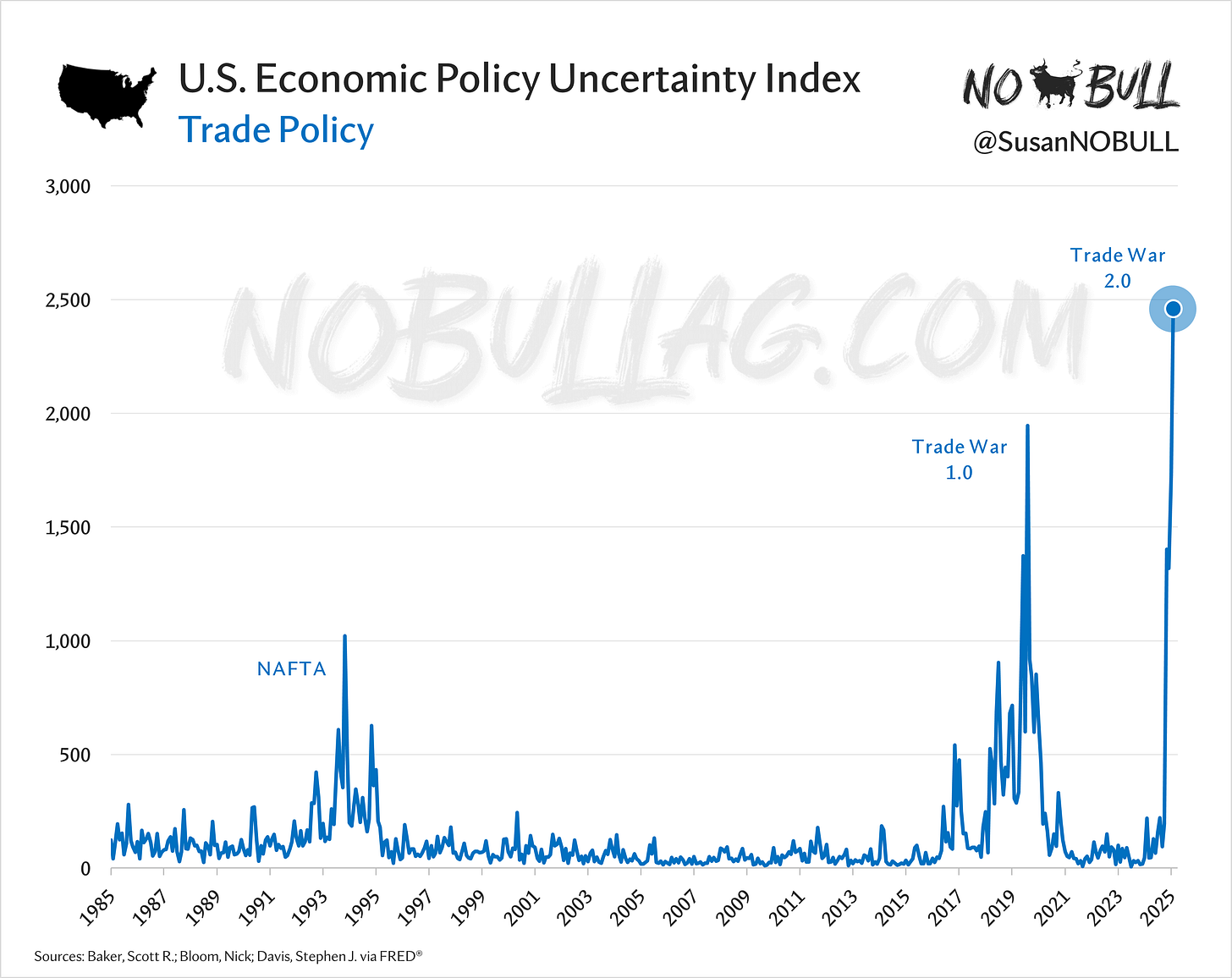

If you are feeling uncertain, you are not alone.

The U.S. Economic Policy Uncertainty Index for Trade Policy has never been this high:

8 | Front loading

The United States saw a record trade deficit in the first month of 2025 as importers raced to import goods ahead of Donald Trump’s promised tariff extravaganza.

Preliminary census data pegs January’s trade deficit at $153 billion, up 24% from December’s then-record $123 billion and nearly 70% higher than January 2024.

When I think ‘front-loading’ (especially as it relates to policy) I cannot help but think of Europe’s infamous EUDR (deforestation regulation) that caused buyers to overbuy Brazilian bean meal before the regulation was set to take effect at the end of 2024.

The regulation ended up postponed one year, though, so it’s business as usual until we see another round of front-loading next fall.

7 | King corn

Much to the dismay of traders and the market, alike, USDA left its 2024/25 corn export estimate unchanged for the 3rd month in a row yesterday, despite the current sales pace running 200 million bushels ahead of their 2,450mbu full year estimate.

Is it front-loading?

Perhaps.

Is USDA trying to account for the (trade) unknown?

There’s a chance of that too (although USDA NEVER makes changes on trade assumptions).

Regardless, there is one corn number that changed again for the 7th consecutive month - China’s imports.

USDA took China’s import estimate down another 2mmt to 8mmt (315 million bushels) on Tuesday, which if realized would be a 5-year low and down 65% year-on-year.

6 | Cause & Effect

There are a number of reasons for China’s declining import prospects in a combination of both price and availability.

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.