What’s HOT & What’s NOT

HOT

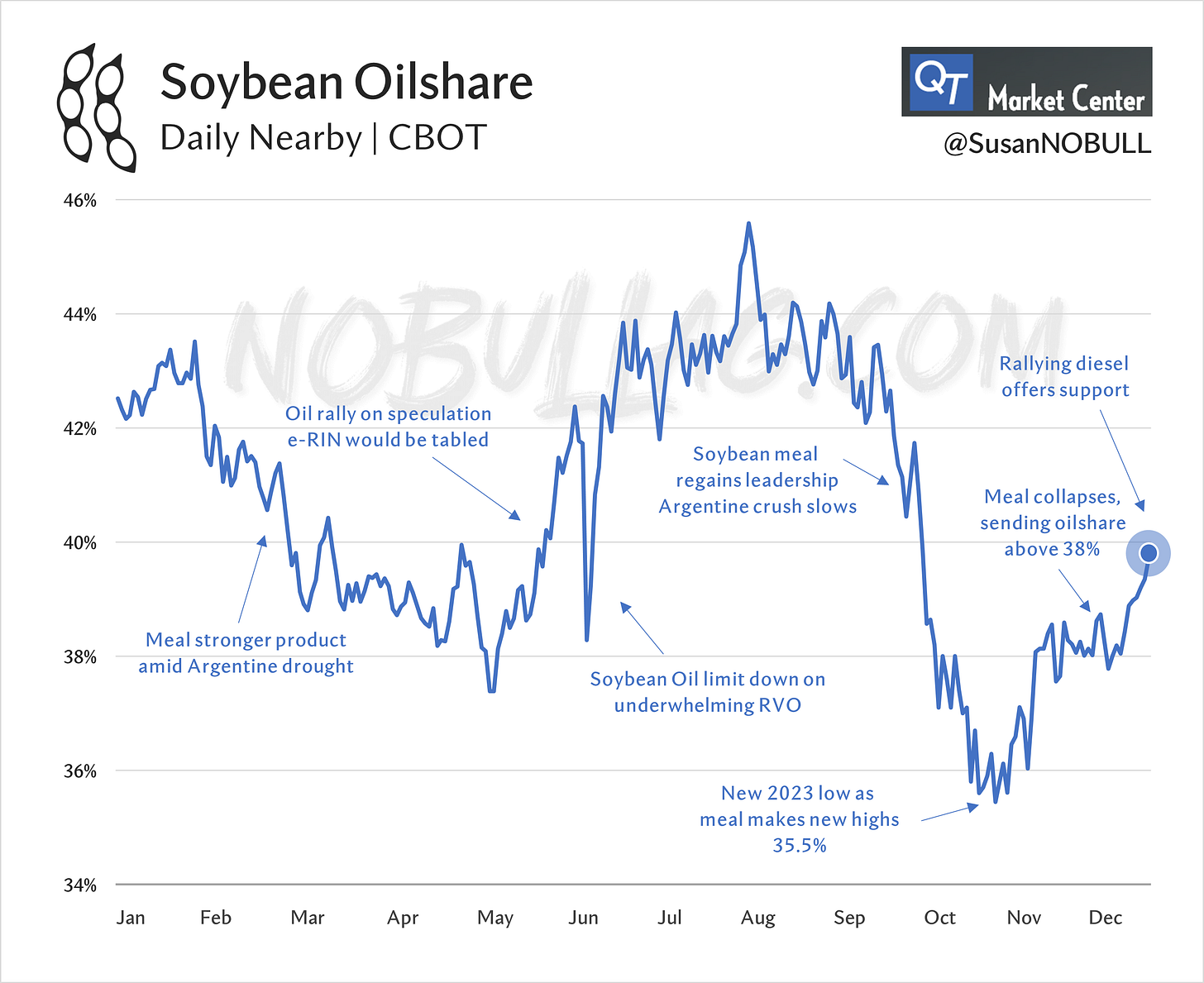

Oilshare is back to flirting with 40% as soybean meal has fallen on its face in recent weeks.

NOT

Much of oil’s “strength” (it’s +0.15% YTD is hardly strong, but at least it hasn’t tanked) can be attributed to weakness in meal which has lost nearly 6% since the calendar turned to January.

Nearby meal is close to testing the early-summer lows, falling nearly $80 from its highs just eight short weeks ago.

HOT

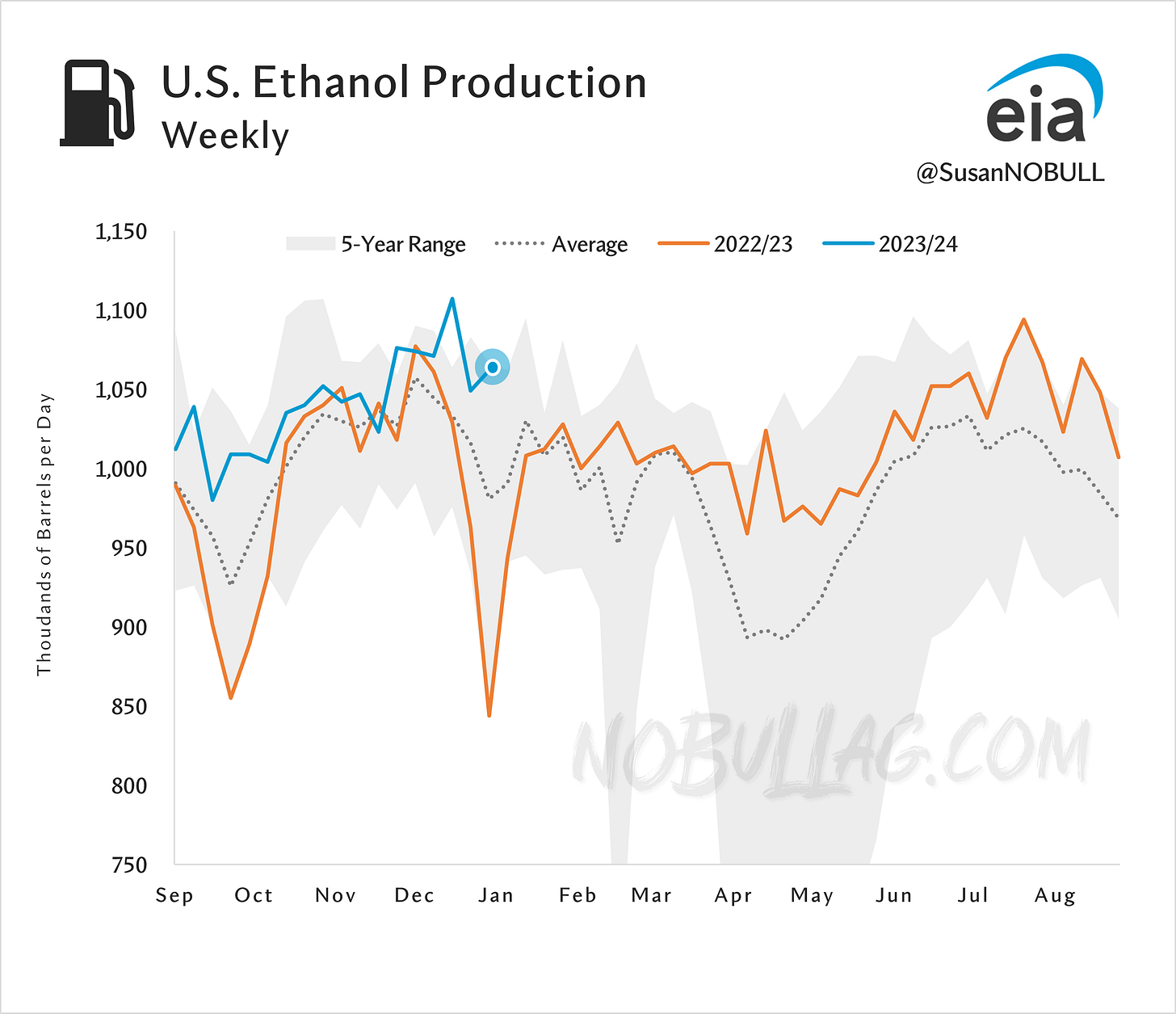

Just like soybean oil appears a winner simply because it hasn’t been a big looser in recent days, ethanol is ‘hot’ relatively speaking.

Futures have bounced in recent days, supported by declining corn prices and a gasoline market whose premium over ethanol remains historically wide.

Weekly production remains strong, which might push USDA to revise their full-year estimate higher in upcoming reports.

One thing to watch is the way this week’s (and next’s) winter storm/blast of below-normal temps impact production rates. More on that in a minute…

NOT (sort of)

While operating margins are far from their early-fall highs, they are still positive and in recovery mode.

Not to fail to mention the industry has had plenty of opportunity to lock in forward returns much higher than Iowa State’s model below indicates.

HOT

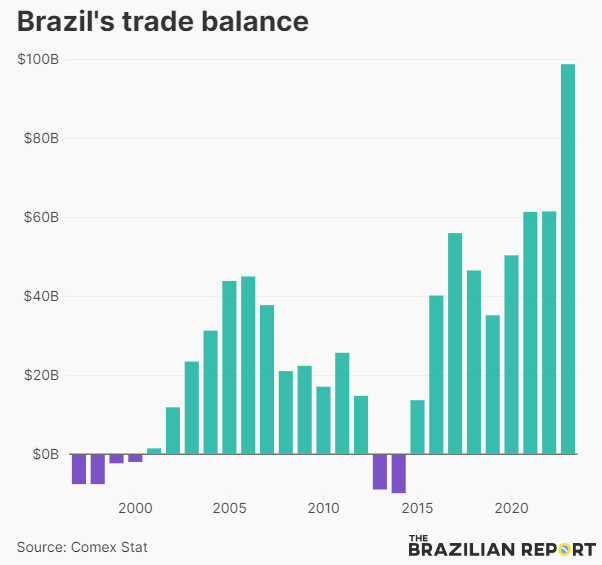

Brazil finished 2023 with a record trade surplus at $98.8 billion - up 60% year-on-year - led higher by a record $81.5 in agriculture and livestock exports.

2023’s record surplus was fueled by a huge jump in ag exports.

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.