Welcome to The Tuesday HOT TAKE. Ideally this won’t turn into an evening thing but as usual, time got away from me today.

As mentioned last week - I am new to Substack which means I am fumbling around trying to make sure I send updates to the right group, plus I suppose it is necessary to give everyone an idea of what they get for $295/year (or $29.50/month if you so choose) - therefore, this week’s updates will remain FREE for all.

Might as well call me Bernie Sanders - until next week, anyway.

Speaking of Bernie - remember this?

Crazy that the railroad strike near-crisis was only a month ago. The past few weeks have been in dog years, if you ask me.

By the way - if I reference an article, I will always link it, so just click the picture.

Alright - back to the railroad. Yesterday news broke that one (of twelve) rail unions had rejected a tentative contract agreement, leaving a strike on the table for mid-late November. You can read about it via Axios HERE.

With the inland river system in utter disarray due to low water, this gives the rail unions substantial bargaining power… shocker.

Alright - on to everyone’s (least) favorite topic: low water.

I have some pictures and video from the Lower Mississippi that I will get to on Thursday, but for today - check out the Sahara Desert - I mean Ohio River at Mound City, Illinois:

That is CBG Mound City across the river to the left and ADM on the right. Thanks to Jason Renaud with CGB for sending me the link to these images. Photo credit: Ballard Drone via Facebook.

Incredible. The only thing missing are a few lounge chairs and a tiki bar.

The River has been closed on and off in this area as groundings were have been a regular occurrence in the channel. Otherwise, you can see the straggler empties in the images above that are like beached whales until we see some rain.

Rain? What’s that?!

Rain is something many of us haven’t seen in a while.

A wee bit of a dry spell has developed across the Plains, Midwest, East, South, Delta, and just about anywhere else.

It looks like the only place that HAS received precipitation the past 30 days IS the desert! What kind of cruel reality are we living in here?!

Zzzzz…

Thinking back over the past month/six weeks my phone has been pretty quiet, reason being that harvest started and it hasn’t stopped.

This week, soybeans take the spotlight as national progress doubled week-on-week, up 22% at 44% harvested versus 38% average.

The largest increases were noted in the N Plains/WCB. MN took the prize up 34% this week.

National progress is 44% done vs a fast 47% last year and 38% average.

Illinois is bringing up the rear at 31% harvested, lagging an average pace by 12%.

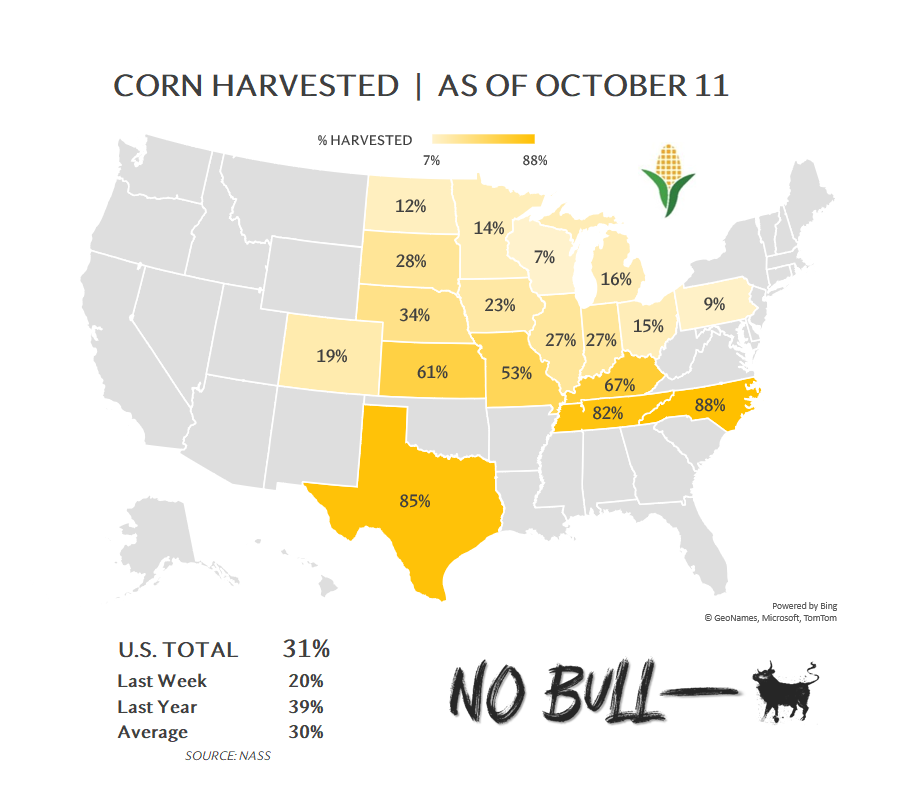

Alright, moving on to corn:

Sorry Illinois, but you are lagging here in a major way too: 16% behind average at 27% complete.

What gives? Later than normal planting, a relatively cool last half of August and a corn crop that just won’t dry down.

As a whole, US corn is 31% harvested, up 11% on the week and vs 30% average.

Last but not least let’s talk about weekly export inspections.

At 35.6 million bushels, soybean export shipments hit a 3-year low for this particular week, even lagging last year when the US Gulf was still limping along post-Hurricane Ida.

A damaged Delta crop + messy river logistics + lackluster demand = a very poor start to the new marketing year.

Accumulated exports are 101 million bushels - less than half of the seasonal pace needed to hit USDA’s current full-year estimate of 2.085 billion bushels.

The problems on the Mississippi will become increasingly evident the next few weeks as the lag in barge arrivals/light-loaded shipments at the Gulf limit our exporting capacity.

I suppose we better touch on corn inspections before calling it a night. At 18 million bushels, we have not exported this weenie of an amount of corn since September of last year (in the Ida aftermath).

More on this mess Thursday.

We will walk through some very basic math that explains Gulf values, barge freight, and how it translates to what you are paid at the local elevator.

Hot Nuggets:

Corridor or no? Weekend military strikes by both sides in the Black Sea bring the status of the Grain Export Corridor into question

UN officials are headed to Moscow to discuss. The current corridor agreement runs through mid-Nov

Oct WASDE at 11am central tomorrow. What will it say? Your guess is as good as mine.

Trade expecting a slight reduction in corn yield/drop in end stocks & the experts are at odds over bean yield, but they can all agree carryout is growing

PPI tomorrow AM with CPI Thursday - are we in for a big, fat macro overhang?

All eyes on South America as planting gets underway. Brazil is forecasted to see record corn AND bean crops, assuming normal weather. We are far from the finish line and with substantial odds of the 3rd La Niña event in a row - anything is possible

Buckle up, this wild ride is far from over. Cya Thursday!

Like this update? Fantastic - subscribe below because eventually I will get this Substack thing figured out and the in-depth, freebie updates will cease.