#10 | 18 Long Months

It has been 18 long months, thousands of headlines and a handful of corridor agreements since Russia invaded Ukraine in February of 2021.

Relations have eroded the past two months as the latest corridor agreement was not renewed and conflict between the two has only intensified.

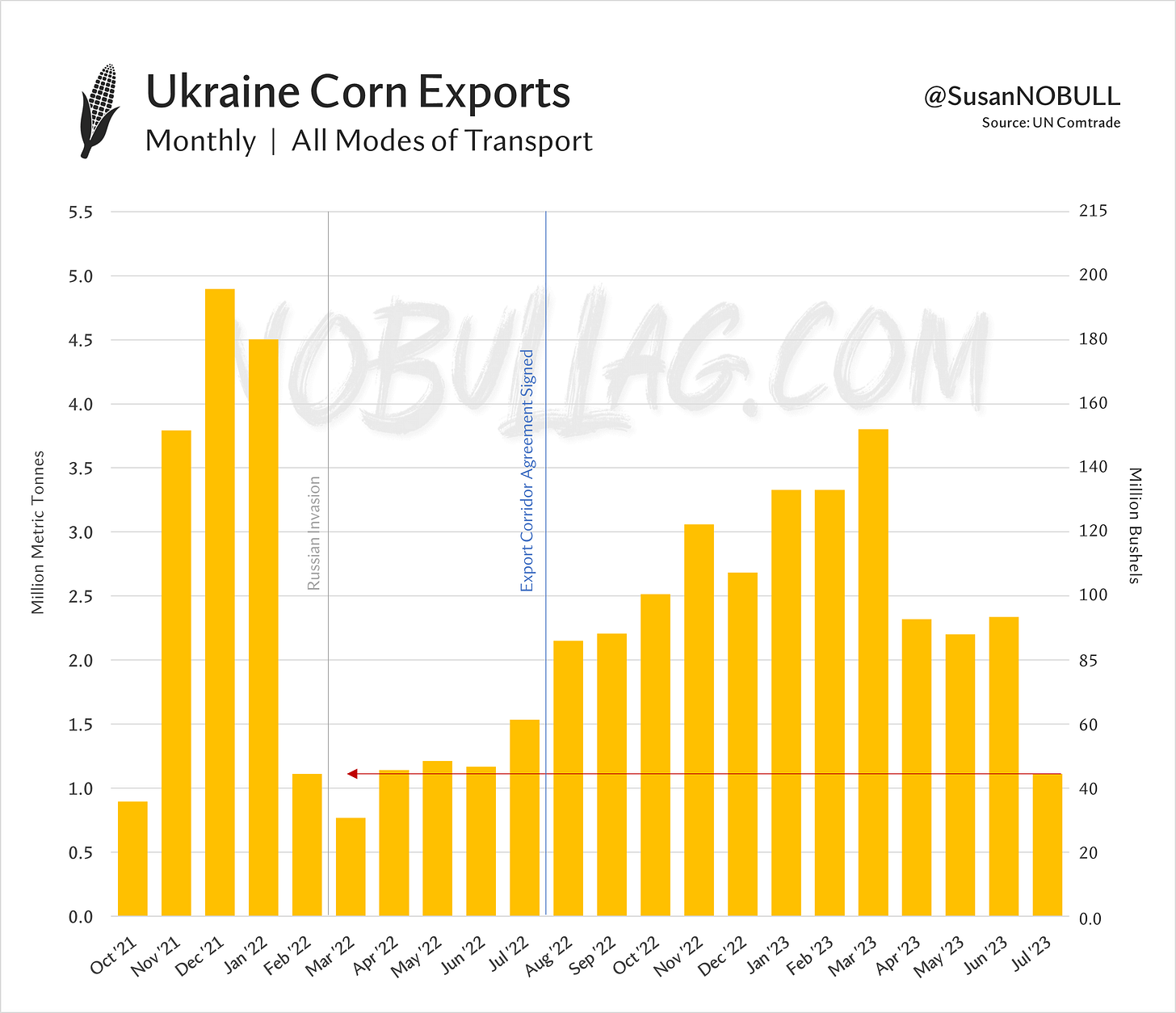

As a result, Ukraine exported 1.135mmt (45mbu) of corn in July, less than half of June’s total and the smallest amount since March 2022.

Ukraine has long-relied upon seaborne exports, making the corridor agreement vitally important not only to Ukrainian agriculture, but world buyers as well.

Europe has won by default in some regard as more bushels have moved via truck and rail into bordering nations than ever before.

Last year’s drought plus the neighboring abundance of cheap Ukrainian supplies pushed EU corn imports to a record high in the months from July 2022 through this past June.

European Commission data shows 2022/23 corn imports at 22.4mmt (880mbu), up 10mmt (394mbu) from the year prior.

Current marketing year corn imports are off to an average start in 2023/24 but it is worth noting 63% have been of Ukrainian origin - up from 38% at this point one year ago.

Ukraine’s ‘cheap and close’ corn export gains have been at the expense of Brazil whose marketshare is currently down 25% year-on-year.

China has been the largest beneficiary of the export corridor though, with almost one-forth of shipments leaving Ukrainian ports, China-bound.

More than half of the nearly 33 million tonnes of grains, oilseeds and other ag products exported as a result of the initiative have been corn (665mbu seaborne exports to date).

… and more than one-third of those shipments were destined for China.

Before moving on - let’s jump back to Europe for a bit where wheat imports were a record 9.3mmt (340mbu) from July 2022 through June 2023 - 3.5x larger than the year prior.

2023/24 is off to a record start as well with the first eight weeks of imports nearly doubling last year’s record pace.

Ukrainian wheat is more than $1 less per bushel than the next cheapest option (Russia) and a lack of seaborne export capacity leaves its buyer options limited.

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.