#10 | On the rise

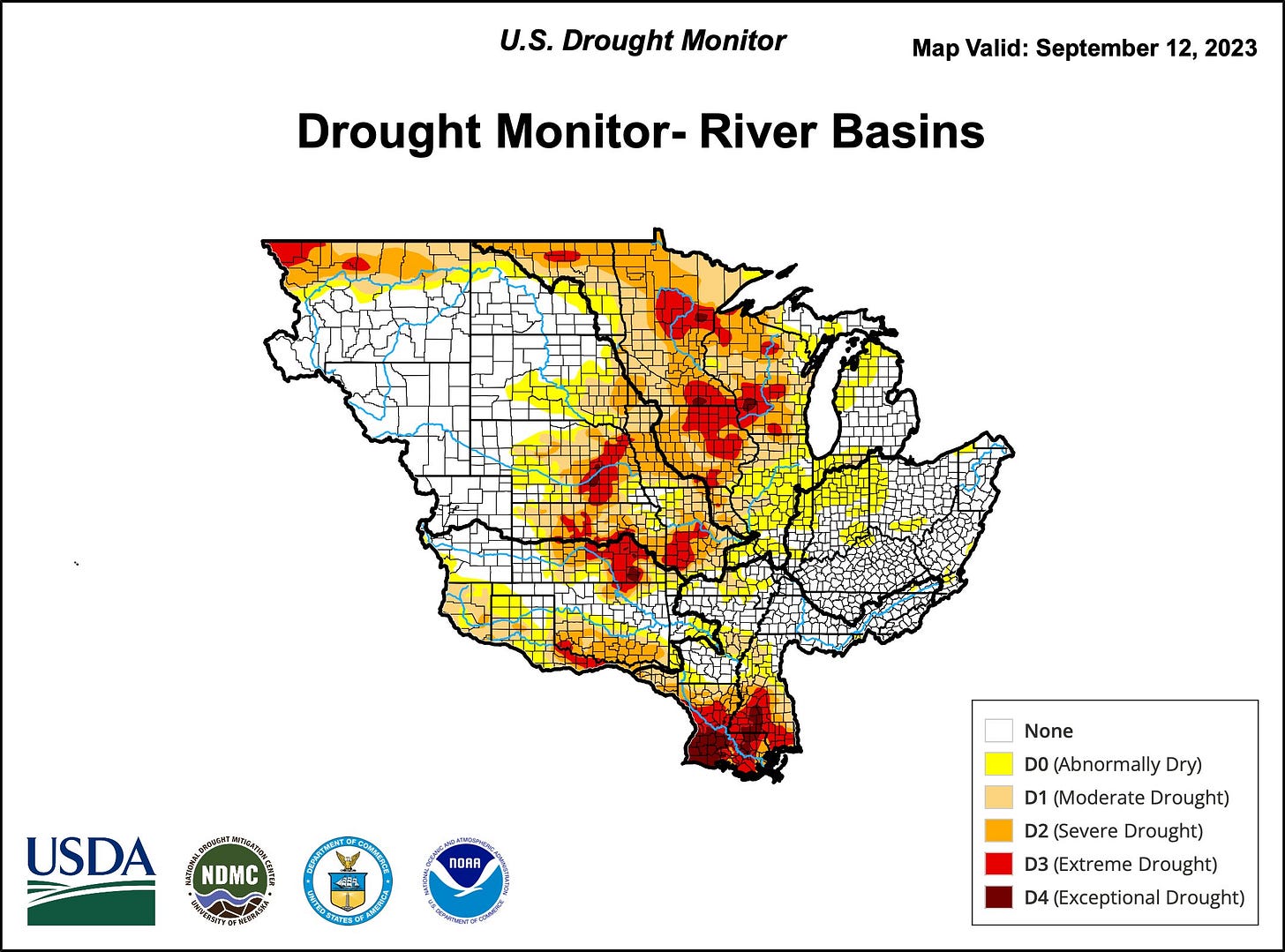

Drought conditions persist in the Mississippi River basin, intensifying in recent weeks:

Water levels are going down and freight is on the rise as draft and tow restrictions reduce river transportation capacities.

Additionally, groundings and dredging operations have resulted in multiple closures and/or narrow passes delaying transit times by two to three days on the Lower Mississippi.

Spot freight in St. Louis is trading near 900% which is more than double average rates and above last year’s record high on this week.

In other words it costs nearly $1 to barge one bushel of soybeans from St. Louis to the Gulf, up from 75 cents one year ago and 45 cents average.

#9 | Elephant in the room

Meanwhile…

#8 | On the 8th Day

A classic:

#7 | Soybean oil, strong like bull

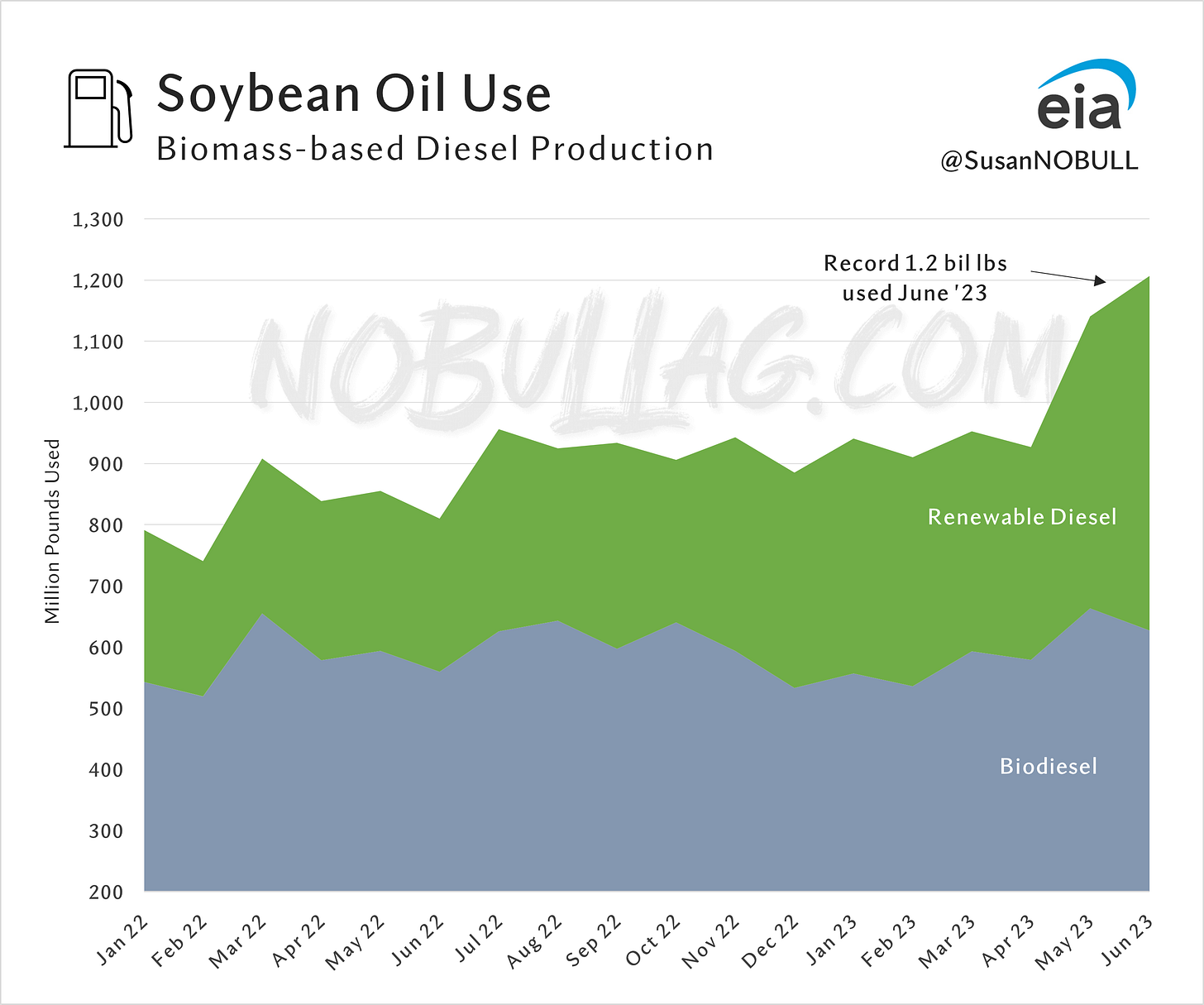

According to the EIA, the US used a record 1.2 billion pounds of soybean oil in renewable fuels production in June, a 50% increase over June of 2022.

Soybean oil continues to hold its position as the largest feedstock for biomass-based diesels. In June, bean oil was 42% of the feedstock-share, up slightly from May as oil remained competitively priced at the start of the summer.

Used cooking oil had a 19% share, corn oil 14%, canola 11% and tallow 9% of the record 2.88 billion pounds of feedstocks used in biomass-based diesel production in June.

Corn oil and tallow use also set a record in June.

#6 | Slight difference

With unprecedented growth in biomass-based diesel production (the renewable diesel boom) resulting in record domestic usage of soybean oil, there is little left over for export (no one would want to buy it anyway as US prices are markedly higher than any other origin/these things go hand-in-hand).

Cumulative marketing year commitments sit at 113mmt - less than one-fifth of commitments at this point, one year ago.

Soybean oil and corn have something in common - USDA has spent report after report reducing their full-year export estimate.

2022/23 bean oil exports have been reduced nine times in the last eleven reports and are currently only 26% of USDA’s full-year projection one year ago.

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.