Corn

For old crop corn, exports & ethanol demand were each raised 50mbu, reducing old crop carryout by 100 million to 2.022 billion - the lowest print so far in the 2023/24 marketing year.

For 2024/25, ethanol demand was left unchanged year-on-year (citing flat motor gasoline demand) while feed/residual are higher (larger crop) and exports grow year-on-year, supported by smaller exports in both S Am and the Black Sea.

As a result, 2024/25 ending stocks are projected to be up 80mbu year-on-year at a 7-year high of 2.102 billion bushels.

It should be noted that this is a welcomed improvement from initial thoughts closer to 2.5bbu that we have all been fearful of for months.

USDA did drop their old crop average farm price a nickel to $4.65 while their initial price projection for the 2024 crop was a $4.40 - down 25 cents year-on-year.

Brazil and Argentina both saw 2mmt (80mbu) reductions in 2023/24 production.

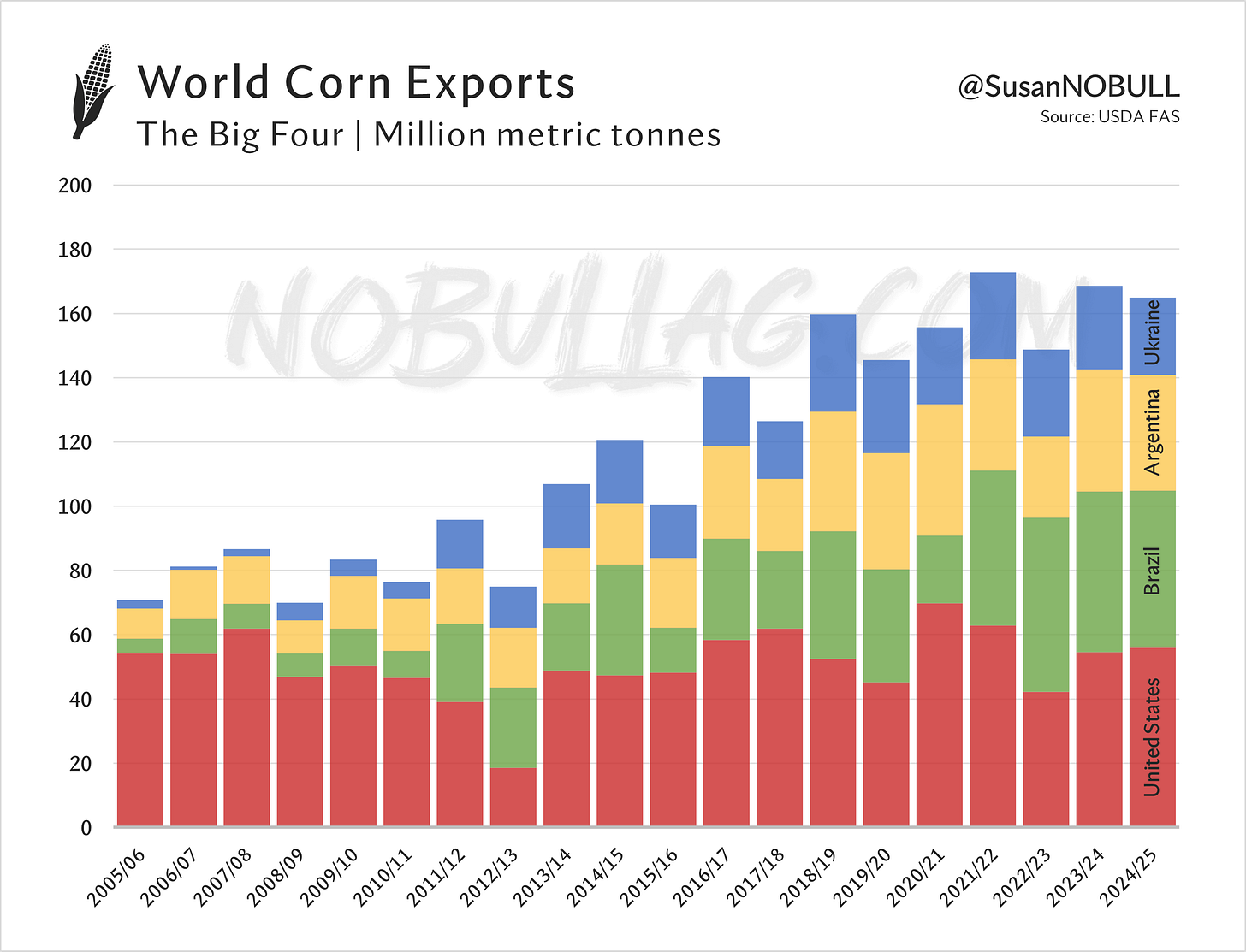

Argentine exports were reduced 4mmt to 36mmt (1.4bbu) but remain the 2nd-highest on record. Brazil’s current crop exports were reduced 2mmt to 50mmt (1.97bbu), leaving them as the #2 corn exporter in the world in 2023/24 - behind the US.

2024/25 will make the second year in a row the U.S. has exported more corn than Brazil following being dethroned by the South American behemoth in 2022/23.

Other items of note:

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.