Tripp (the nine-year-old, home sick from school) is now dispatching trucks…

PRINTABLE, full report recap HERE.

Ahhh it is another glorious report day, packed full of surprises...

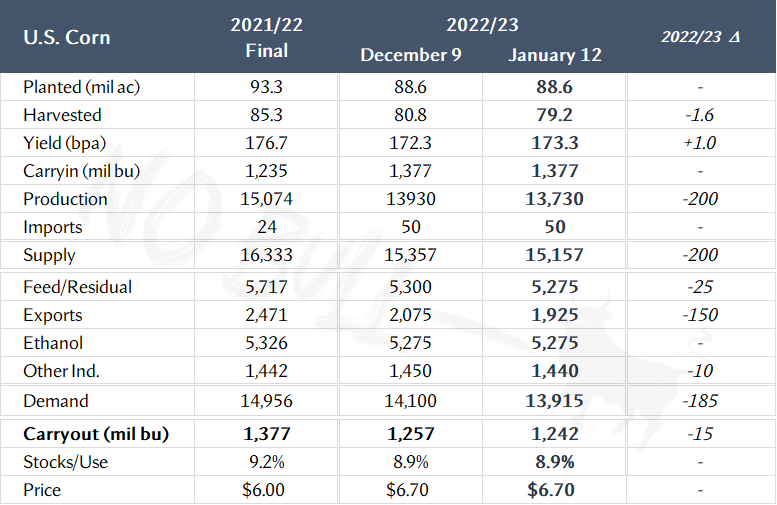

2022 U.S. Corn

In a surprise, USDA increased corn yield a full bushel per acre at 173.3 bpa (vs avg trade guess of 172.5 and 172.3 in Nov).

By the way - shout out Illinois for your record 214 bpa yield (previous record was 210 in 2018).

The bump in yield was no match for harvested acres though, as USDA slashed them an unprecedented 1.6 million acres.

Remember states in the west and southern plains that struggled with drought? One word - abandonment.

Drought-stricken states in the west and southern plains saw dramatic reductions in crop size.

Changes from November:

ND -36.3 mil

IA -34.9 mil

NE -107 mil

KS -51.7 mil

CO -17.8 mil

TX -14.4 mil

ND, SD, IA, NE, KS, CO, & TX combined production is down nearly 900 million bushels, year-on-year.

Hear that sound? It is a gigantic corn vacuum in the Plains!

By the time the dust settled today, 2022 production fell 200 million bushels after accounting for the drop in harvested acres and increase in yield.

At 13.73 billion bushels - 2022 production was the smallest since 2019 and was 119 million bushels below the lowest pre-report guess.

We can’t have a big drop in supply without a drop in demand…

In response, USDA cut a combined 35 million bushels from feed and industrial use then whacked exports by 150 million.

Given the fact (as of this morning’s export sales report) commitments have been lagging the pace needed to hit USDA’s full-year estimate by more than 300 million bushels - today’s whack was warranted.

Today’s sales were AWFUL…

After today’s drop in production and near-equal drop in demand, 2022/23 ending stocks were reduced 15 million bushels to 1.242 billion bushels.

USDA backed into their math today but keep an eye on corn exports because they have been pathetic up until this point but with troubles brewing elsewhere, the U.S. might find its way back in the game soon.

2022 U.S. Soybeans

Beans saw a 300k acre drop in harvested area along with 0.7 bpa drop in yield. At 49.5, this year’s yield is more than 2 bpa less than 2021.

Only two states saw year-on-year increases in yield:

Like corn, 2022 production fell well below pre-report estimates. At 4.276 billion bushels, 2022 production was around 50 million bushels less than the lowest pre-report estimate.

Exports were reduced by 55 million bushels as Chinese demand was reduced slightly. The net effect was a 10 million bushel decrease in ending stocks to 210 million bushels.

She’s tight fellas, with little room for error.

World Changes

Corn

USDA reduced Argentina’s production by 3mmt at 52.0 and exports saw an equal decline

BAGE left their production estimate unchanged this week at 50 mmt

Brazil's corn production was reduced 1mmt at 125.

Conab decreased their estimate of Brazilian production to 125.0 vs 125.8 in Dec

Ukraine’s exports were increased 3mmt

No change for the EU (wheat imports were +1mmt though)

China’s corn production was increased 3mmt but imports were left unchanged at 18mt for the gazillionth month in a row

Soybeans

Argentine production dropped 4mmt to 45.5mmt, with crush reduced 1.75mmt and exports reduced 2mmt

BAGE also cut Argy production this week, down 4.5mmt to 41.0

Brazilian production increased 1mmt to a record 153mmt and exports increased to 91mmt

Early Thursday, Conab cut Brazil by 765tmt to 152.7mmt

Chinese domestic production was raised 2mmt while imports were reduced 2mmt to 96mmt (hmm I do believe that is just what the CCP ordered) and crush dropped 1mmt

2023 Wheat

You hate growing it and I hate talking about it…

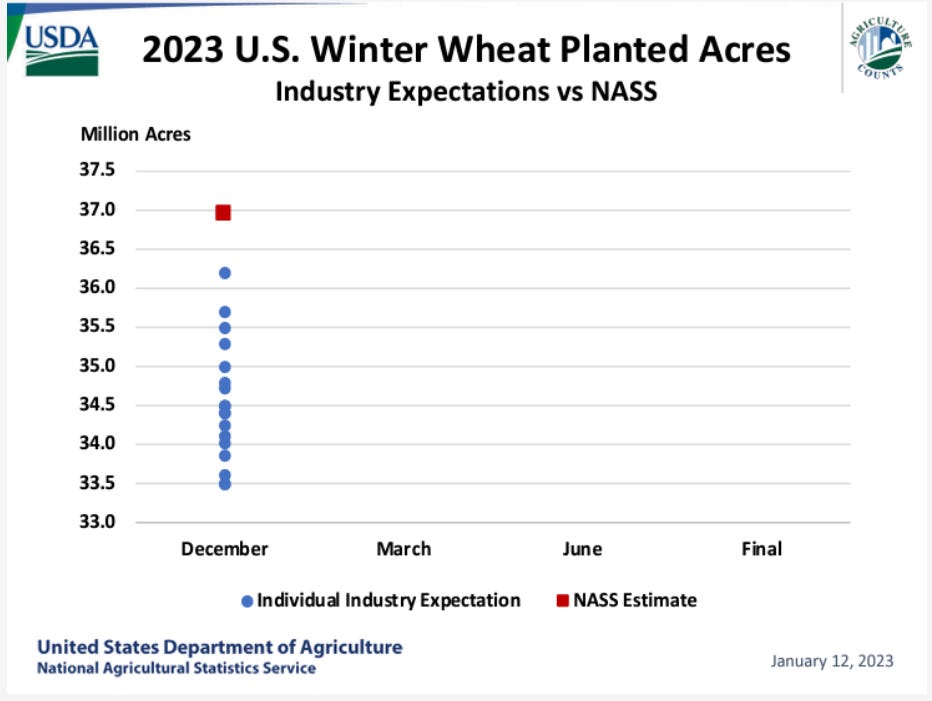

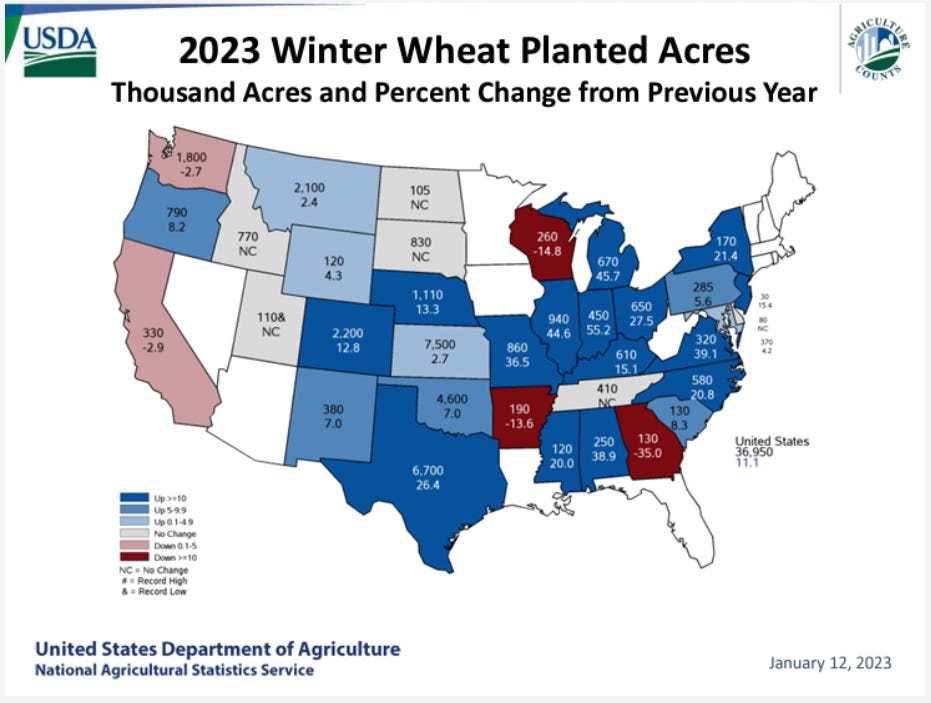

Alright, so 2023 wheat acres came in substantially above pre-report expectations but I am unsure that it means much in the bigger picture as it will be a few more months before we see if all of those planted acres are in fact viable.

#abandonment!

HRW acres were up 10% year-on-year, while SRW acres were up 20%.

As the Donald would say - it was a YUGE surprise to the upside, but we do not know the viability of those acres and that is that.

Dec 1 Stocks

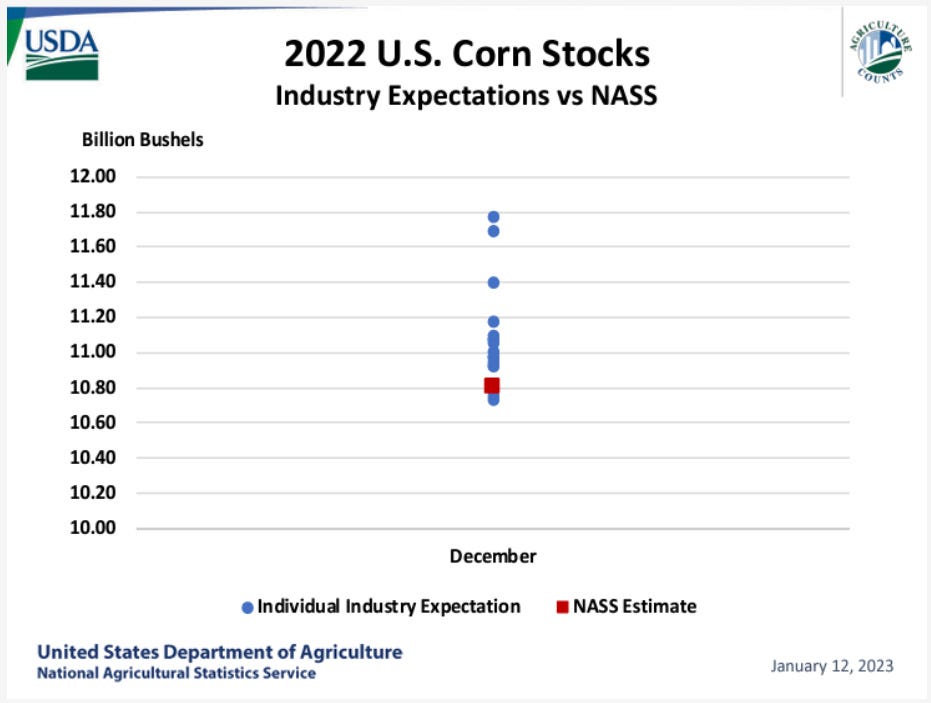

Quarterly stocks fell at the low end (or below) expectations.

A shockingly smaller corn crop led to a stocks surprise to the downside:

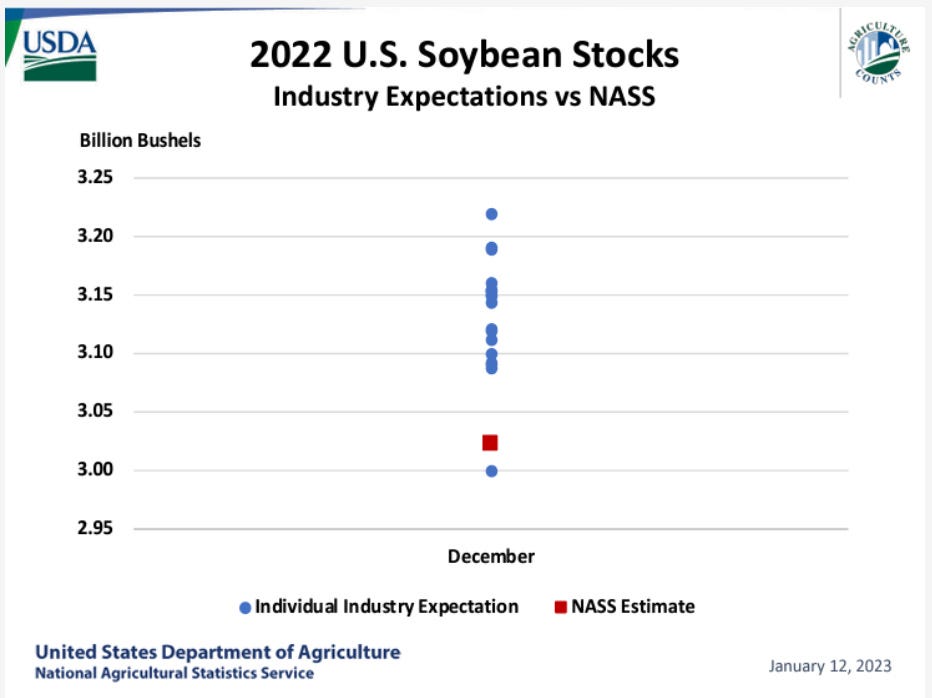

December bean stocks came in far below average pre-report expectations as 2022 production was reduced and a damaged Delta crop plus low water conditions on the Mississippi prevented a build in the pipeline.

Wheat stocks came in below even the lowest pre-report guess and this happened even with an upward revision in June 1 stocks, implying better than expected feed use in those quarters.

Final Thoughts - Report Day

I hate reports.

This is because of the buildup heading into them (the anxiety - to sell or not to sell).

It is also due to our tendency to get fixated on one or two numbers, leading us to miss the forest for the trees.

Without further complicating matters - today’s report was a surprise, to say the least.

Scroll back up and check out the dot plots - comparing pre-report trade estimates (blue) with the actual numbers (red).

Big misses to the downside which led to big upside moves today.

USDA’s large reduction in US 2022 corn production will light a fire under what has been a struggling corn market. Likewise, US soybean ending stocks are tight with little room for error.

Never a dull moment!

Thanks,