She looks so innocent, but there is a lot of attitude packed behind that sweet little smile.

No clue where she got that from.

Note to Self: ‘Tis the Season

US soybeans exports naturally come to a screeching halt not long after the new year begins and Brazilian harvest gets underway.

Traditionally, the US has a bean exporting window that stretches from September through February (shaded area)… but that window has been cut short on occasion as an early Brazilian harvest steals business right out from under us.

Harvest really ramps up by February then exports see their peak during the next 3 to 4 months depending on the size of the crop.

Continued wet weather and cool temps have gotten harvest off to a slow start this year though, sending a little last minute business back to the US.

This has left the US in a position to pick up a little extra business by default.

As I mentioned Tuesday, export inspections remain strong with last week’s shipments being one of the highest for that particular week of the year on record.

Sales also remain (relatively) strong. This morning’s weekly sales were a 6-week high at 42 million bushels - 2.5x higher than the 5-year average for this week of the marketing year.

Brazil’s slow progress has helped make export sales flashes great again and light a fire under old crop futures in recent days.

We have had five flashes of old crop bean sales in the past seven business days totaling close to 30 million bushels. Four of those have been to unknown destinations, while this morning’s was reported as China.

In a notable turn of events, we saw four corn flashes as well over the course of those same seven days, to the tune of 23 million bushels.

Two of those corn sales were to unknown… which has offered a bit of support to the corn market with chatter “unknown” may in fact be China.

Either way we welcome the business with open arms as commitments still lag the seasonal pace needed to hit USDA’s recently (dramatically) reduced estimate by more than 200 million bushels.

Corn exports will be under increased scrutiny in the coming weeks and months. US beans are all but done (after this last little burst of business) and corn will remain a focal point as we play catchup.

Unfortunately for us these last-minute soybean sales may be nothing other than moving what would otherwise be summer business forward.

Soybean export commitments sit nearly 200 million bushels ahead of the seasonal pace needed to hit USDA’s current 1,990 million bushel full year estimate, but there is a good chance we will hit quite the lull especially with Brazil’s whopper coming on strong.

Notable Improvement

With spring planting only a few months away, market focus will soon shift away from the Southern Hemisphere and back to U.S. weather.

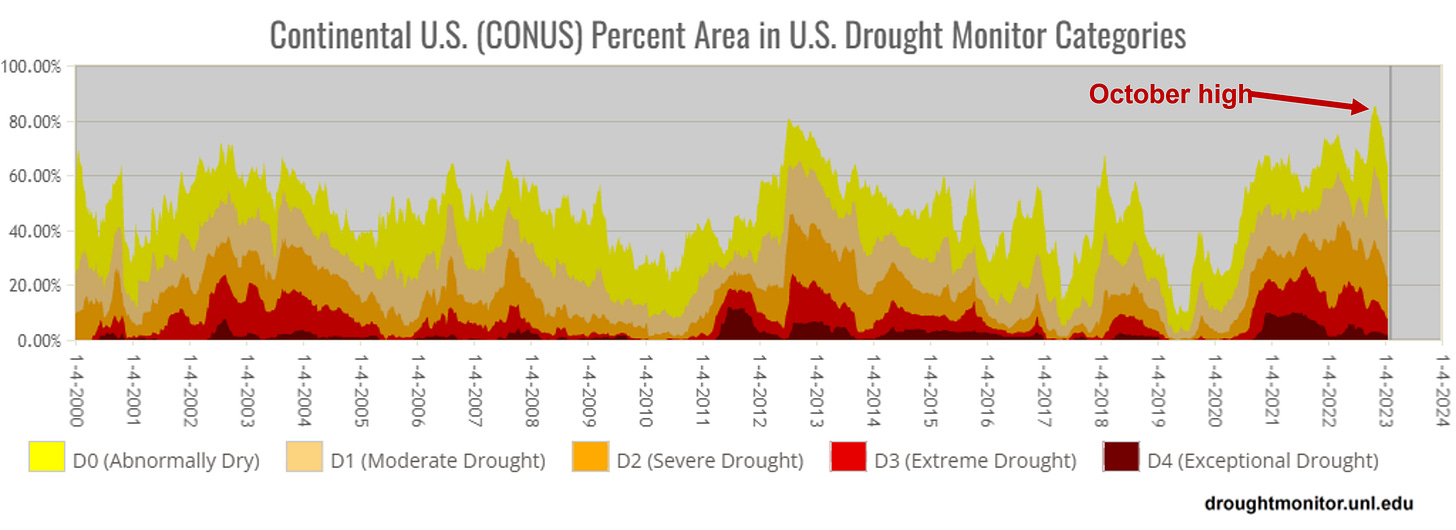

Today, 63% of the continental United States is experiencing some level of drought, down from nearly 85% in late October.

The United States (particularly in the east) has seen notable improvement in conditions the past three months.

Right now, 45% of US corn, 38% of US beans and 59% of US wheat production are located in areas experiencing drought, down from more than 70% of production in late October.

For now, drought continues to leave its mark across the Western Belt and Southern Plains.

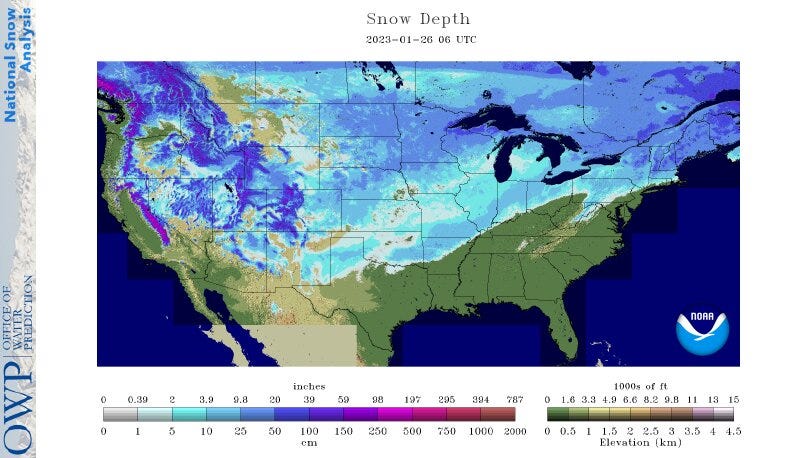

Recent snows have been welcomed with open arms, particularly on unprotected wheat acres across the Plains.

The 2023 winter wheat crop has been to hell and back since being planted in the dust last fall. Good-to-excellent conditions were at record-low levels heading into the winter months.

Add in late-December’s arctic blast and it is likely we see conditions deteriorate even further when USDA release their monthly condition update for key states on Monday afternoon.

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.