If you missed last week’s No Bull (Part One of Goin’ Green), I outlined the cause of what I would call the largest fundamental shift in fuel demand in modern times, thanks to California.

California’s Low Carbon Fuel Standard

Legislates a reduction in the carbon intensity of transportation fuels sold in or supplied to California

Established declining targets for greenhouse emissions through 2030

Spurred a revolution in biomass-based diesel production

Biodiesel vs Renewable Diesel

Traditional biodiesel = max blend of 20% with petroleum diesel & tends to gel in low temps

Renewable Diesel is a ‘drop-in’ fuel that can be stored/transported in existing infrastructure & used as a 1-for-1 replacement with petroleum-based diesel in engines

The Renewable Diesel BOOM

Renewable diesel production exceeded that of biodiesel for the first time in history near the end of 2022 & is set to more than double the next few years

Rising targets for state & federal renewable fuel programs & large biomass-based diesel tax credits are incentivizing rapid growth

Unsurprisingly, legislation similar to California’s LCFS has spread up the west coast and to other states across the U.S., plus Canada

Today, we are going to take a dive into the effects of the policy changes and resulting boom in renewable diesel demand - both intended and unintended consequences that are having a monumental impact on soy processing in the United States.

I will warn you - this one is long (hence the fact it is technically one day late), but I did my homework and let this serve as your cheat sheet to agriculture’s role in the renewable energy transformation that is underway here in the U.S.

I am slightly biased but if you are a free subscriber - there is no better time than now to upgrade to paid.

Charting a New Course

Renewable diesel is off like a rocket as 2022’s production is set to surpass 2020+2021’s production, combined.

I say “set to” as 2022 EIA has only reported data through November.

In fact, last year the U.S. produced more renewable diesel than it did if you add production from 2015 through 2019 together.

Renewable diesel production on a per day basis increased 73% year-on-year in 2022 and is estimated to grow at another 52% in 2023, and 42% by the end of 2024, according to the U.S. Energy Information Administration.

Consequently, EIA expects traditional biodiesel production to decline in the coming years as both biodiesel and renewable diesel compete for the same feedstocks (soybean oil, waste oils, animal fats, etc.).

High feedstock prices will limit biodiesel profitability and ultimately cut production as its margins are drastically smaller than those of renewable diesel.

Feedstock Fun Facts

In order to produce any biofuel - you need a feedstock.

Feedstocks range from corn or sugarcane for ethanol to vegetable oils, animal fats or waste oils as the more common feedstocks for both biodiesel and renewable diesel.

Wood chips, corn stover and all sorts of other ‘waste’ products are also used in renewable fuel production.

In fact, someone reached out to me via Twitter recently who is building a plant in Canada that utilizes forestry and ag waste to produce renewable diesel.

Soybean Oil

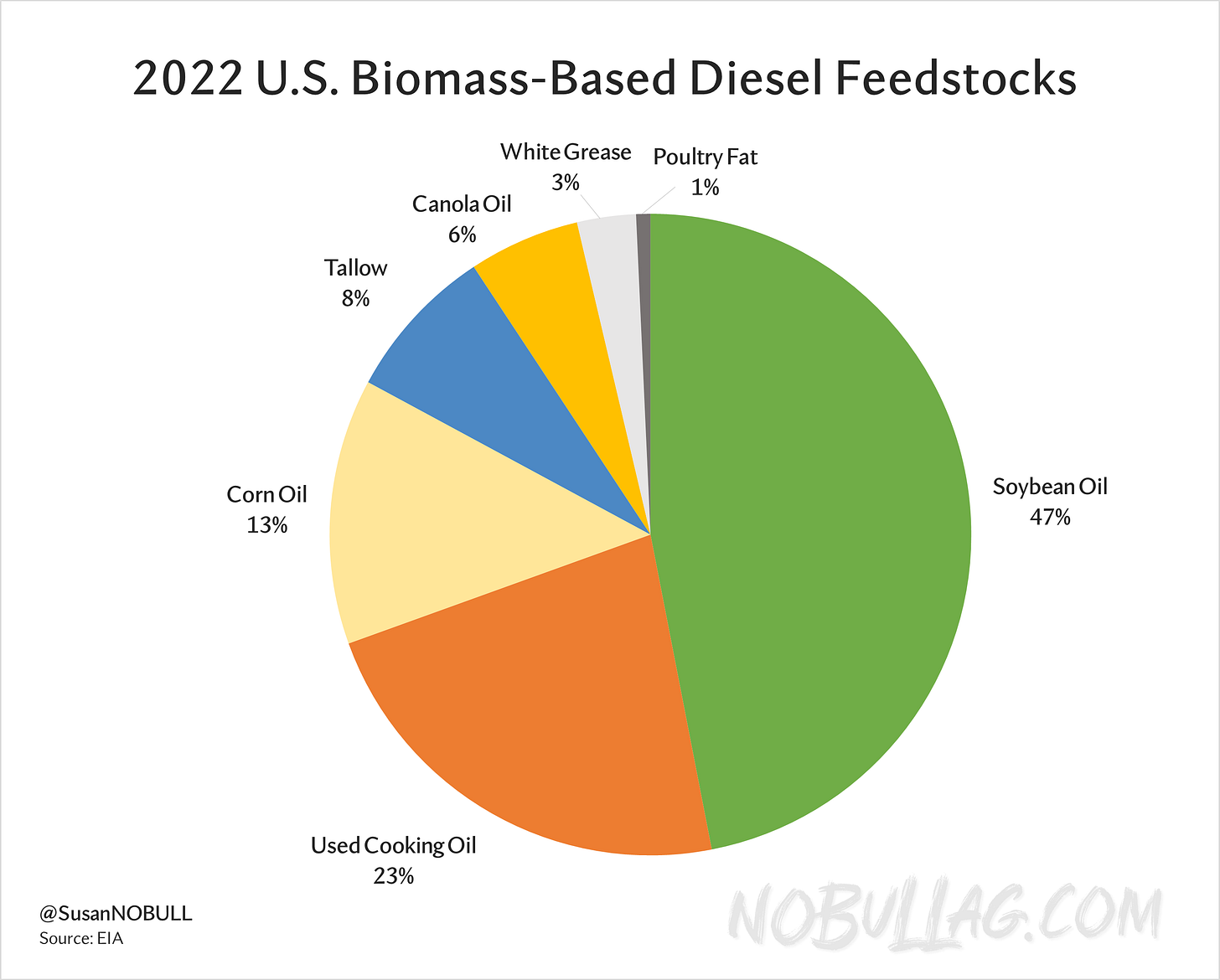

Soybean oil has long been the primary feedstock for biomass-based diesels here in the U.S. accounting for nearly half of feedstock use in 2022, although it’s percentage-share is technically on the decline.

Gasp! say it isn’t so?! We will get to that in a minute…

Biofuels’ demand for soybean oil has never greater though, as it is estimated to be a record 44% of total U.S. soybean oil demand this marketing year.

Consequently, soybean oil exports are set to hit a record low in 2022/23 as strong domestic demand has priced U.S. oil out of the world market.

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.