Tripp got to dress up like a literary character at school today.

He decided to repurpose the (gigantic) Case IH combine Valentine’s Day box he constructed last year and throw on some bibs and a flannel shirt since some of his favorite books are from a children’s series by Case IH detailing equipment and operations on the farm.

PS - This is his ‘I am super excited’ smile.

Double Take

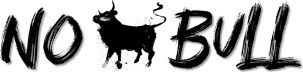

Europe surpassed a milestone recently, importing more corn in the seven months from July 2022 through January 2023 than it did collectively in 12 months prior to that.

Imports sit at nearly 16.5mmt, up 7mmt (275mil bu) compared with the same period in 2021 as 2022’s drought sent production to a 14-year low.

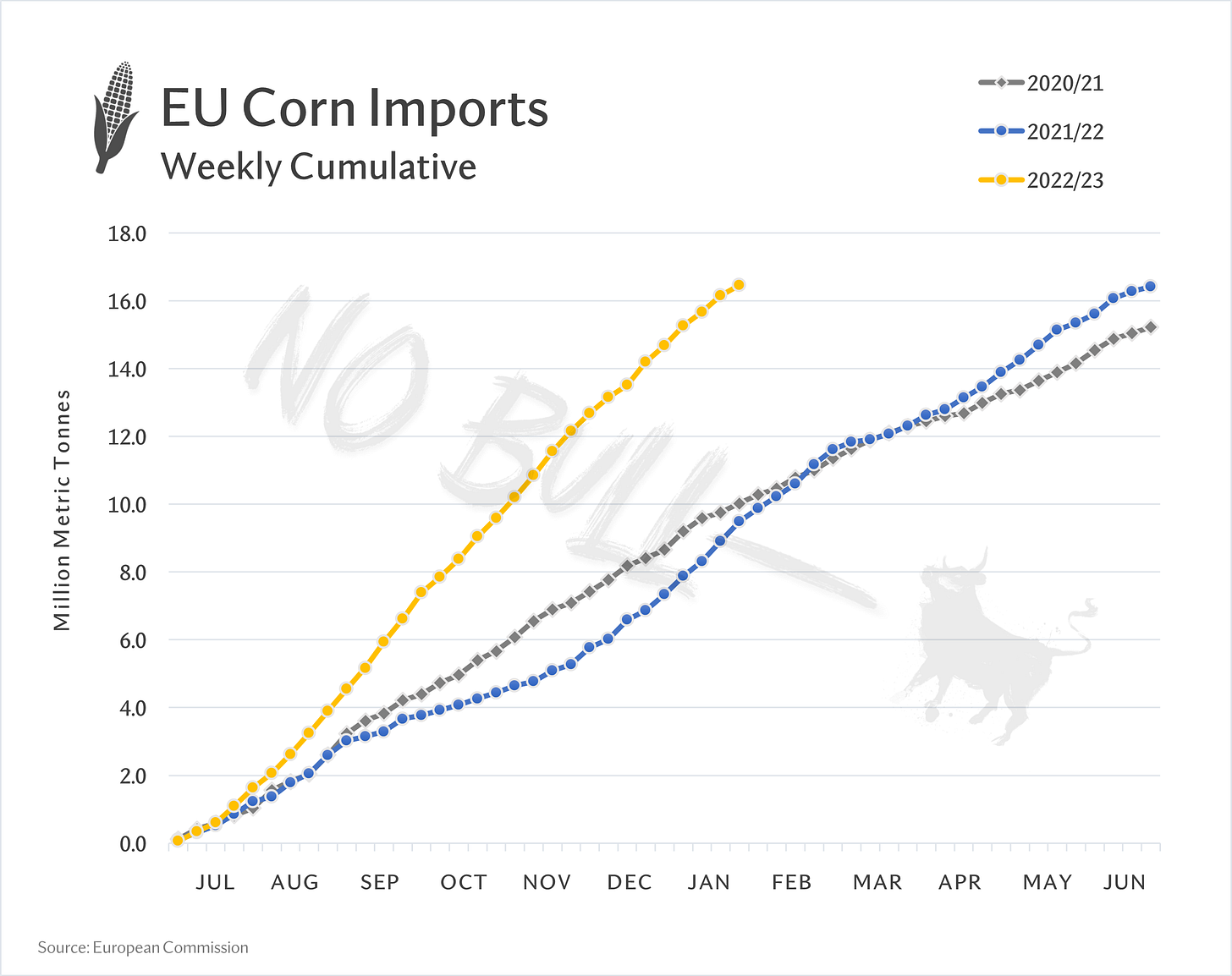

Likewise wheat…. well, I am not sure any comments are needed.

More than 60% of the EU’s wheat imports have been of Ukrainian origin this marketing year as prices have remained low and clearly freight is minimal given the fact the two are neighbors.

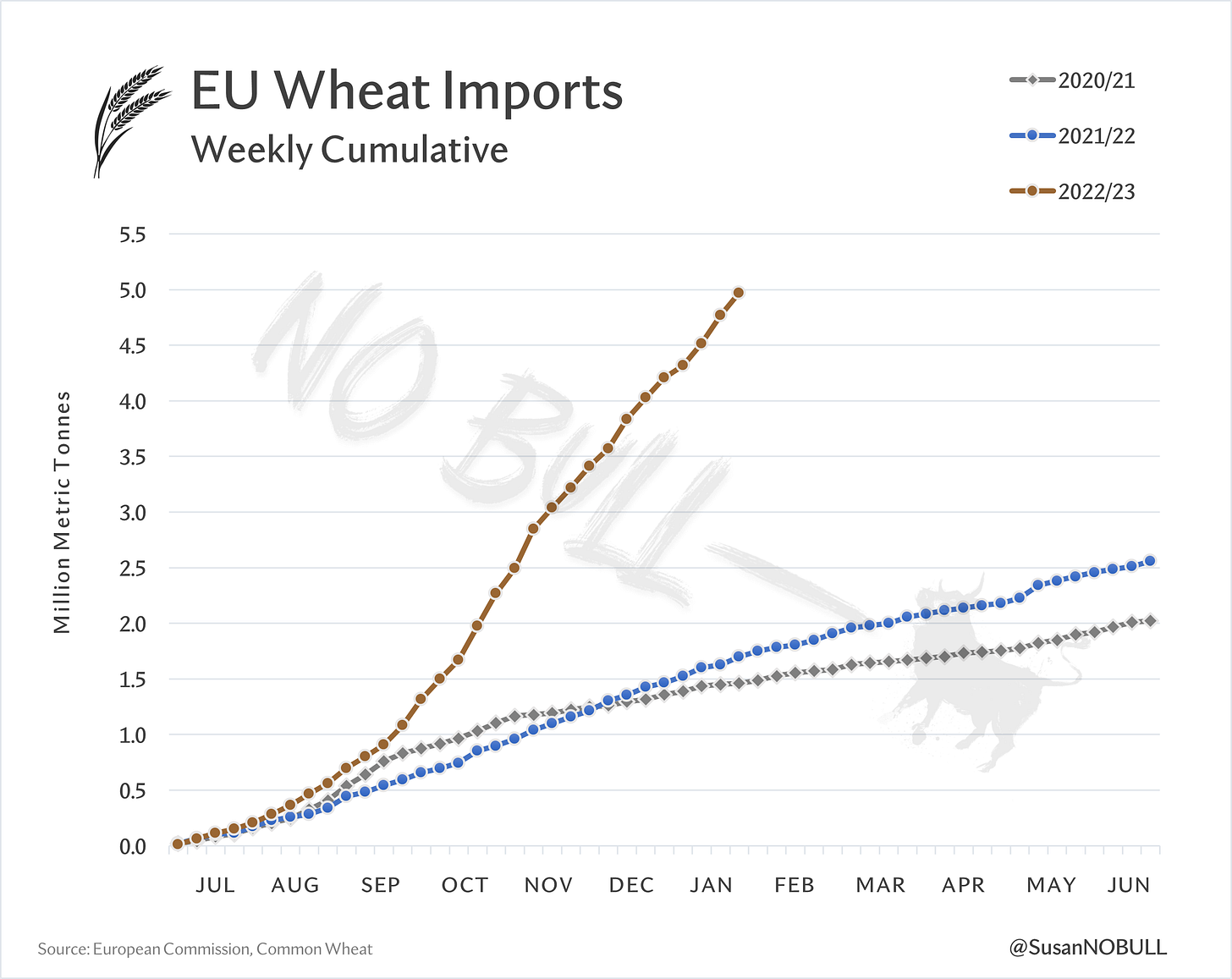

Unlike the grains, EU bean imports have fallen 20% year on year as high energy costs have curbed crushing demand (bean plants run on natural gas - more on this in a moment).

Although totals are down, the good news is US beans have been 49% of the EU’s 6mmt (220 mil bu) of imports since July (vs 37% last year) and essentially flip-flopping marketshare with Brazil.

Soymeal imports are also down year-on-year (-4%) as bird flu outbreaks have hampered demand and cheaper alternatives like rapeseed and rapeseed meal from Ukraine also fill the void.

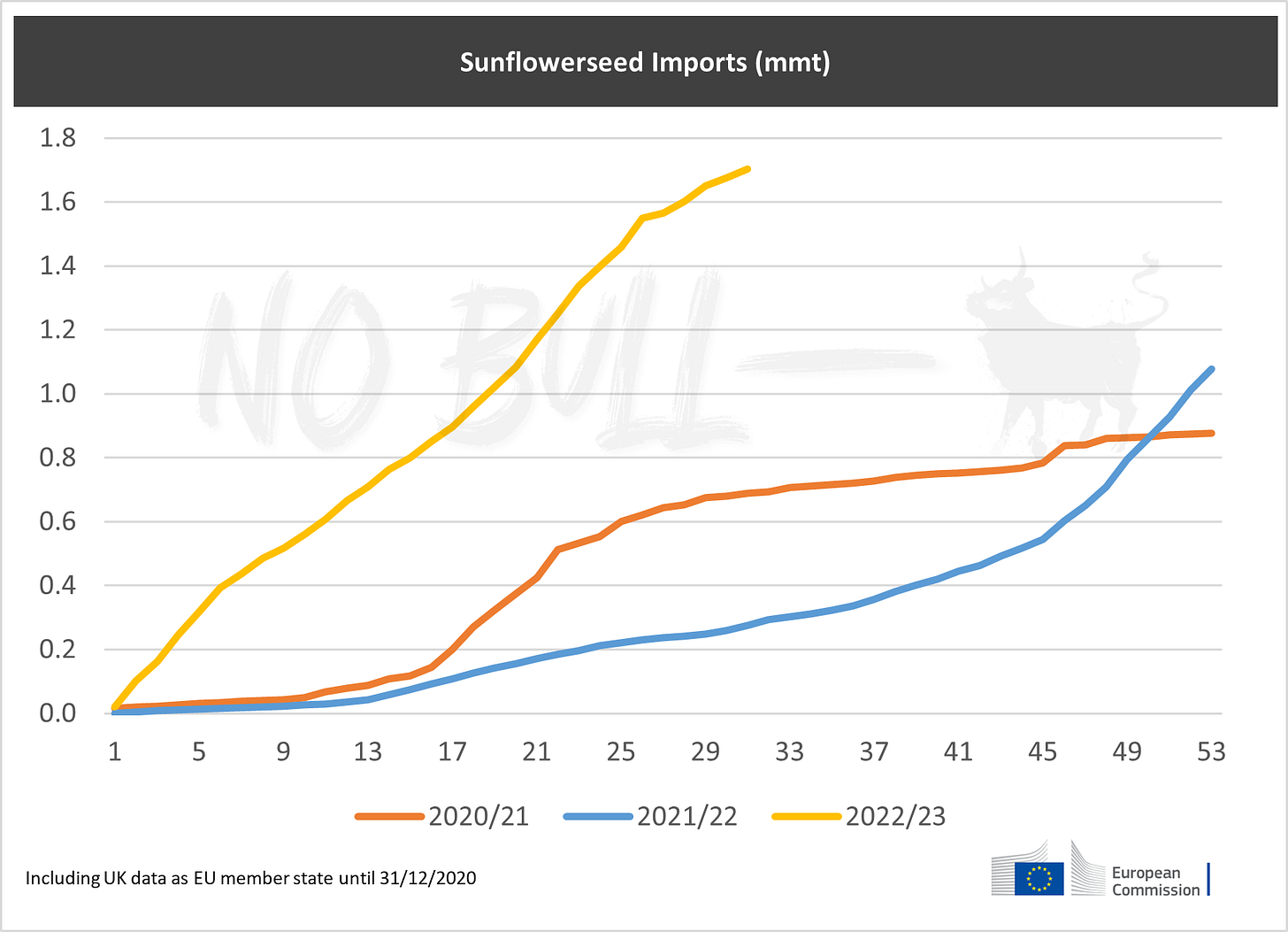

And last but not least - get a load of this one. Sunseed imports are off the charts from you guessed it - Ukraine.

The EU’s imports of Ukrainian sunflowerseed are up more than 9000% (I checked my math three times - it is correct) year on year as the oilseed is cheap and in abundant supplies given Ukraine’s energy constraints and lack of processing and/or exporting capacity.

Double Vision

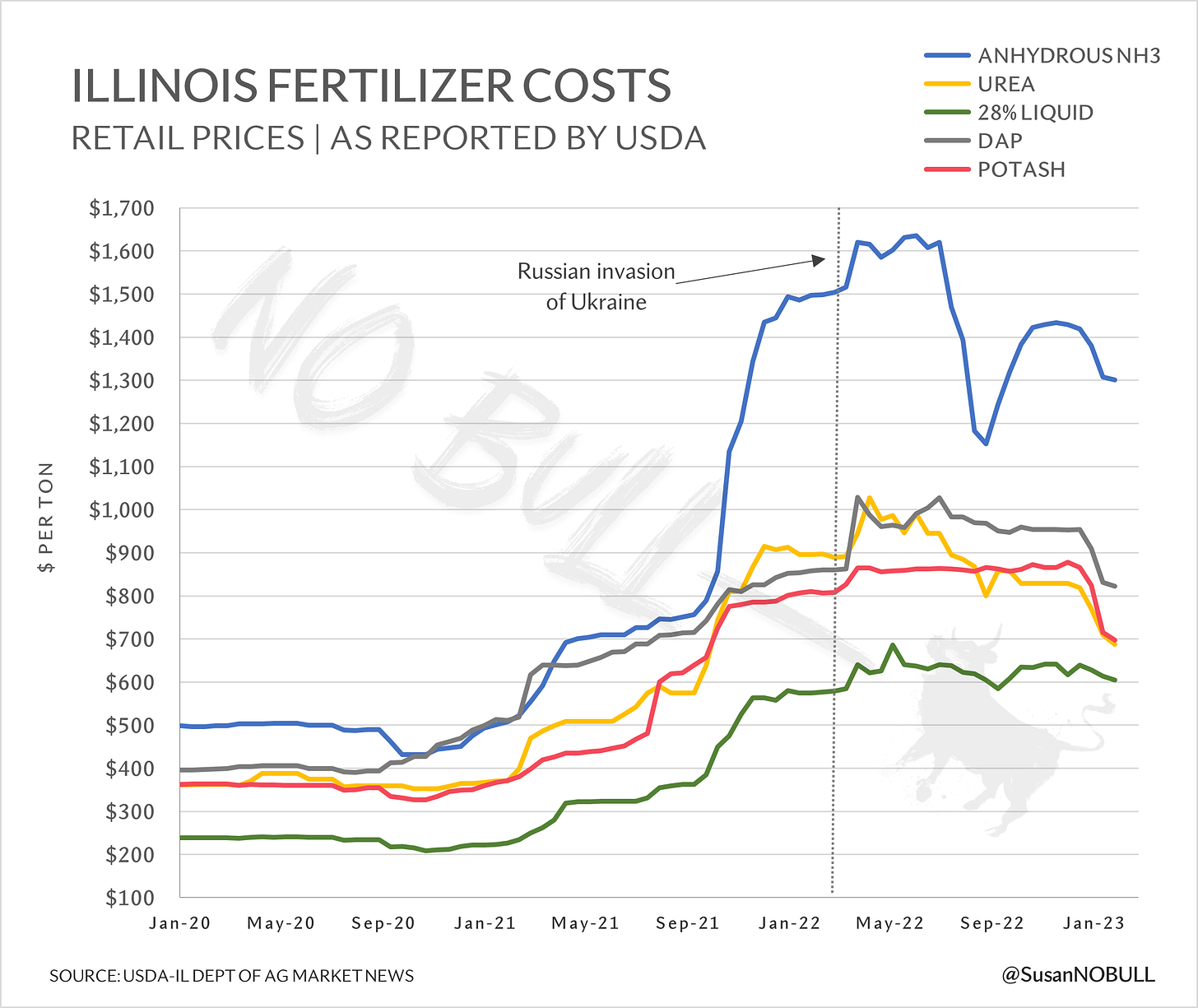

I would bet there have been a few times over the course of the past couple years you have thought you were seeing double when you looked at your fertilizer bill.

Thankfully, prices are in retreat mode, well off of last year’s highs and even considerably less than retail prices as reported by USDA in mid-December.

Potash prices are down 20% the past six weeks, Urea down 16%, DAP off 14% and anhydrous is down 8%.

Anhydrous remains the outlier in the crowd, some-60% higher than prices seen in the fall of 2021 when NH3 decided to shoot to the moon.

Part of anhydrous’ recent rebound in prices (+13% from early fall 22' lows) was due to messy river logistics as its transit upstream has been anything but cheap.

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.