A New Era in Corn Demand

In last week's No Bull, we discussed the evolving landscape of the corn export market, as Brazil's rapid growth continues to capture market share from the United States.

Although it is disappointing to see the United States lose its title as the world's largest corn exporter in 2022/23, all hope is not lost.

Domestic demand growth has outpaced that of exports over the past 15 years, driven by the implementation of the Renewable Fuel Standard in the mid-2000s.

The RFS was created as part of the Energy Policy Act of 2005 and expanded under the Energy Independence and Security Act of 2007 with a goal of reducing the United States’ dependence on foreign oil.

In addition to its fuel component, corn’s processing for ethanol also generates distillers grains, a protein-rich feed ingredient has helped to offset corn that might have otherwise been used for animal feed.

Distillers grains are a major component of livestock diets and are the largest non-corn ingredient in animal rations in the United States.

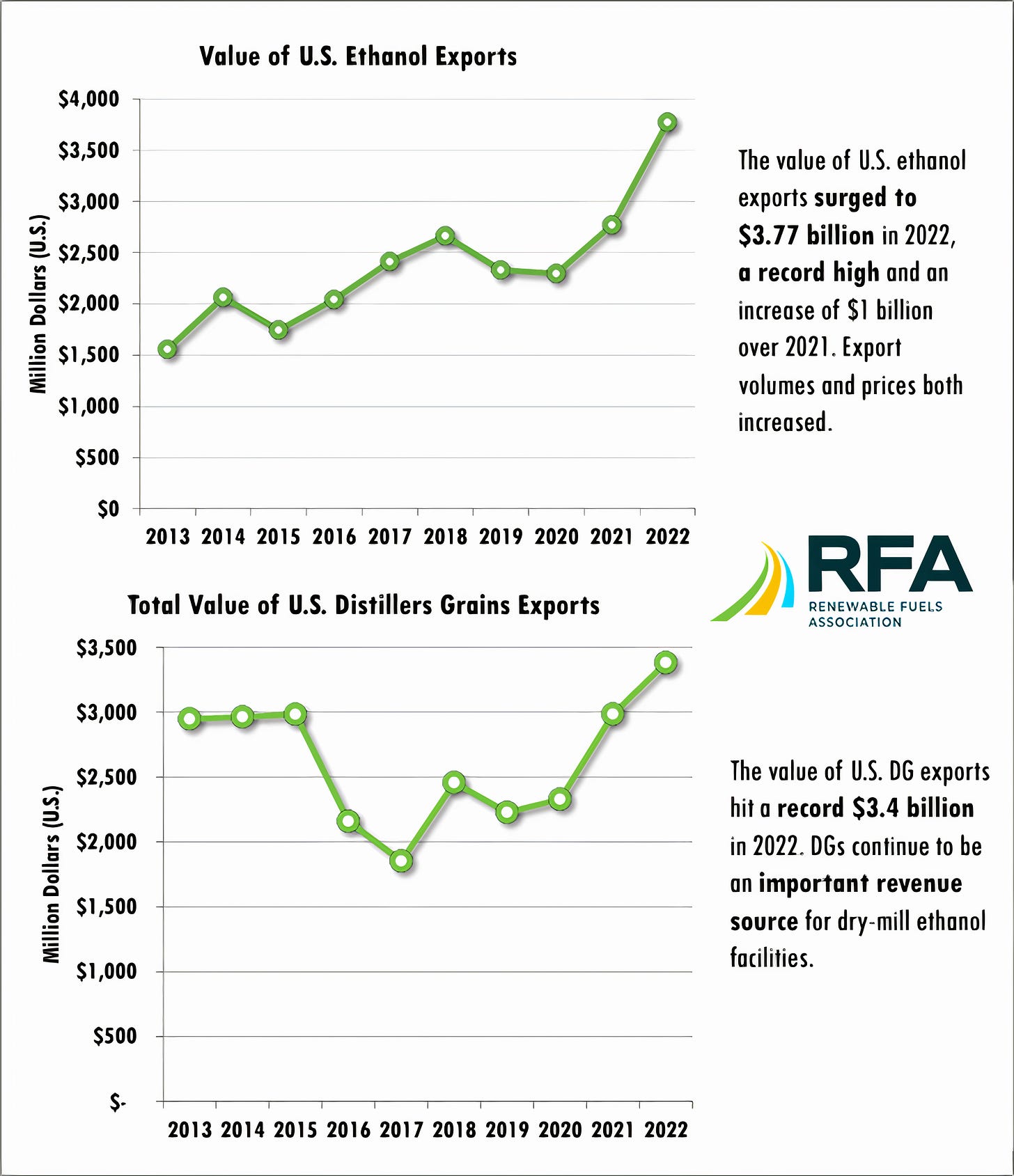

Both ethanol and distillers grains have not only found significant domestic use but are also valuable exports.

In fact, the export value of both US ethanol and distillers grains reached record highs last year at $3.77 billion and $3.4 billion respectively, contributing to offsetting the decrease in corn exports due to domestic ethanol production demand.

This highlights the shifting dynamics of US corn demand over the past three decades.

Keep reading with a 7-day free trial

Subscribe to No Bull to keep reading this post and get 7 days of free access to the full post archives.