NO BULL---- Keeping Things in Perspective

09/29/2022

KEEPING THINGS IN PERSPECTIVE

Grandma's 83rd birthday was a smashing success!

We spent the evening at Chaumette Vineyards & Winery's annual Balloon Glow. No, they don't take flight but I can assure you the 'glow'(ing) is mesmerizing enough.

The Mighty Mississippi

...is a bit less mighty than normal

There is a reason they call it the Mighty Mississippi.

At more than 2,300 miles long, the Mississippi River is the second-longest river in the United States. Did you know the Missouri (which empties into the Mississippi) is actually the longest - beating the Mississippi by ~100 miles?

The Mississippi River drains an area of 1.2 million square miles including all or parts of 32 states and two Canadian provinces - 40% of the continental US. Normal discharge rates are nearly 600,000 cubic feet per second - aka 270 million gallons per minute.

The Mississippi is one of the world's most important commercial waterways and vitally important for US grain exports as the US Gulf accounts for more than 60% of corn and soybean exports each year.

The Inland Waterways System is a big part of the reason US agriculture has been the dominant force in global markets for decades.

No doubt about it - we take it for granted every single day and it isn't until it stops functioning that we are reminded how vitally important its efficiencies are.

While the Mississippi River is still flowing, it currently occupies a front seat on the struggle bus as water levels continue to drop, hampering navigation from the heart of the Corn Belt all the way to New Orleans.

I have been watching river forecast maps for many years now and I cannot remember seeing brown dots (indicating low water) before. Heaven knows there have been plenty of purples and reds high water), but those are no where to be found today.

As we talked about last week, falling water levels are limiting the amount of bushels that can be loaded on barges - known in the industry as drafts (how far down in the water a barge can sit and still safely make its way to the Gulf).

Full drafts in St. Louis are 12'6. One week ago, drafts were reduced to 10'0 and today barges are being loaded to 9'6 or as low as 9'0.

Every one-foot reduction in draft equals 7,800 less bushels of capacity per barge (corn). This means it takes more barges to move the same amount of bushels.

Add in restrictions on tow sizes and you have a problem that grows exponentially.

Let's just say you have a tow of 20 corn barges at full drafts, that is 1.7 million bushels being pushed downriver by one line boat. Using today's 9' drafts and a 20% reduction in tow size, that same boat would only be moving 900,000 bushels of corn.

Do the math and it now takes 1.8 barges to do the work of 1 barge at full drafts - assuming the factors above.

Plus, there are hundreds of barges that have been loaded the past few weeks (grain & other products) to drafts that are deeper than navigable water levels on the Lower Mississippi. This has led to groundings, intermittent river closures, and it is even forcing some companies to offload cargo before barges can continue south. Yes, scoop some bushels off otherwise the barge will literally get stuck in the mud.

It is a compounding problem that has a ripple effect throughout the entire system and with no rain in sight (to both slow harvest AND add water to the river), we will be talking about this mess for the foreseeable future.

Barge Freight

3....2....1... BLASTOFF!

Wow, that escalated quickly.

Last Thursday I mentioned spot barge freight in St. Louis hit 955% - the second-highest nearby level in history only surpassed by the same week in 2014. At 955% of tariff, it costs $1.14 to get one bushel of soybeans to the US Gulf via barge.

Well, records are made to be broken and that is exactly what has happened this week as falling river levels have only exacerbated the problem.

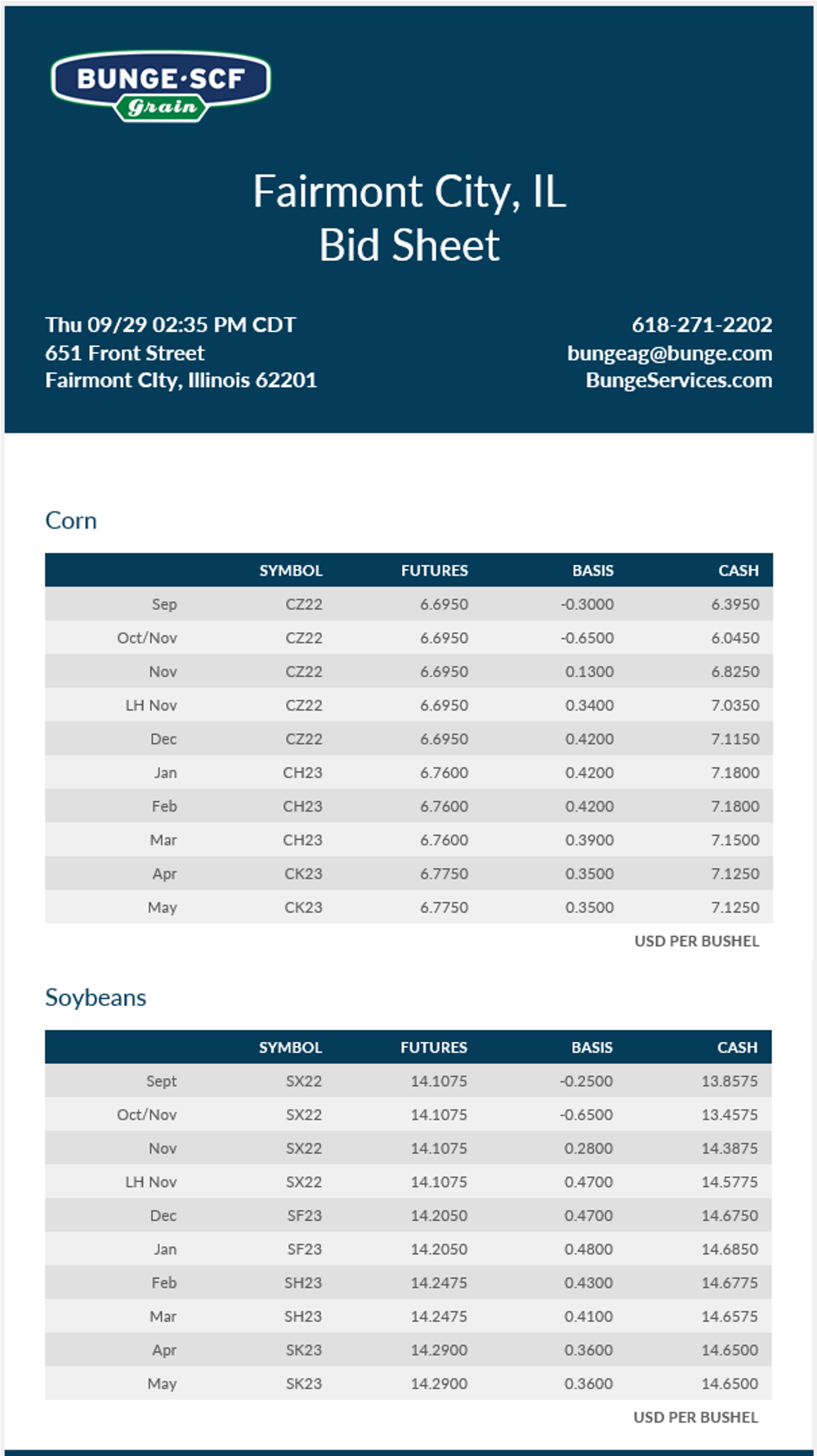

Spot freight traded to 1500% in St. Louis earlier this week, tanking basis levels for September and October deliveries as transportation costs soar. At current rates it takes $1.80 to get a bushel of beans to the Gulf - three times freight costs just three weeks ago.

Rule of thumb - if you are anywhere near a river facility and basis drops 10-15 cents or more in one day, barge freight is most likely the culprit.

This isn't a surprise for this time of year, but we are definitely in an extreme situation as soaring freight costs have pressured basis and brought wide carries into the market (i.e. - the market's way of telling you it doesn't want your bushels now by paying you more later).

Go back two weeks ago and river facilities in St. Louis were paying around 20 cents more for November delivery soybeans than they were for October. Today, November's bid is nearly $1 higher than October.

Life comes at you fast!

Beans are not alone - January delivery corn is ~$1.15 higher than October which means piles and ag bags will be popping up everywhere.

Plus, DP (deferred pricing) rates will be screaming higher as those charges are a direct function of the carry in the bid. Not sure why anyone would put bushels on DP given historically high cash prices, but to each their own.

Here is a little secret - if you have harvest delivery contracts and you have noticed the bid has tanked the past few days, ask if they will let you roll your contract to November or later delivery pocketing some of the carry.

Doubtful they will give you all of the carry, but there is a good chance you can roll and add some to your contracted price (if you are able to hold the bushels on farm).

One last thing related to barges:

Messy logistics are the last thing we need just as the US soybean export program is ramping up. Weekly export inspections were less than 10 million bushels - the lowest for this week in more than a decade - and even lower than last year when the US Gulf was still reeling from Hurricane Ida.

Selling bushels is one thing but shipping them is another.

No doubt about it - this fall will be challenging for exporters.

First, it was a slew of damaged beans (many of which are still waiting on better quality northern bushels to be blended with) and now it is a logistical nightmare full of light-loaded barges.

An exporter will have to unload one-and-a-half 9' draft light-loaded soybean barges today to get the same bushels they would by unloading one full-draft barge.

That, my friends, is problematic

Corridor Conundrums

I have officially lost track of the headlines. The Nord Stream leak, an annex, Kremlin this, Kremlin that... it has been one right after the other but managed to breathe a little life back into wheat (and support corn), nonetheless.

The most important thing to remember here is we do not know. We don't know what any of this looks like going forward, much less what Putin's next (deranged) move will be.

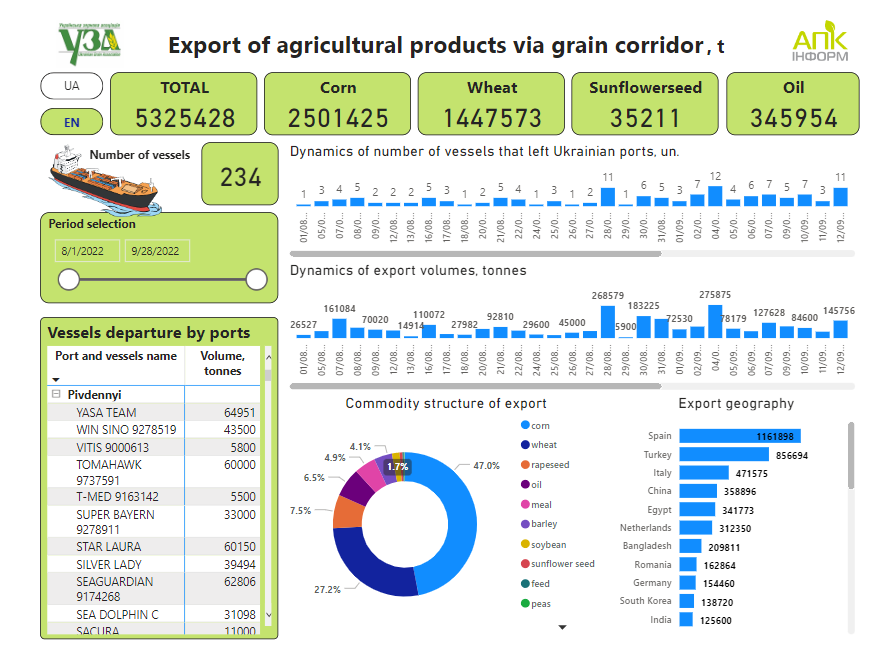

Checking in on the infamous Grain Export Corridor, you can see Ukraine has made substantial progress in terms of waterborne exports. Through yesterday, 234 vessels have left Ukrainian ports carrying corn, wheat, sunflowerseed, and sunseed oil.

Let me put those 234 vessels in perspective for you though:

110 of them were corn FYI

Enough said.

Same (November) Soybeans

Different Direction

Even though November CBOT soybean futures are nearly 80 cents off of last week's highs, prices paid to Brazilian producers have actually increased thanks to a weaker Real.

Same commodity, same futures contract, yet a totally different result.

Let's put soybeans in perspective with 2-year seasonal chart (in dollars):

While we are at it - let's do Dec corn too:

(I did a double take on CZ22 and CZ23 - twins!)

FINAL THOUGHTS

KEEPING THINGS IN PERSPECTIVE

Perspective is so important - in a variety of contexts.

Perspective can be anything from Ukraine's 110 sailed vessels of corn that sound amazing but still leave them shipping a fraction of normal export volumes to calculating barge freight rates and explaining why your local basis took a 75-cent whack this week thanks to low water levels on the Mississippi. Or better yet, viewing a 2-year seasonal chart on new crop corn and beans that puts recent market action in perspective.

More than a decade ago I started writing in order to put things in perspective for producers - a perspective that was actually useful versus the normal long-winded market crap.

Whether you realize it or not, we are all fighting the same battles just from a different perspective.

The exporter is crying hoping new crop soybeans finally arrive. The boat captain is smoking like a chimney trying to keep his tow out of the mud. The river elevator is flirting with disaster as freight screams to record levels and subsequently, the farmer is screaming BULL---- as he realizes October basis just dropped $1 in a matter of days.

Same battle. Different perspectives.

Don't be a prisoner. Take the time to see it through someone else's eyes and remember the things you learned during this battle and apply those lessons going forward.