NO BULL---- BY THE NUMBERS

09/22/2022

BY THE NUMBERS

My best bud turned 83 today but she is still young at heart. Love you very much, Grandma Elsie!

Let the partying begin!

MORTGAGE MATH

According to Freddie Mac, the average 30-year, fixed rate mortgage is now 6.29% - its highest level since 2008. Today marks the 5th consecutive week of increases, up from 6.02% last week and (brace yourself) 2.88% this week, one year ago.

Anyone trying to buy a home has been grappling with an epic one-two punch: an unprecedented increase in home prices AND a 30-year rate that has more than doubled in one year's time.

Median home prices are 15% higher than what they were one year ago. At the same time, interest rates are 3.41% higher. When you do the math (assuming 20%) down, you are paying $905 MORE each month for the SAME house.

Stretch that over the lifetime of the loan and it is the equivalent of buying that 2021 median home two times.

While interest rates remain relatively palatable, historically speaking, that jump from sub-3% to above 6% changes the scope in a dramatic way. Using last September's 2.88% rate, the monthly payment would be $1,461 for today's median US home - $715 LESS than payments on that same home at today's 6.29% rate.

Over the lifetime of that loan, you will pay $257,000 MORE in interest alone. Woof.

Not exactly a shocker here but affordability has plummeted.

Monthly payments have ballooned to 25% of median family income - a level of unaffordability not seen since the mid-80s.

ON THE DECLINE

Speaking of (un)affordability...

I was driving on I-55 last weekend and this Love's sign caught my eye - both because it was refreshing to see gas below $3 and I couldn't help but say HOLY ---- at the $2.34 DIFFERENCE between gas and diesel.

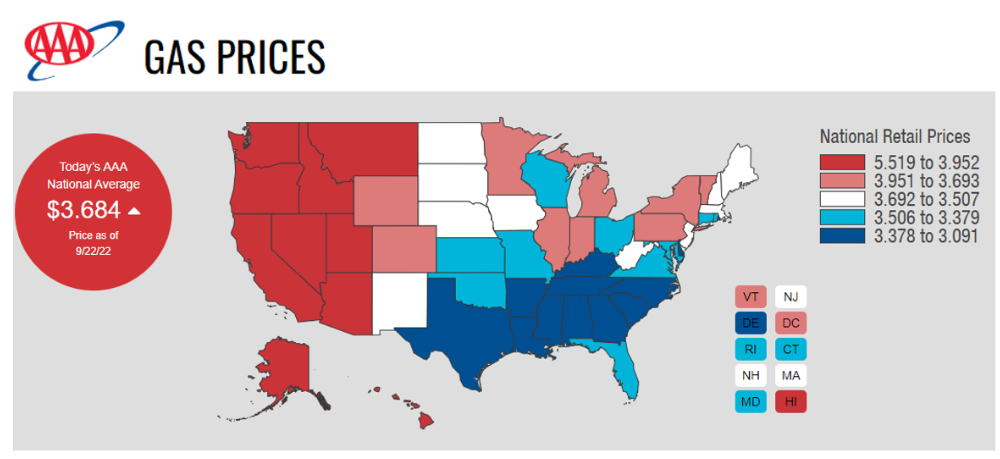

According to AAA, the national average gas price is $3.68 per gallon, up 1 cent from the day prior. This 1-cent increase marks the end of gas' 99-day-streak of declining prices since climbing to new highs north of $5 this summer.

Interesting that lower gas prices do not seem to be improving demand, as demand is lower year-on-year with an notable acceleration to the downside in recent weeks.

Gasoline isn't alone either as distillate (diesel) demand has tanked, all while prices continue to fall. The Energy Information Administration reports average retail diesel prices are $4.964 per gallon currently, the 13th price decline in 14 weeks.

$1.00

The US dollar continues its trek higher, hitting another new 20-year high today at 111.81 bolstered by escalation in the Black Sea as Russia said it would mobilize 300,000 military reservists Wednesday.

At today’s close, the dollar is up 7% since late-June, 12.8% since late-March, 15.6% since the beginning of the year, and 17.8% since last September.

Its plight creates nothing but headwinds for US ag exports (and anything else we export, for that matter) as it makes our goods and services more expensive for the world buyer. If we aren’t seeing it today, give it time. This sustained rally will eventually hit us like a ton of bricks.

RIVER RECKONINGS

Harvest has arrived and generally that means one thing - barge freight moves one direction and that is higher.

Right on time, barge freight has taken a notable jump higher in recent days - with spot freight in St. Louis trading at 955% according to AMS data, up from 695% last week.

By the way, there has only been one other time in history nearby freight has traded higher than current levels in St. Louis - that was back in 2014. The high watermark for STL October freight was around 1700%, a few years back.

At 955% of tariff, that means it will take $1.25 to get one bushel of corn to the Gulf - up 34c from last week and 53c from the week before that.

Basis suddenly drop? This would be the reason.

Clearly barge freight is demand driven, but we are also juggling a handful of items like a Delta harvest of icky damaged soybeans (occupying barges with little hope of a fast unload), the possibility of a Gulf hurricane interrupting export and harvest operations in the coming weeks, and low water up and down the Mississippi.

The poor guys in the Delta quickly went from too much water to not enough as loading operations have been suspended at some southern facilities due to low water. Drafts and tow sizes have also been reduced, meaning you can't hold as many bushels on each barge and turnaround times are inevitably slower.

Meanwhile in Memphis...

St. Louis is just as rough, with drafts reduced as low as 10 feet (vs the normal 12'6).

2.5 feet doesn't sound like a big deal, right?

It is a BIG deal though.

For corn, 2.5 feet on a box barge means it can transport ~20,000 bushels LESS.

Throw that barge in a tow with 14 others (15-barge tow) and combined, they are transporting ~300,000 bushels less today than it would at normal drafts.

The 1.3 million bushels of corn in a normal tow now becomes less than 1 million. And in a compounding effect, those 300,000 bushels that were left out of this tow will need ~4.4 additional barges for their transport to the Gulf.

Less bushels on each barge = it takes more barges to do the same amount of work = barge freight goes higher as a result.

FINAL THOUGHTS

BY THE NUMBERS

Harvest is upon us and that means there is ONE man that takes blame for everything...

Stay safe out there - I will catch you next week!