In case you missed it - NO BULL---- Ask the Experts

New to NO BULL----?

It's fantastic and better yet, it's FREE

CLICK HERE TO BE ADDED TO THE LIST

09/08/2022

What is it with this child chasing birds? Seagulls, chickens... or turkeys, it doesn't matter. If they have a beak and feathers, Genevieve is all over it!

Ask the Experts

It's not what you know, but who you know.

This week, we are mixing it up a bit. Instead of the normal format I decided to reach out to a few friends, asking some burning questions as farm real estate continues to make new highs, interest is on the rise, harvest is underway, and 'tis the season to lock in (astronomically high) fertilizer prices.

Who I know is putting you in the know this week.

Ready... set... go!

The Land Rush

Jim @theLandTalker Rothermich of Iowa Appraisal has been a NO BULL---- regular for the past two years now and for good reason.

For instance, just last week I highlighted an Iowa auction Jim reported on as 80 acres sold for $26,000 each. If you missed it, here is .

Recent months have been unprecedented in the farm real estate market, no matter the state. Special thanks to Jim for his thoughts on the matter!

Jim, why are we seeing this land rush - not only in Iowa but in states across the Belt?

Large amounts of cash have been sitting on the sidelines looking for a home. This includes both farmers and investors. Land is viewed as a hedge against inflation and the buyer pool has increased significantly from investors looking for a safe-stable investment. Iowa cropland is the gold standard.

Is this market ever going to cool off? I see that after 15 consecutive months of year-on-year increases in acres sold, August 2022 sales were 11% lower than August 2021. Have we passed the peak?

There have been several “no sales” at auction since mid-July. These have been lower to mid-quality farms and most have been successfully negotiated after the auction but are taking more work to get sold.

This trend may continue in the fall but may not be much of an issue if grain prices rally. It is definitely something to watch.

What are the most notable changes are you seeing in the industry?

Buyer premiums at auction are trending. Typically, in Iowa, the seller pays the auctioneer/realtor’s commission. The land market is so hot right now that auction companies can show sellers they can let the buyer pay the commission and has little or even no affect on the sale price of their farm.

Some realtors call it a buyer penalty. Either way you look at it, it is trending at Iowa auctions and in other areas around the country.

Alright Jim, last question. If you had one helpful tip for a producer during these wild times – what would it be?

Yes - a helpful tip for single producers: study your county plat books & marry into a family with large land holdings.

For the older producers, higher land prices are bringing farms to the market that have been held in tight hands for generations. Several farms have been sold that have been in the same family since the 1800’s. I think we are in both a buyer's and seller's market.

There is finally a good supply of land coming to the market. Know your market. Yes, prices are high, but you might only have one chance in a lifetime to purchase a certain farm. You only pay for a good farm once.

Learn more about Iowa Appraisal HERE.

Thanks Jim for your thoughts!

I had to laugh when he responded with that helpful hint for single producers. As a result I dug back in the archives for this classic:

Show Me the Money!

Well, if you are buying land most likely you will need someone to front you the cash. It just so happens I know a guy!

Alan Singleton is President of Consolidated Grain and Barge's lending division, AgriFinancial Services. We first met several years ago when I began working as a merchandiser for CGB and we remain good friends today.

Alan, few people are aware that Consolidated Grain and Barge has a lending division. How did a grain company get into the lending business and are your financial services offered exclusively for CGB customers?

AgriFinancial became a part of CGB Enterprises, Inc. in 2001 when CGB purchased Agricultural Mortgage Company of America (the original name) from the three founding partners. CGB was first interested in AgFi as an added service to their crop insurance division (Diversified Services). This addition would extend their product offering to include crop insurance, marketing advice, and financial services. Ultimately, the decision was made to establish it as a separate division, joining the family of eight business units for CGB; all serving agriculture in various capacities.

AgriFinancial originates loans, leases, and lines of credit across the United States for farmers and ranchers who raise most commodity types including grains, livestock, tree fruits and nuts, vineyards, and wineries. Today, the company services approximately $2.1 billion, which represents more than 3,300 customers.

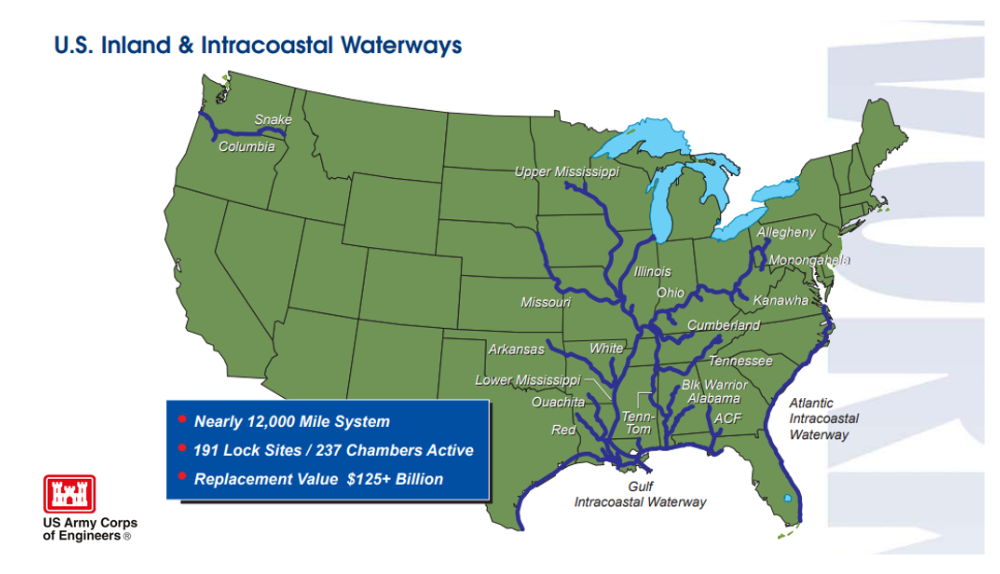

Currently, Consolidated Grain and Barge Co. has approximately 125 grain elevator locations. According to the Grain and Milling Annual Survey, CGB is the fifth largest company in terms of licensed storage space. Additionally, the company has substantial assets in logistics; including river, rail, and truck transportation, as well as soybean processing.

Rates are clearly on the rise. Are you seeing any slowdown in loan origination and what would your suggestions be for producers who are currently in need of financing?

Rates have indeed risen over the past several months, dropped back more recently and now are trending higher again. Luckily, many farmers took advantage of lower rates over the past couple of years and locked in fixed rates for longer periods.

Consequently, demand is off somewhat but there is still need in terms of new purchases and improving debt structure.

For folks looking for new money, or perhaps adjusting their outstanding debt, I would encourage them to manage long term rate risk. No one can truly predict future interest rates, and managing that risk is very important to every operation having debt that is expected to take years to pay.

Rather than putting all of the debt on variable, short term (three to five year), or long term fixed rates, we suggest portioning the debt among the various products.

By using some long term fixed rates, some intermediate fixed rates, and maybe even some variable rates, the risk of rate movement can be managed very closely while the debt balance is high. As the debt pays down over the years, rate movement becomes less of an issue. Using this strategy saves the producer money when compared to using a long term fixed rate for the entire balance.

If there is one thing agriculture seems to have plenty of it is bankers and grain marketing gurus. What separates your business/your team from the other ag lenders out there?

There are many bankers out there who are only going to sell you on rate, but that’s just a small piece of the puzzle. Our lending team first listens to your specific goals you have for your operation and then designs a financial structure that helps support that. Yes, rate is important, but it’s not the whole formula.

A producer could be interested in an expansion, diversification, succession planning, tax management, cash flow protection – no two operations are alike and a lender needs to not only take the time to hear about a farmer or rancher’s vision for their farm, but understand how their financial structure is going to help set them up for success in accomplishing it. Our team does that better than anyone else in the industry!

Alright, last question Alan. Not sure you can top Jim's advice for single farmers, but if there is one helpful hint you would give to a producer – what would that be?

I have alluded to Black Swans numerous times over the years in presentations to farmers. Black Swans are those events that can happen unexpectedly and can bring significant unintended consequences to the operation.

Currently, a great example is the Russian invasion of Ukraine. The impact of grain prices and fertilizer supply is real and significant. The “hint” is to always, ALWAYS, consider possible events and their impact. Perhaps more than ever, seek price protection on both inputs and outputs. Effective risk management separates the winners and the losers.

Thanks for your time, Alan.

One other thing I think has always set AgriFinancial apart is the fact a real person will pickup when you call. It isn't one of those banks that send you through a maze of options before a real person picks up. Don't believe me? Try them out at 1-877-548-2622.

Learn more about AgriFinancial HERE.

All Hands on Deck

This one will be fun!

Harvest is underway and that means all hands will be on deck shipping new crop bushels down the most efficient transportation system in the world. THIS is what originally set US agriculture apart from the rest of the world - our ability to move bushels in an inexpensive manner.

Meet Blake and Brian of Heartland Companies!

Blake, last year the harvest season got off to a rocky start as Hurricane Ida hit the US Gulf wreaking havoc for a number of weeks and sending barge freight rates skyrocketing higher. Fortunately we are not seeing any major storms headed for the Gulf today, but what challenges is the industry facing right now?

In my opinion, the biggest challenge facing the barge industry today is the impact of the labor shortage. This translates into higher operating costs with wage pressure to the upside along with rising fuel prices. The tightness in the labor market has certainly been felt across our industry probably more so than others given how demanding the job is on deck crews. The labor shortage is reducing operational capacity at fleets across the system, thus, slowing barge velocity & pushing freight values higher.

Farmers in the Deep South have needed an ark in recent weeks as excessive rains have slowed harvest and damaged crops. How do delays like this impact your business and barge freight in general?

Harvest delays resulting from excessive rain typically weigh on barge freight values. The lack of harvest pressure (i.e. grain movement to the river) pressures values lower as shippers have contract freight stacked on them that they need to load before they need to step into the spot market to secure freight.

Not to mention, old crop stocks are depleted while the country waits for new crop. This year is a bit more uncharacteristic given the tightness in the overall barge market in conjunction with strong Gulf elevations and soybean demand. Values remain at multi-year highs.

Quick freight lesson here, then we will get back to Blake:

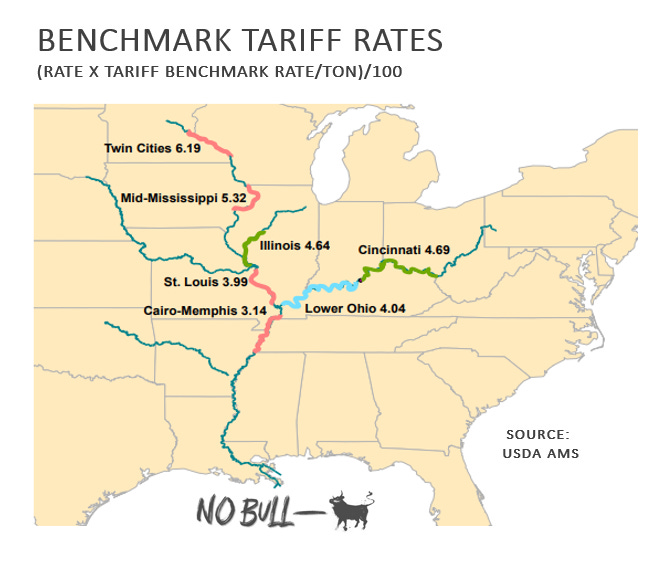

Barge freight trades at a percentage of a benchmark tariff rate. With spot freight rates (aka if you need a barge today) in St. Louis, it will cost you 600% of tariff.

St. Louis' rate is $3.99/ton, so $3.99 X 600% = $24.00 per ton of cargo. That means it will cost around 72 cents to ship a bushel of soybeans from St. Louis to the Gulf right now.

This crowd looks at barges and generally thinks grain, but barges transport much more than corn and soybeans. What does the non-grain program look like right now?

The non-grain program is robust, particularly export coal. The US is forecasted to export nearly 87 million tonnes of coal this year while this number is expected to increase 13% next year to nearly 100 million tonnes.

Export coal has been a major demand driver for the large integrated barge lines for both open & covered barges. Import cement, aggregates, and scrap metals have also been strong. Increased demand for barges keeps freight prices strong.

Brian! Your company builds barges. Let's hear about it!

Heartland Fabrication builds 120 to 150 hopper barges per year out of total industry production of ~350 to 600 barges per year.

Hopper barge construction is done in a modular and assembly line process. We have has 8 hopper barges in various stages of construction along the assembly line at any given time. You can see the process in the short video below.

From start to finish, it takes approximately 20 days to produce each hopper barge. Hopper barges are expected to last 25-30 years, and at the end of their useful economic life, they are pulled out of the water, cut up, and the steel is scrapped and recycled. The inland marine industry will scrap 300-600 barges each year.

Last question - if I wanted to get in the barge business, what would it cost to have a new one built today and how does that compare with recent years?

A brand new 14’ hull covered hopper barge today will cost approximately $1,000,000, which is up from approximately $600,000 per barge as recent as 2020. The biggest increase in cost is a result of the increase in steel plate (currently $1,750 per ton vs. $600 per ton in 2020), but all other costs have gone up also (labor, weld wire, deck fittings, paint, fiberglass covers, utilities, etc.).

As a result, barge freight values are climbing slowly, and will continue to climb, in order to produce economic returns compensatory for the replacement of barge assets as they wear out.

Thanks Blake and Brian!

Learn more about Heartland Companies HERE.

"Green Ammonia"

Meet Eric Kelley. We go WAY back to the country elevator days.

More on Eric's path from a grain elevator overlooking Mississippi River bottoms in southeastern Missouri to being on the cutting-edge of new tech in ag in a moment. First, let's dive right in and learn a few things about "Green Ammonia"!

Eric, what exactly is “Green Ammonia" and why would a producer want to consider this as an alternative to the traditional Anhydrous Ammonia he has always used?

“Green Ammonia” is the same Anhydrous Ammonia “NH3” product we have always used as fertilizer, but this NH3 production process is free of fossil fuels.

All NH3 is produced through the Haber-Bosch process, where hydrogen and nitrogen are converted to ammonia. Historically this has always been done using natural gas as the fuel to create the hydrogen. Today, 99% of NH3 is produced using carbon-based fossil fuels, accounting for 2% of the world's carbon emissions each year.

Our state-of-the-art technology facilitates the same process, producing the same NH3 - but without the natural gas and resulting emissions by using renewable electrical energy to convert hydrogen to ammonia - all in a compact unit we call the IAMM (Independent Ammonia Making Machine).

Change is coming, no matter the industry as the world transitions to clean energy. We have all seen skyrocketing fertilizer prices in recent months, driven largely by escalating natural gas prices. This is not a short-term situation and will keep fertilizer prices high for the foreseeable future.

Tell me more about this NH3-making machine. How many tons of anhydrous ammonia can it produce each day and who is your target customer?

Our IAMM is a relatively compact, modular green ammonia facility that allows a retail fertilizer dealer, grower or anyone for that matter, to produce 4.4 tons/day or nearly 1,600 tons of NH3 each year using only inputs of water and electricity. The IAMM facility has a predicted lifespan of 20+ years.

For the first time ever, a customer will know where the NH3 will be, when they are going to have the NH3, how much they will get, and the cost of that NH3 before its ever even produced.

The recent big, fat climate bill (I mean Inflation Reduction Act) includes a lot of incentives for all things green. Did this new legislation include anything for your IAMM unit?

Yes, there are provisions for direct incentives (subsidy) to the IAMM facility owner for creating green hydrogen for at least the next decade. We estimate this direct payback subsidy to the IAMM facility owner, as much as $480/ton of NH3 produced, that is a huge savings for fertilizer producers.

The IAMM-Complete package production facility, may be the only system available to meet all the requirements for the producer of the NH3 to get this direct subsidy.

Can you give us an idea what the facility costs to install and how much power will it take to run the unit?

The AmmPower IAMM- Complete package, meaning full production of NH3, is roughly $4.75 million. That includes on-site commissioning, training of personnel, warranty, and one year of remote monitoring. That does not include shipping to the client or on-site ammonia storage.

The amount of energy required is most simply answered as 9 MWh (megawatt hours) per metric ton of NH3 produced. So at full capacity of 4 metric tons per day (4.4 short tons), its roughly 36 MWh of electrical usage every 24 hours. Electrical supply can be either grid, renewable, or a combination of both.

Thank you, Eric. I find this technology fascinating and am excited to be able to bring it to the masses. Cap it off by explaining your career path a bit:

Its funny - I began my agricultural career as purely a learning experience. I have always been an entrepreneur and after college I owned and operated several businesses over the years. I was always intrigued by agriculture operations but was basically dumb to the process.

I lucked upon a private family-owned agriculture retailer/farming family who brought me in and mentored me, and truly treated me like family allowing me to be involved in all aspects of the business. I have always been a sponge for information and these experiences gave me an education in all things agriculture that is only really learned by donation of sweat, blood and long days. It provided me with a graduate level education in grain handling, crop protection, nutrient management, fertility, custom application, and so much more.

The ability to plan/implement real world solutions and knowing how to be on the ground making it function is ultimately how farmers really shine and we were there to help them do that.

Along the way I started Kelley Precision Ag to help growers with soil testing and nutrient management needs and like so many things in my life, it took a life of its own.

A few years ago I was approached by AmmPower as they were looking for someone to help them understand the fertilizer market. AmmPower is in essence a technology company with knowledge in ammonia/hydrogen production but they lacked knowledge of farming and agriculture.

They had a goal of creating a small, modular easy-to-produce NH3 system to help distribute fertilizer to the direct end-user cutting out the middle man, and that’s what we have done.

You can learn more about AmmPower and the IAMM HERE.

FINAL THOUGHTS

Ask the Experts

Thanks again to Jim, Alan, the guys at Heartland and Eric for their contributions this week.

Most people hear "it's not what you know, but who you know" and immediately think it is a snooty comment.

I don't view it that way at all. If I have learned anything the past 15 years, success is about resourcefulness and the desire to learn.

I get the privilege of sitting at this computer each week and identifying relevant topics, doing the homework, and putting the information out there in a way that makes it easy to digest.

I learn.

You learn.

We all win.

(unless you're the guy who sent me a message a few weeks back and said he was tired of my anti-green, anti-Biden quips and subsequently unsubscribed)