NO BULL---- Notable and Quotable

New to NO BULL----?

It's fantastic and better yet, it's FREE

CLICK HERE TO BE ADDED TO THE LIST

08/11/2022

NOTABLE & QUOTABLE

Missouri will never grow corn like the I-states, but we make up for it with crystal clear rivers and streams.

Earlier this week, Genevieve and I spent a couple days with family at Echo Bluff State Park - in the heart of the Ozarks.

Genevieve and my nephew Zeke make quite the pair.

Me: Smile, guys!

Genevieve: Cheeeezzzzeeeeee (complete with the hand motions)

This child is FEARLESS (and absolutely living her best life).

To say she brings me joy (and keeps me on my toes) is the understatement of the century! This water is much more swift than it appears and she was insistent that her trips down the river remained unassisted.

The State spent more than $50 million on the lodge, cabins, and campground along spring-fed Sinking Creek - and you can tell.

If you are looking for a hidden treasure, amidst some of the country's largest springs right off of the Current and Jacks Fork Rivers, check it out HERE. I say 'hidden' but the word is out. It is very difficult to secure reservations, so make sure you plan ahead.

"Zero Percent Inflation"

Yesterday, President Biden touted "zero percent inflation" at a White House press conference, in response to July CPI data released earlier in the day showing annual inflation at 8.5%.

Technically the President wasn't wrong as month-on-month inflation was down slightly from June's 9.1% - but it remains near a 40-year high.

Sure, 8.5% is lower than 9.1% - but it's far from 0%.

The teeny tiny month-on-month decline isn't anything to cheer about, especially considering the fact gasoline was down 7.7% from June, as you have probably noticed a little relief at the pump.

According to EIA, retail gasoline prices have dropped for the 7th consecutive week, at $4.038 per gallon - down from $5.006 in mid-June. AAA and Gas Buddy both have reported national averages below $4 in recent days which is something we have not seen since prior to Russia's invasion of Ukraine.

Likewise, diesel has declined for 8 straight weeks, sitting at $4.993 today after its historic run to $5.81 in June.

It seems strange to be cheering at the thought of sub-$4 gas and sub-$5 diesel... but here we are.

At the other end of the spectrum (offsetting energies' declines) food saw a historic jump in July with food at home up 10.9% from one year ago - the fastest pace of inflation since May 1979. Food away from home was up a staggering 13.1% from last year, but both categories saw very minor increases month-on-month.

Notably, breakfast is becoming more expensive with eggs up 38%, butter up 26.4%, and coffee more than 20% higher than July 2021. And food is far from the only thing with sticker shock as electricity is up 15%, airfares are up 28%, new cars are up more than 10%. Even everyone's favorite frosty cold one is up 4.6% year-on-year.

The "Inflation Reduction" Act

So, what are we going to do about this out-of-control inflation? Spend more to save more, that's what!

Earlier this week the Senate passed the Inflation Reduction Act, a successor to the Build Back Better Act of 2021 (remember that whopper?).

Hitting a few of the high (or low, depending on how you look at it) points of the bill, the act includes a 15% corporate minimum tax, a beefed up IRS for tax enforcement, drug price controls, copious amounts of spending on on energy and health insurance subsidies and claims it will result in a total deficit reduction of more than $300 billion in the coming years.

I am unsure who decided it should be called the "Inflation Reduction Act" considering that $369 billion of the bill's authorized $437 billion in spending is earmarked for investments to curb climate change and support clean energy.

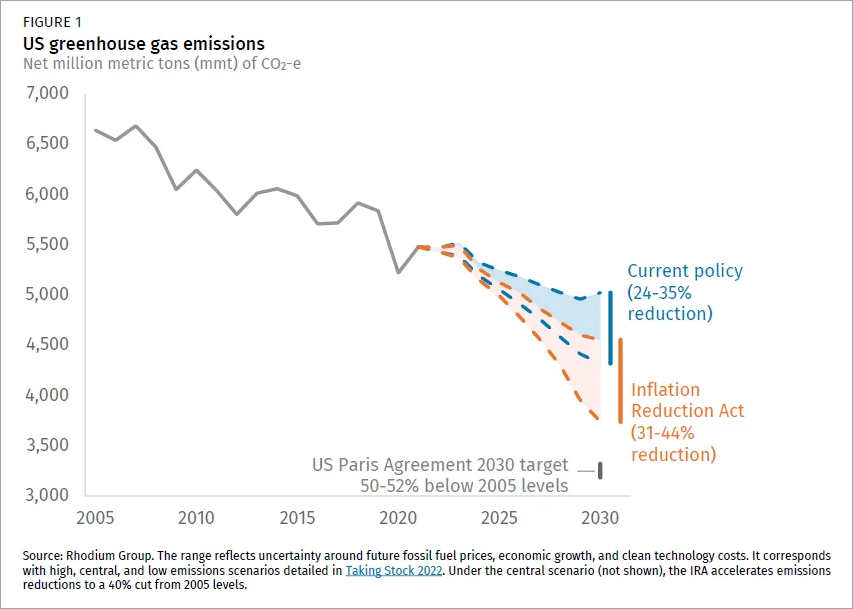

This is BY FAR, the largest legislative step ever taken by Congress to address climate change, projected to reduce US greenhouse gas emissions by ~40% by the year 2030.

Some key climate points include support for American-made electric vehicle manufacturing, while also extending the $7,500 EV vehicle tax credit, but excluding vehicles whose battery components were not predominantly sourced from North America or by a US trade partner. We will get into a few of these details next week.

The bill has also breathed new life into biofuels, with substantial supportive provisions (largely beneficial to the renewable diesel ~aka soybean oil~ space).

Nearly $40 billion is directed towards agriculture, with funds for everything from EQIP, to conservation, to "distressed" borrowers of USDA loans, discriminated producers and hefty subsidies for clean rural energy.

The bill now heads to the House, with a likely vote on Friday.

The Heat Is On

Europe is on the struggle bus. Not only are they bearing the brunt of the Russian energy debacle, but they are grappling with an historic heat wave, roasting crops and sending projected corn output to 15-year lows.

Recent private estimates suggest EU corn production could fall at much at 500 million bushels - that is 500 million bushels they do not have to lose in the current environment.

You could call this the perfect storm, as Russia's invasion of Ukraine has limited Europe's access to much-needed wheat and other grains, leaving supplies scarce to begin with. Add in drought conditions across major production areas and you have the catalyst that managed to revive a struggling CBOT corn market.

Admittingly, I do not know much about European corn production. What I do know, however - this is the LAST thing Europe needs.

France and Romania are impacted the most, while Italy was a notable buyer of new crop US corn this past week - 105,000 tonnes (4 million bushels). That is the one and only new crop purchase of US corn I can find in the FAS Export Sales Reporting System - dating back to 1998.

Remember in feeding, wheat for corn and corn for wheat. Feedgrains are interchangeable and rations are adjusted based on availability and cost-effectiveness.

So with both wheat and corn in short supply thanks to the Russia-Ukraine mess, Europe was already struggling to meet its needs. Now with drought threatening its 2022 corn production, Matif corn futures are trading near €335/tonne ($8.80/bushel) - surpassing the price of Matif milling wheat, a rare event to say the least.

We will probably be talking about this one quite a bit in the coming weeks and months, starting with any changes seen on tomorrow's WASDE Report.

"I hate the August report."

- Susan David, every August for the past 15 years

Okay, just kidding. I have not been paying attention to the finer details of USDA reports for my entire career. The August report sure can be annoying though.

Yield is clearly a focal point, as it is generally USDA's first adjustment from the Outlook Forum/trend yields used in May. This year is different, as they did take corn yield 1 bpa lower a few months back - reflecting later planting dates and subsequent impacts to yield.

August's yield calculations are survey-based, also taking weather, crop ratings, satellite imagery, and the kitchen sink into consideration. USDA does not step foot in a field until the September report.

As you know, countless groups of "experts" submit pre-report guesstimates, each using their own approach in calculating yield. For corn, guesses range from 173.2 to 177.6 with an average of 175.9 versus USDA's 177.0 in July.

Given this year's wild weather patterns - we should revert to the throw a dart at a post-it on the wall method as it may prove to be just as accurate as anything.

Remember, we are going from a trend-type (totally on paper, assuming normal weather) yield to something that incorporates real observations and real data... maybe. The adjustments from July to August tend to be large, with a nearly 5 bpa drop last year.

As expected, market swings post-August WASDE can be large as well.

Moving on to beans... August weather makes or breaks them and considering we are not even halfway through the month - there isn't a so-called expert out there that knows any more than you nor I at this stage in the game.

Guesses for soybean yield on tomorrow's report range from 49.9 to 52.5, with the average estimate at 51.1 bpa, down from 51.5 previously.

Beans tend to be volatile, even on the calmest of days, so buckle up buttercup because tomorrow should be interesting.

Not that we will necessarily see a huge yield adjustments that make the bean market move in a big way, but because of the outsized moves we have seen in recent weeks and the fact that bean stocks are TIGHT - for this year and next.

But, back to yield... a 1 bpa adjustment to new crop yield is ~40% of current projected new crop ending stocks.

Like my quote says - I hate reports like this where so much emphasis is put on a few numbers. You don't know. I don't know. None of us know exactly what they will print, much less how the market will react.

Plan accordingly and manage your own risk. We are far enough along you should have a decent idea on production and know where you need to be priced.

PS - if recent rains bolstered your yield prospects... USE that new number, silly!

Final Thoughts

NOTABLE AND QUOTABLE

I love this one. It sums it up quite well:

A lot has happened over the course of the past week.

China has stepped up their purchases in a big way, scooping up both new crop soybeans and corn.

Sometimes things don't matter until they matter... and suddenly EU corn production REALLY matters. At the same time we are seeing more vessel movement in the Black Sea but trade remains skeptical to say the least.

Plus, we are rounding the home stretch into northern hemisphere harvest where US corn might have a glimmer of hope given the issues across the pond.

And don't forget we have the acreage wildcard tomorrow as NASS opted to re-survey ND, SD, & MN in July - as large areas in the Northern Plains remained unplanted in June.

Best of luck tomorrow. I will catch you next week!